Portfolio Insights: Why China Is Not A Trade

Summary

We believe that a long-term equity allocation to China, the world’s second largest economy and equity market, is in our clients’ best interest. Although recent market volatility and political tensions may make a tactical approach look appealing, history tells a different story. Moreover, fundamentals remain strong and valuations remain relatively low despite the recent rally.

2020 Recap

2020 has undoubtedly been a year full of unprecedented events that no one could have anticipated. Eight months into the year, we have overcome many challenges, and many are still evolving and remain to be resolved. Financial markets have closely followed headline news starting with the covid-19 outbreak in January. It is encouraging to see that many investors are capable of holding steady through volatile markets and focusing on long term investment opportunities. It was never easy to hold the conviction of staying invested particularly during the peak of volatility in March when we saw a sharp selloff in the US market. However, for those investors that have a long-term investment horizon and rode through the market have been rewarded while those who engaged in panic selling largely missed out on the market rebound. This phenomenon is not unique to this point in time. Rather, as students of stock market history in both China and the US, we have seen this occur time and time again.

Despite a good start to the year, the market corrected in January following the initial lock down in China. It did not settle until the announcement of the spread of the covid-19 emergency globally: first in Europe, then in the UK, and subsequently in the United States in March. Broadly speaking, markets have been performing along with the development of the covid-19. It is worth noting that the market is now differentiating between countries based on their response to the pandemic. After some initial confusion, the market now appears to be appropriately rewarding the countries that have dealt with the situation better and the sectors that are either capable of either adapting quickly or offering services suited to a life in quarantine.

As a result, China equities have proven more resilient following the sharp market correction in March in the US. Moreover, sectors such as consumer discretionary and communication services have outperformed significantly since then. Investors are rewarding China’s quick response and recovery and, more specifically, Chinese companies that offer convenient services such as online grocery shopping, uninterrupted online education for millions of students, at-home entertainment, and social media platforms that allow users to stay connected virtually with their family, friends, and relatives. Shares in companies of this sort have significantly outperformed the global equity market, broadly speaking.

Have You Missed Out?

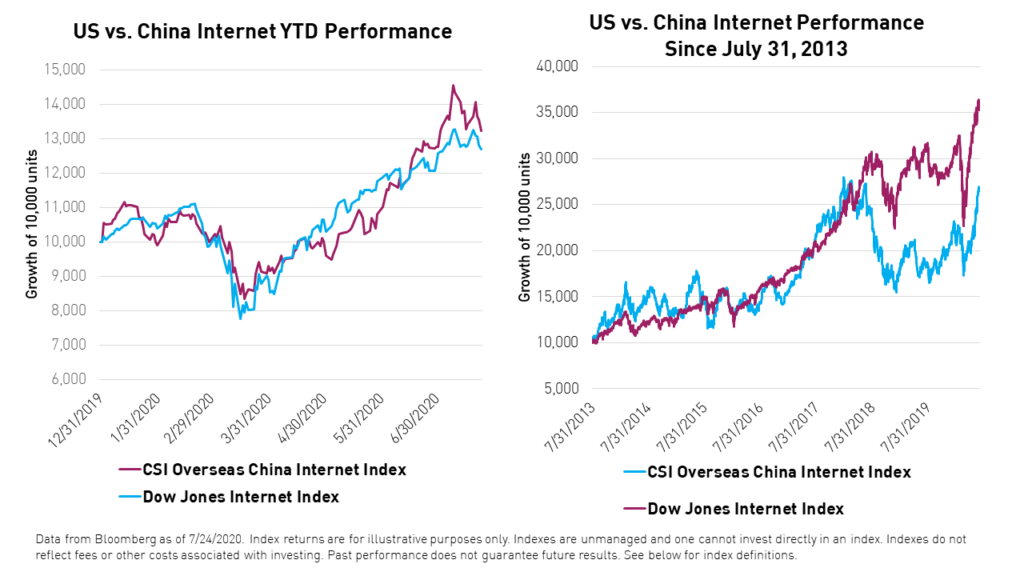

Naturally, our clients have been asking if they have missed the boat given the strong short-term performance. We used the China internet and technology sector as an example, and found that, year-to-date, the index trended pretty much in line with its counterpart in the United States. This is true over the long term as well, that is, until 2018 when the market began to price in the potential impact of trade tariffs on the underlying companies. As a result, China internet companies underperformed their US equivalents by 99%. In our view, the trade war was priced in at an extreme level and caused the valuations of companies in the sector to become completely detached from fundamentals.

This undervaluation came at the same time as many Chinese technology companies began to set examples for their global peers. Services that have been on offer for years in China are only now starting to take off internationally. Seemingly cutting-edge innovations such as mobile payments, 5G, online healthcare, autonomous vehicles, electric vehicles, and robotics were all put to use in China long before they were adopted abroad. However, trade tensions seemed to have caused collective amnesia among global investors. Suddenly, innovative firms came to be treated as export-dependent vestiges of a formerly globalized world, despite the fact that the vast majority of their demand came from within China. The billions of mobile phone subscribers in china form what is probably the strongest customer base in the world. This customer base will continue to contribute to the growth of these companies and encourage them to stay innovated and gain greater market share both domestically and internationally.

