Key Takeaways From 2023 BloombergNEF Summit & EV Outlook

By Anthony Sassine, CFA

Every year, electric vehicle (EV) investors, policymakers, and industry participants flock to San Francisco to attend the Bloomberg New Energy Finance (BNEF) EV Summit. The summit is a melding of the minds for the global EV industry that signals future trends and developments on the horizon. We attended this year's summit and noted some differences from last year that may herald changes in the EV market going forward and have also helped inform our outlook for EVs in 2023, which we have included in this article.

Key Takeaways From The BNEF EV Summit

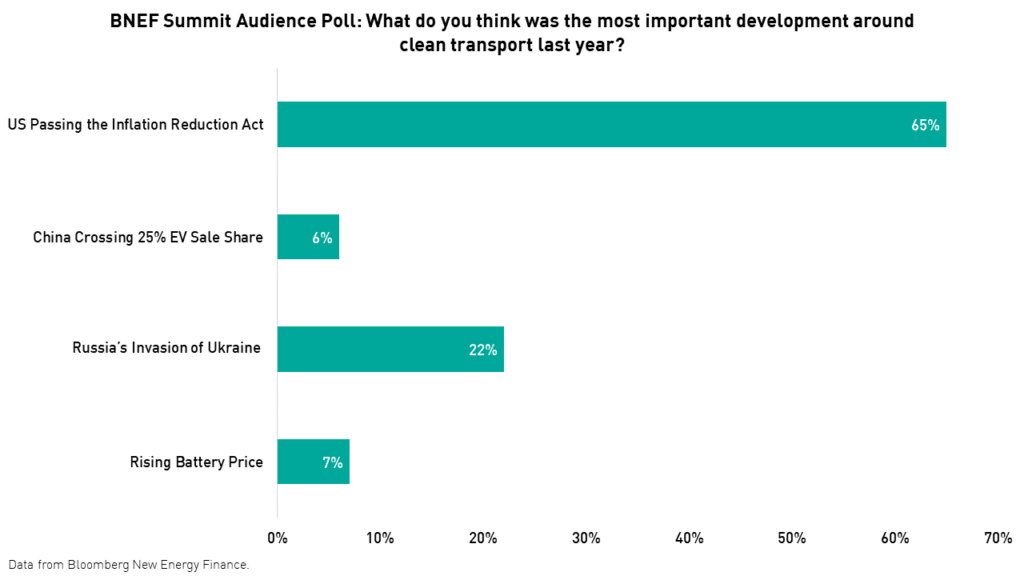

Participants hailed the Inflation Reduction Act (IRA), passed in the US last summer, as the most significant development for EVs globally in 2022. 65% of the conference's participants said that it was the most important development around clean transport last year. Participants also said that they are eagerly awaiting the passage of similar legislation in the European Union (EU). At the same time, there was a lack of buzz around IPOs, SPACs, and hydrogen startups compared to last year, which may indicate a more focused industry going forward.

State and federal government officials were also in attendance at the conference, including representatives from state departments of energy and transportation. A representative from the Climate Conservative Caucus spoke to climate issues and the IRA and reported a shift in the Republican stance towards climate change.

The affordability of electric transportation tends to be a key concern to local and national governments. Patty Monahan, the Transportation Lead Commissioner at the California Energy Commission (CEC), said that we must ensure that EVs are accessible to all and not just the “arugula-eating, Tesla Driving elite.”

