The Art of Investing in China: Q1 – A Quarter With Two Halves

By Dr. Xiaolin Chen

Q1 at a Glance

The new year began with some long-overdue optimism as covid-19 vaccines became available in the West. We started to see the light at the end of the tunnel as we experience a slow and gradual re-opening and can now reasonably expect the economy to normalize in the near term. Markets rallied on that basis and began to price in forward-looking optimism. What triggered the market to pause and turn in a different direction in the second half of the quarter was inflationary pressure in the U.S. caused by the potential for an overheating economy propped up by the largest US fiscal stimulus outside of war times and the Fed’s commitment to keeping monetary policy easy. This pushed inflation expectations and bond yields higher and introduced downside volatility. Investors seized on these developments as an opportunity to take profits from last year's gains.

Are these concerns warranted? Here is our take.

The economy is coming out of a deep slowdown and the gap to be filled between actual and potential output is extraordinary. New stimulus should not result in substantial overheating. We believe inflationary pressure will ease as this year’s temporary fiscal stimulus fades. We agree with Treasury Secretary Janet Yellen that the American Rescue Plan Act (ARPA) should bring the economy roughly back to full employment and is unlikely to result in substantial overheating.

Major bond yields fell to exceptionally low levels following the covid-19 shock last year, suggesting the market was expecting a deep and prolonged recession. As it became clear that this was unlikely to be the case, benchmark yields in nearly every major market have readjusted higher since the start of the year. Among G10 economies, 10-year yields have risen by 25-90 basis points (bps) over a short period of time. However, they still fall well short of the spikes seen during the 2013 US Taper Tantrum or the 2015 German Bund Tantrum. Those episodes resulted from perceived monetary policy tightening and stretched positioning, whereas the current repricing is reflationary in nature and reflects the ongoing economic recovery.

The sectors that comprise the “New China” such as E-Commerce and technology companies are relatively more sensitive to higher US interest rates and domestic policies. Pressure on these sectors was compounded by the US SEC issuing interim final rules for implementation of the Holding Foreign Companies Accountable Act (HFCA). Concerns over China tightening policy too soon also added downside pressure for Chinese equities in Q1. As a result, growth-oriented and long duration interest rate-sensitive areas were the hardest hit and the performance dispersion between sectors was wide.

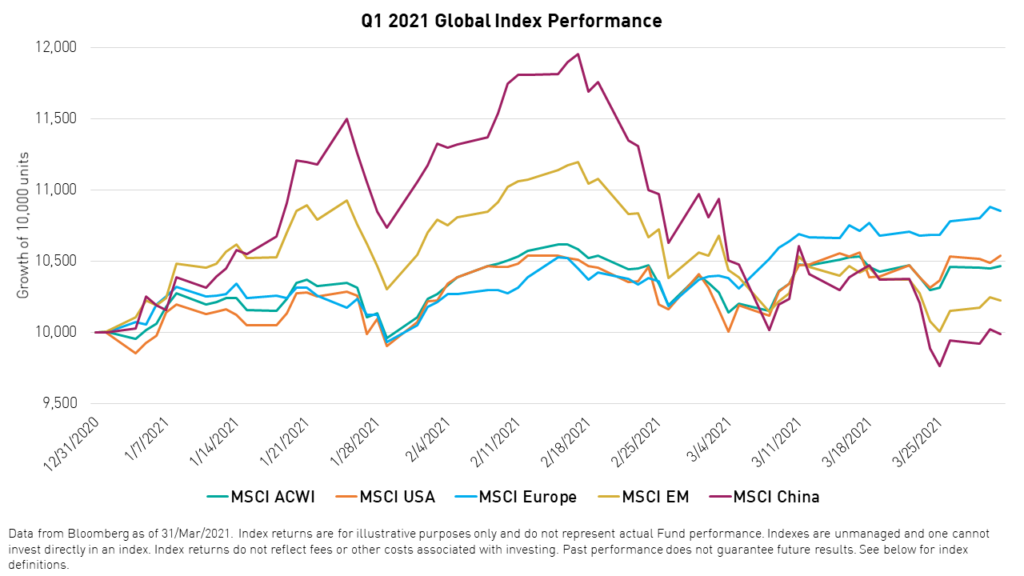

Despite considerable intra-quarter volatility, the MSCI All Country World Index (ACWI) returned +4.7%, a gain to which defensive developed market stocks contributed heavily. The MSCI USA Index returned +5.5%, MSCI Europe gained +8.5% after being dragged down by Emerging countries, the broad MSCI Emerging Markets Index returned +2.2%, and the MSCI China Index experienced an abrupt correction in March to fall by -6.1%, but finished the quarter only marginally down by 20 bps.3 We often hear the old saying “sell in May and go away.” As such, the second half of the correction in Q1 may have brought Q2 weakness forward in our opinion.