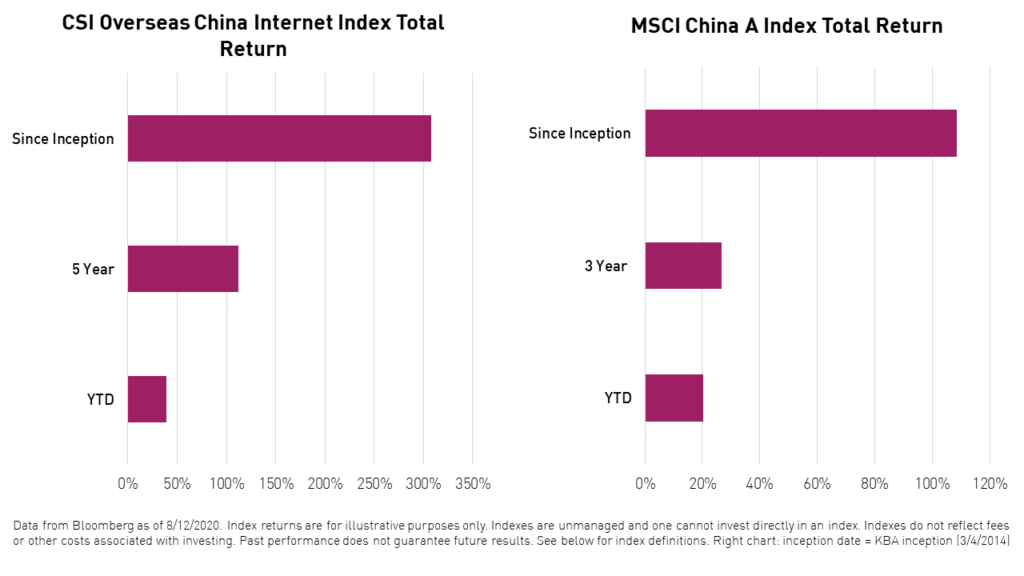

It is common even for a most seasoned investor to think that perhaps he or she could time the market and enter it at a ‘right’ time. Many have attempted to do so and many high prices have been paid over the years. For example, year-to-date as of June 30th, the best 10 days of returns for the China internet sector, as measured by the CSI Overseas China Internet Index, have accounted for nearly 50% of its year-to-date return1. However, the probability of anyone guessing one day correctly is low, let alone guessing all ten days correctly. Timing rallies to predict short and unpredictable market behavior is mission impossible. On the other hand, just staying invested through all of the volatility would have resulted in a total return of nearly 33% year-to-date as of August 12. Moreover, clients that have remained invested since the index launch have returned over 300%. The same analysis holds true when we look at broad China onshore equity market. While the past is no guarantee of the future, it is all we have to go on and what it tells us is clear: staying invested, on average, has resulted in better outcomes than buying and selling based on short-term market events.

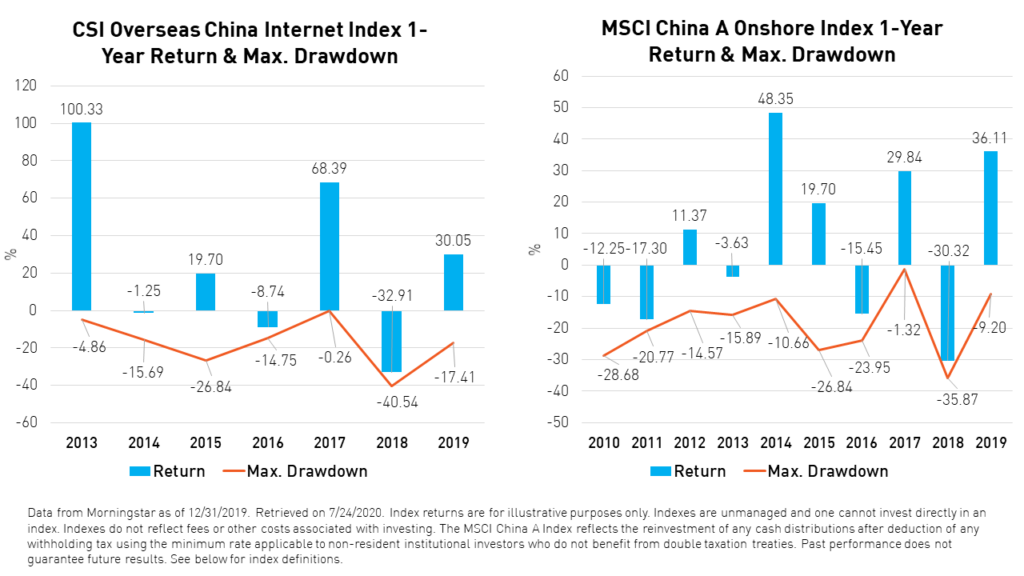

Nonetheless, we do recognize that both China internet and broad China equity are often placed in an Emerging Markets bucket and introduce a great deal of volatility as a result. Even an institutional client could behave like a retail client during heightened market volatility and mistakenly sell at the bottom. Riding through the volatility is not an easy decision. When looking back at the historical performance of both the China internet/technology sector and the broad onshore equity market we find that both have always recovered from their respective maximum drawdowns and returned better on a whole-year basis.