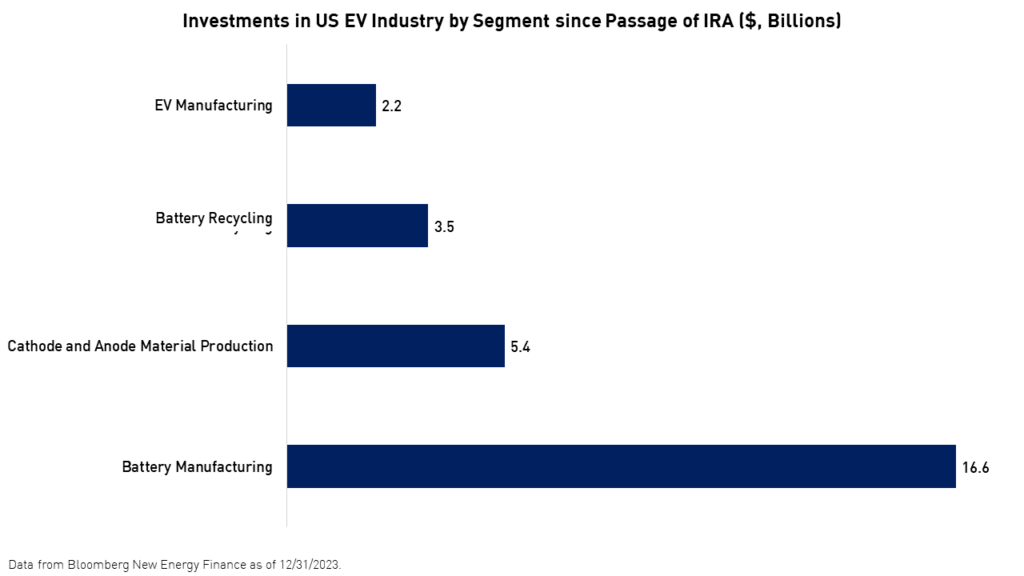

China’s leading position in EV adoption and the supply chain for metals compared to the US and Europe was also highlighted during the conference. China possesses the largest EV market, with the most electric vehicle chargers. Many at the conference agreed that the IRA could provide the US the advantage it needs to become a global leader in EVs. Most importantly, the IRA may help bridge the production cost gap between the US and China. For example, battery production costs $30 less per kilowatt-hour (kWh) in China. Meanwhile, the IRA provides up to $45 per KWH for battery research, innovation, and manufacturing.

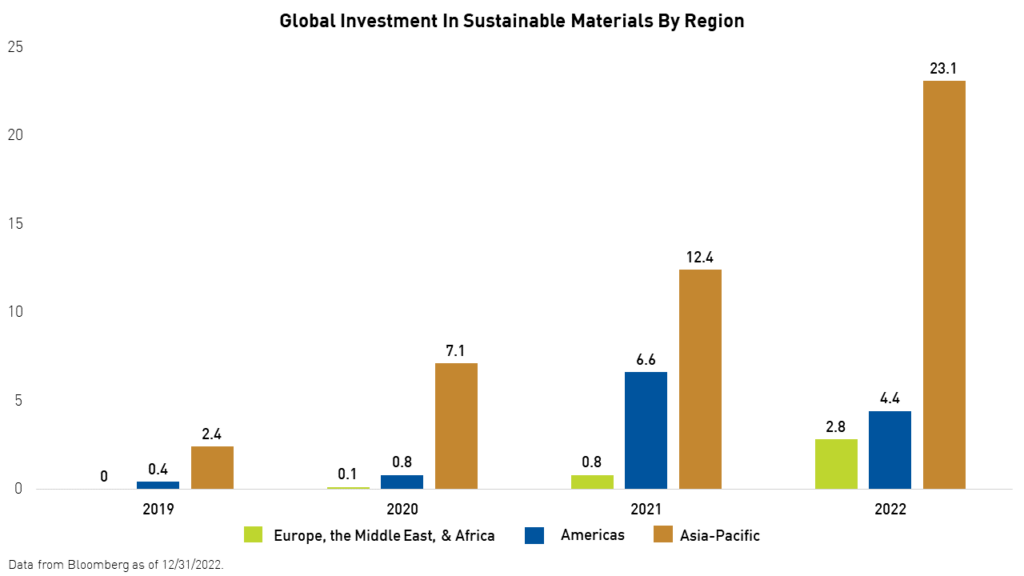

The IRA has already incentivized many companies to announce new investments or accelerate plans. The act has already led to nearly $29 billion worth of new investment in batteries and EV manufacturing, according to BNEF.