In our view, the equity market is currently transitioning from the initial bull market of the ‘Hope’ phase, in which the performance is typically driven by valuation expansion, to the core ‘Growth’ phase, in which the returns are propelled by earnings. Given the positive macro data points we have seen recently, we believe the near-term earnings momentum remains positive. Both sales recovery and margin expansion will likely contribute evenly to the earnings rebound in our opinion. Furthermore, reopening elsewhere in the world is likely to benefit China through demand for exports. We reiterate that the near-term volatility did not materially change our fundamental view of the asset class of China and we have seen investors phasing in China exposure in recent weeks.

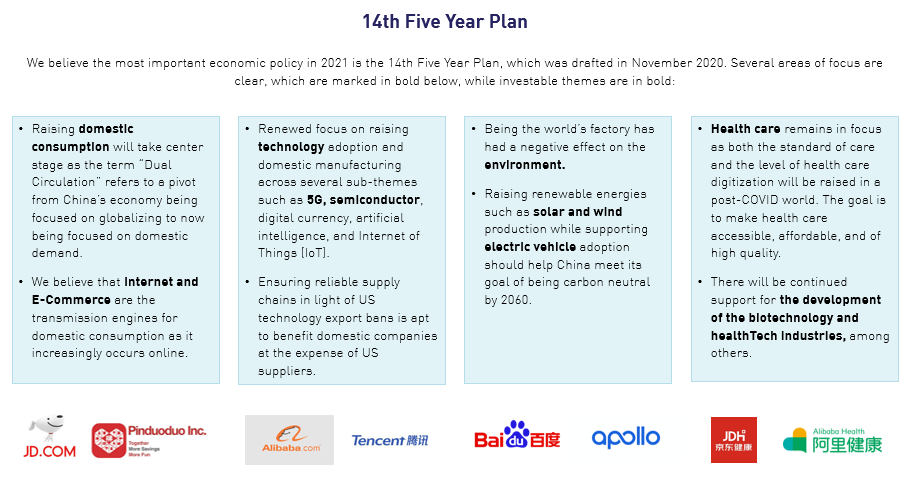

Event Highlight: The 14th National People’s Congress (NPC)

China’s National People’s Congress (NPC), convened in March, is one of the most important events for the country and global investors, as it sets the government agenda for the next 5 years. The industries mentioned in the agenda will, subsequently, receive various forms of policy and financial support.

As expected, the Five-Year Plan (FYP), which was finalized at the NPC, focused heavily on technology development and upgrading consumption patterns in the domestic market. If the previous FYPs were focused on expanding these industries, then the 14th FYP’s focus is on upgrading and advancing them. Fostering new growth drivers such as the digital economy, the upgrading of industrial processes, the rise of the middle-class consumer, and the transition to a green economy over the coming years are essential to reaching the 2035 goal of achieving a truly modernized society. Some highlights include:

- Striving toward carbon neutrality by 2060 by promoting green development to curb emissions.

- Further opening to attract high-quality investment by increasing collaboration with the world through trade and investment deals that will complement domestic growth.

- Increasing China’s level of science and technology sophistication and achieving major breakthroughs in key core technologies in a move toward technological self-sufficiency to hedge against uncertainty in the global environment. The government has announced policy initiatives ranging from programs to support fundamental research breakthroughs to tax incentives boosting technology development.

- The plan highlights several technology industries in which the government wishes that China will become a global leader. These include cutting-edge fields such as artificial intelligence, quantum computing, and telecommunications (5G).

- Promoting domestic demand by improving the quality of domestic supply through industrialization will be complemented by an increase in demand for quality. Specific areas of focus include upgrading the manufacturing sectors, increasing household consumption, and increasing urban-rural mobility.

Fund Performance in Review

Asian equities are sensitive to the global macro growth and rates backdrop - Chinese equities are no exception. We believe growth remains strong relative to the long-term trend and rates will move higher only in a gradual and orderly fashion. Hence, the performance disparity between sectors that are sensitive to long-duration interest rates and those that are not highlights the importance of earnings. We expect GDP growth in Q2 across most developed market (DM) and emerging market (EM) economies to rebound sharply. Yet, the market today probably is not fully reflecting the above-consensus growth. This suggests more near-term upside and a broadly supportive environment for equities.