Taking a tactical approach and/or panicking when volatility rises increases the likelihood of selling out of a position at a low and missing the upside. As you can see below, half of the time both indices not only recovered from their lows, but actually finished the year in positive territory. The recovery range can be very wide depending on the year.

Capturing China as an asset class is not about being opportunistic; it is not a trade. Historically, investors have seen better risk-adjusted returns when they have invested for the long-term.

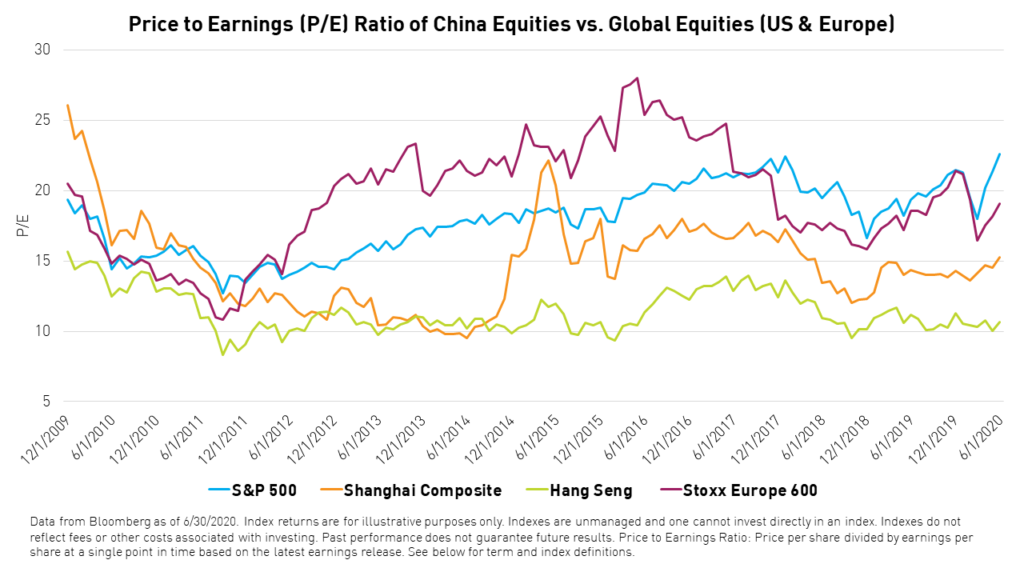

Fundamental valuations also support our view. Average valuations in broad china indices remain low compared to their European and American counterparts. As reforms continue in China, companies that have returned to full production levels and are quickly adapting to new standards of living will have significant room to catch up with their counterparts Therefore, we see meaningful upside for Chinese equities from here on out.

Conclusion

In our opinion, China was never just a trade, and should not be treated as a tactical trade in clients’ portfolios. We believe that investing in China is not about if and when one should invest, but rather about managing your time horizons to allow for a strategic allocation to this asset class.

We firmly believe that our clients did not miss the boat. We encourage clients to think long-term when considering their exposure to the world’s second largest equity market.

1. Data from Bloomberg as of 6/30/2020.

Index Definitions:

MSCI China A Index: The MSCI China A Index captures large and mid-cap representation across China securities listed on the Shanghai and Shenzhen exchanges. The index covers only those securities that are accessible through "Stock Connect". The index is designed for international investors and is calculated using China A Stock Connect listings based on the offshore RMB exchange rate (CNH).

The CSI Overseas China Internet Index: CSI Overseas China Internet Index selects overseas listed Chinese Internet companies as the index constituents; the index is weighted by free float market cap. The index can measure the overall performance of overseas listed Chinese Internet companies. The Index is within the scope of the IOSCO Assurance Report as at 30 September 2018. The index was launched on September 20, 2011.

MSCI China Index: The MSCI China Index captures large and mid-cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs). With 703 constituents, the index covers about 85% of this China equity universe. Currently, the index includes Large Cap A and Mid-Cap A-shares represented at 20% of their free float adjusted market capitalization. The index was launched on October 31, 1995.

MSCI Emerging Markets Index: The MSCI Emerging Markets Index is a free-float weighted equity index that captures large and mid cap representation across Emerging Market (EM) countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. The index was launched on January 1, 2001.

S&P 500 Index: The S&P 500 Index is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 9.9 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 3.4 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization. The index was launched on March 4, 1957.

Term Definitions:

Price to Earnings (P/E) Ratio: The ratio of share price to earnings per share