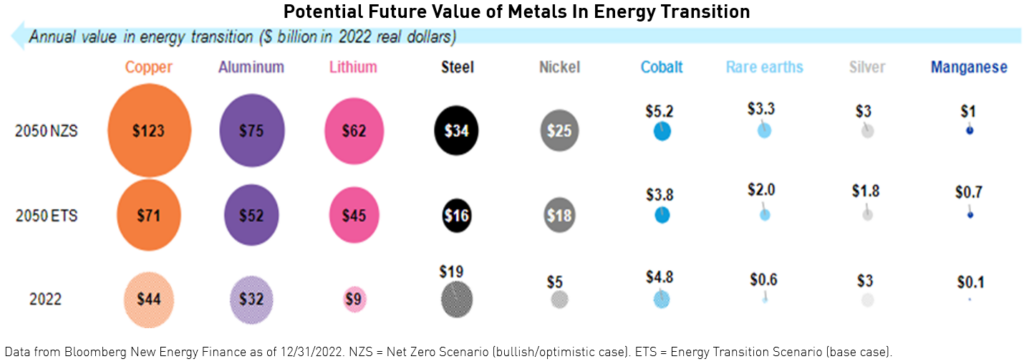

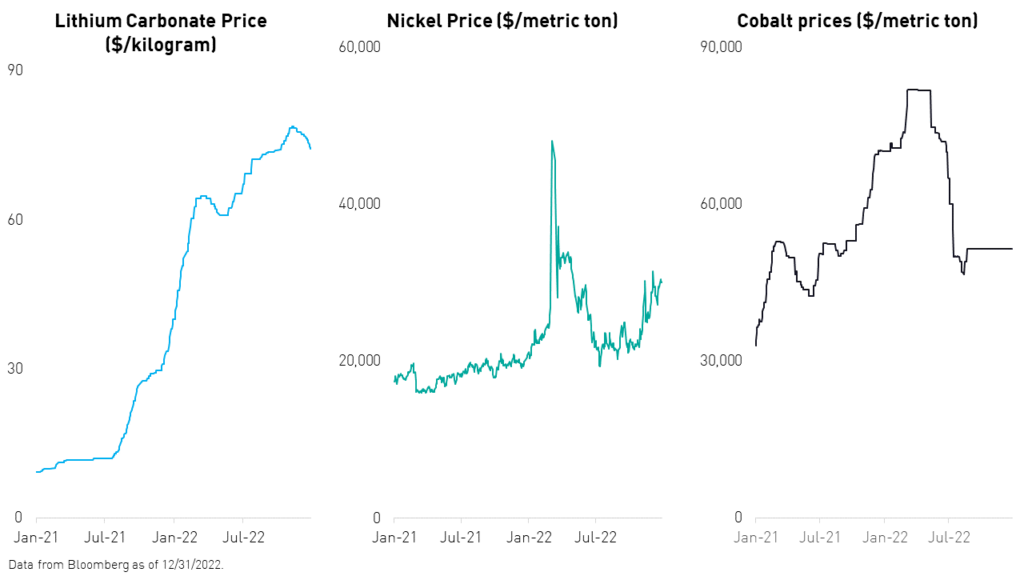

Ensuring an adequate supply of the raw materials necessary to produce EVs was also a topic of discussion at the conference. While certain metals are seeing new supply become available rapidly, the supply and demand imbalances for others are expected to persist for the foreseeable future. We do not currently possess enough copper, aluminum, nickel, cobalt, lithium, and manganese to electrify transportation fully. Battery recycling could be a solution in the long term to ease the supply glut as newly-developed sodium-Ion batteries can offer the same range with less lithium.

One of the liveliest sessions at the conference involved a debate over whether we will need larger battery packs in the future. The conclusion was that, with more charging stations, smaller battery packs would be adequate. However, consumer tastes may continue to prevent the industry from moving to smaller battery packs, which require smaller vehicles to power. In the US, for example, SUVs and pickup trucks continue to dominate car sales.