In the first half of the quarter (as of 16 February), optimism built up in late 2020 carried over to 2021 and markets rewarded the prospect of improving growth alongside accommodative monetary conditions.2 The broad Chinese equity index MSCI China returned 19.0% and our equity funds returned between 8.8 and 33.0%, in which, KWEB +33.0%, KBA +8.8%, KESG +11.4%, and KURE +15.7%.

Fueled by concerns over China’s policy tightening and the spike in US 10-year treasury yields, the second half of the quarter saw a -16.7% correction for MSCI China and our Funds pulled back by 12.8 – 25.0% as the sectors most sensitive to rates were the hardest hit.

KraneShares CSI China Internet UCITS ETF (KWEB)

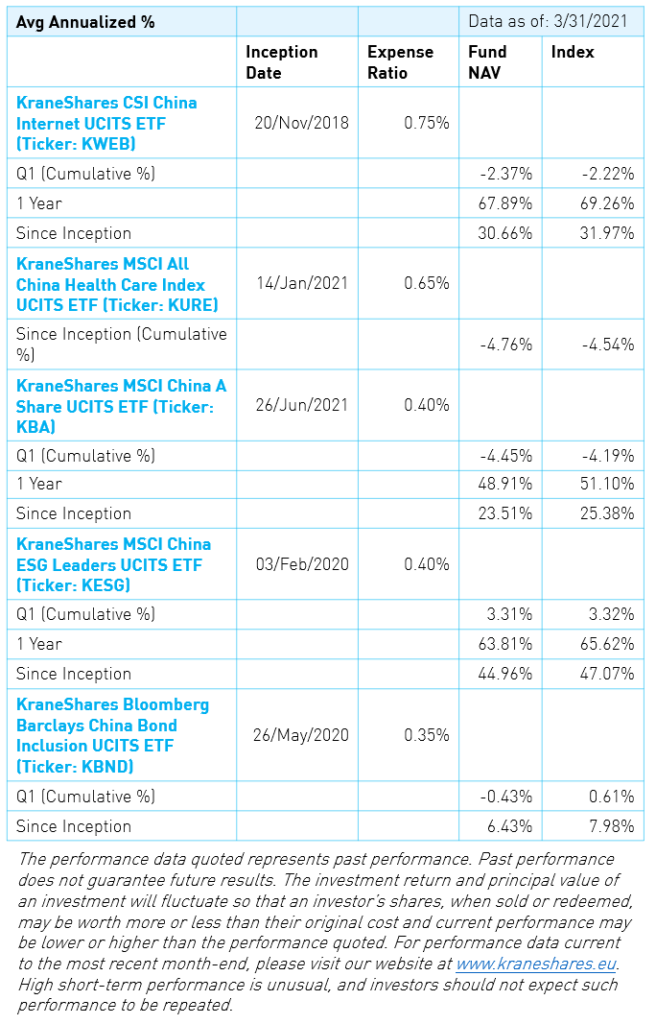

+ The fund finished the quarter down -2.4% despite having invested nearly 45% of its holdings in the Consumer Discretionary sector, which returned -5.8% overall.*

+ The pandemic accelerated the need for digitalization, and we expect that trend to continue into 2021, boosting demand in areas such as cloud, E-Commerce, local services, and online education. Meanwhile, sectors such as advertising and travel that were hit the hardest last year should see an acceleration in business growth this year, albeit off of a low base.

+ Into 2021, top-line growth matters more than profitability following a strong run in 2020. The focus is likely to turn to whether Internet names can sustain revenue growth without a pandemic. We estimate that most of our covered companies within the fund may deliver 30 – 60%+ revenue growth over the next one to three years.

+ 2021 is set to be a year of investment for internet firms and we see that E-Commerce players are committed to reinvesting for growth. Pinduoduo raised $6.5 billion in late 2020 and was expected to invest in upstream agri-food technology, logistics infrastructure, and consumer-to-manufacturing (C2M) initiatives. JD expects investments in users, logistics (supply chain and warehouses), lower-tier cities, and supermarkets to continue in 2021. While Vipshop continues to invest in user growth, its margins are likely to remain largely stable and investments will be focused on user acquisition and retention, and merchandising.2

+ Chinese internet companies have stepped up their efforts to acquire new users and improve their monetization efficiency. These investments should pave the way for sustainable earnings growth over the long term.

+/- We observed significant dispersion in stock performance in the internet sector. For example, Bilibili shares saw a quarterly gain of +25% after the company grew revenues by +104% year-over-year in Q4 2020. Meanwhile, Kuaishou Technology fell -25% and JD Health fell -26% despite growing revenues by +52% and +81% year-over-year in Q4 and the second half of 2020, respectively.3 We believe companies such as these were unjustifiably hit by the growth selloff and could be undervalued.

KraneShares MCSI All China Healthcare Index UCITS ETF (KURE)

+ The fund invests in all publicly traded China-based health care companies to offer investors access to this unique sector that is at the front and center of reforms to state-owned and heavily regulated industries in China. Over the years, we have seen private players (i.e. non-state-owned companies) start to play an important role in offering tailored personal healthcare services to customers domestically. MeiNian, for instance, has branches across cities in China and offers the most comprehensive personal health examination centers that patients can visit whenever they need, which is a service that has not been broadly available in China in the past.

+ The sector was the second-best performing sector in China last year, returning a total of +62.1% as the healthcare technology subsector returned +77.5%.3 The outperformance of China healthcare in 2020 reflects the unique, event-driven acceleration of the development of China’s healthcare system. However, an overhaul of China’s healthcare system had been underway for years.

– The performance dispersion between healthcare sectors was wide in the first quarter. Biotechnology companies outperformed other sub-sectors in the first quarter as Beigene gained +34.7%. Meanwhile, healthcare technology companies were caught in the growth selloff as Ali Health fell -3.9%.3

KraneShares MSCI China A Shares UCITS ETF (KBA)

+ The Fund offers broad exposure to China’s onshore equity market with a balanced sector allocation to reflect MSCI’s index inclusion effort. As cyclical sectors rebounded strongly from 2020’s underperformance in Q1, Utilities, Materials, and Energy stocks all contributed positively to the fund’s Q1 performance.

+ Although Utilities have the lowest holding weight in the fund, the sector contributed the most to the fund’s returns in Q1. For example, Shenzhen Energy Group is one of the main power generation companies in Shenzhen, China. The company is involved in developing, researching, and investing in high-tech new energy-related technologies as well as urban solid waste treatment and wastewater treatment. The company reported a 2020 net profit that grew +134.2% year-over-year and topped returns from the underlying holdings of the Fund after its stock returned over 83.6% in Q1.3

– The massive valuation expansion that supported the top performers in 2020 came to an end and these companies have had a completely different experience in 2021. Information Technology, Consumer Staples, and Health Care have all detracted and underperformed due to headline volatility. However, we expect earnings momentum to remain positive for these sectors in the coming months and anticipate a rebound from here.

KraneShares MSCI China ESG Leaders UCITS ETF (KESG)

+ The Fund invests in Chinese equities listed both onshore and offshore with the goal of holding the companies that rank in the top 50% within the Environment, Social and Governance (ESG) rankings produced by MSCI ESG research. Given the relatively higher quality in the selection of the underlying stocks, the fund demonstrated resilience during the recent market downturn.

+ KESG outperformed broad China A-shares by 776bps in Q1 (+3.31% vs KBA -4.45%). Despite the broad challenges to the sectors that are sensitive to rates, we saw companies in the Financials, Industrials, and Real Estate sectors returned twice as much compared to most other sectors in the fund.3 This performance dispersion suggests investors are differentiating between companies within the same sectors and rewarding the ones that have demonstrated better compliance with ESG standards.

– Consumer Discretionary lagged in performance in Q1 in general and is the highest weighted sector in the Fund, a result of the index methodology. In particular, electric vehicle manufacturers underperformed as Geely Automobile returned -25.4%, NIO -20.0%, and BYD -18.0%.3 In addition to the growth selloff, investors may also have been concerned about production delays due to semiconductor shortages toward the end of the first quarter. Nio announced a five-day production halt on March 29th for this reason.2

KraneShares Bloomberg Barclays China Bond Inclusion UCITS ETF (KBND)

+ The Fund offers a balanced risk profile between agency and treasury bonds, thus providing a barbell strategy by holding both long and short-duration bonds. Although some of the long-dated government bonds continue to add value to the Fund, we have seen consistent and stable returns from the policy bank bonds that are relatively shorter in duration, but higher in yield.

+ Historically, China’s central bank has seldom used bond purchasing to manage liquidity. Instead, they typically target the near-term lending rate to ensure yields are within a reasonable range to avoid scaring investors with a squeeze in the financial conditions. Therefore, agency bonds usually offer higher yields than government bonds, even those with the same durations.

+ KBND finished the quarter marginally down by -43 bps compared to the Global Aggregate, which was down by -450 bps, and the U.S. Aggregate, which was down by -340bps, an outperformance of 297 – 407 bps for the quarter. This outperformance comes despite the underlying currency depreciating by 0.50% in the quarter after a strong appreciation last year of over 6.64%. However, we expect the appreciation trend to continue this year and beyond, as global growth starts to pick up, to the benefit of China’s exports, which surged by nearly 40% in the first quarter.1 Most importantly, the wide monetary policy gulf between the US and China may lead to further appreciation in the RMB.

Potential risks

First, our base case scenario is that global markets recover from the recent correction as evidence of the perceived global and regional recovery comes through. However, a slower than anticipated pace of recovery and even higher bond yields may result in downside pressure for equities in the near term. For example, stocks that are more sensitive to long-duration interest rates have underperformed since mid-February and could see more headline risk if rates continue to rise.

Second, many Chinese companies will start to release Q1 earnings in April. We will be watching closely and report our thoughts in the next publication. Earnings releases will help investors decide whether valuations are indeed stretched. Strong revenue growth will be required for growth companies to outperform.

Last, the regulatory risk in China will remain on investors’ minds at least in the next quarter or so.

We believe that the following two questions will need to be addressed in the second quarter:

1) Will government policies remain accommodative and serve as a boost to economic growth rather than tightening too soon out of fear of inflation?

2) Regulations introduced for certain new-china sectors may dampen investor confidence. Will these sectors become over-regulated and will regulation pose the risk of dampening market-oriented competition, development, and these firms’ ability to become world leaders in the industry?

We will be monitoring these areas closely and are continuously assessing their impact on our funds.

Conclusion

We remain constructive on China’s capital markets and view the recent pullback from mid-February’s highs as a potentially attractive entry point for long-term investors. We are comfortable with our market and sector allocations in the context of a strong global reflationary upswing. We also maintain a selective engagement in longer-duration growth themes. We believe Chinese policymakers will take a balanced approach by improving regulatory oversight without risking China’s growth trajectory and market efficiency.

Performance data from Bloomberg as of 3/31/2021.

*Represented by the MSCI China Consumer Discretionary Index

Citations

- “China’s first-quarter exports jump nearly 40%,” MarketWatch. April 12, 2021.

- Source: Bloomberg Intelligence

- Data from Bloomberg as of 3/31/2021.

Term Definitions

Gross Domestic Product (GDP): A sum of the cumulative economic value produced within a country, usually over a year.

Index Definitions

MSCI Emerging Markets Index: The MSCI Emerging Markets Index is a free-float weighted equity index that captures large and mid-cap representation across Emerging Market (EM) countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. The index was launched on January 1, 2001.

MSCI China Index: The MSCI China Index captures large and mid-cap representation across China A-shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs). With 703 constituents, the index covers about 85% of this China equity universe. Currently, the index includes Large Cap A and Mid-Cap A-shares represented at 20% of their free float-adjusted market capitalization. The index was launched on October 31, 1995.

Bloomberg Barclays Global Aggregate Index: The Bloomberg Barclays Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate, and securitized fixed-rate bonds from both developed and emerging markets issuers. The index was launched on January 1, 1990 .

MSCI China Consumer Discretionary Net USD Index: The MSCI China Consumer Discretionary Index captures large and mid cap representation across China H shares, B shares, Red chips and P chips. Currently, the index also includes Large Cap A and Mid Cap A shares represented at 20% of their free float adjusted market capitalization. All securities in the index are classified in the Consumer Discretionary sector as per the Global Industry Classification Standard (GICS®). The index was launched on September 15, 1999.

MSCI All Country World Index (ACWI): The MSCI ACWI captures large and mid-cap representation across 23 Developed Markets (DM) and 27 Emerging Markets (EM) countries*. With 2,978 constituents, the index covers approximately 85% of the global investable equity opportunity set. The index was launched on January 1, 2001.

MSCI USA Index: The MSCI USA Index is designed to measure the performance of the large and mid cap segments of the US market. With 621 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in the US. The index was launched on March 31, 1986.

MSCI Europe Index: The MSCI Europe Index captures large and mid cap representation across 15 Developed Markets (DM) countries in Europe*. With 434 constituents, the index covers approximately 85% of the free float-adjusted market capitalization across the European Developed Markets equity universe. The index was launched on March 31, 1986.

Bloomberg Barclays US Aggregate Bond Index: The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar, fixed-rate taxable bond market. The index includes treasuries, government-related, and corporate securities, MBS (agency fixed-rate pass-throughs), ABS, and CMBS (agency and non-agency). The index was launched on January 1, 1976.