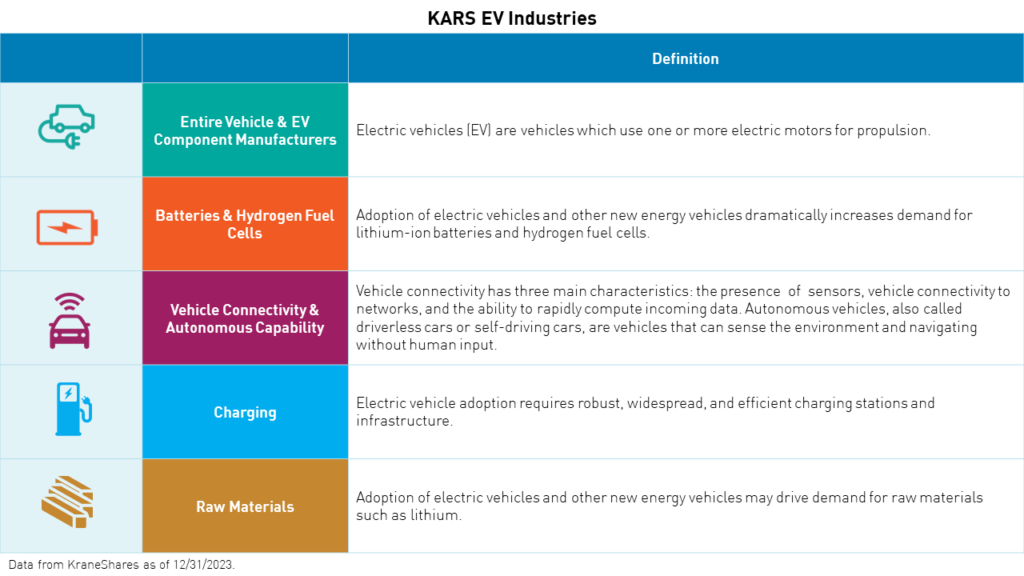

The KraneShares Electric Vehicles & Future Mobility ESG Screened UCITS ETF (Ticker: KARS) invests in the equities of companies involved in the EV ecosystem.

KARS Performance Review

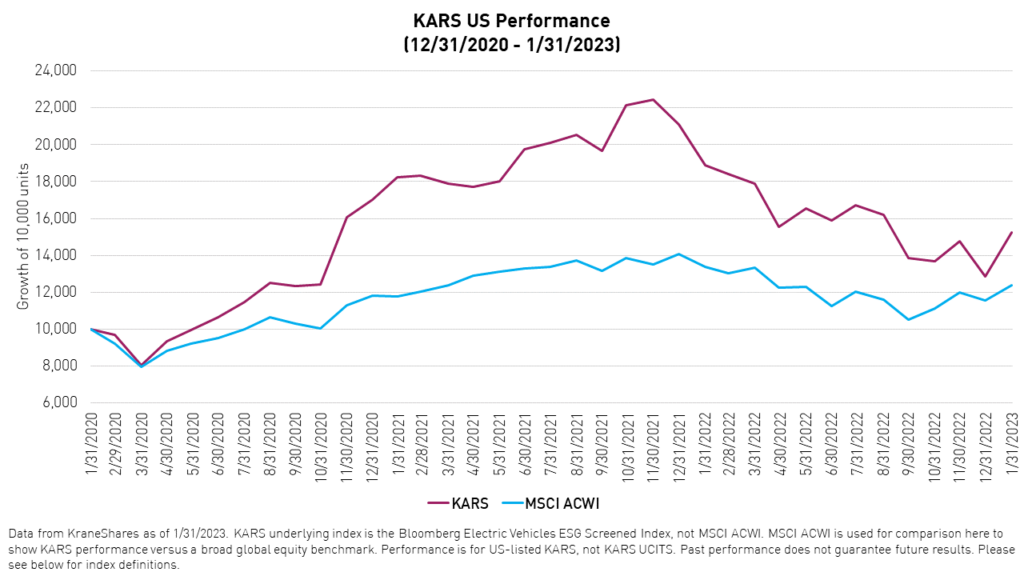

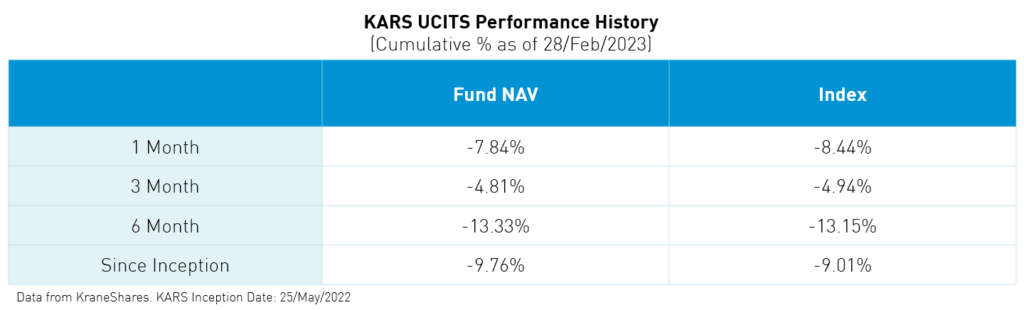

KARS had a good start to the year. The fund was up over +9% year-to-date as of 28th February, 2023 compared to MSCI ACWI's +4% return.1 While MSCI ACWI is not the fund's benchmark, we believe it is informative to look at the EV ecosystem's performance against a global equity benchmark.

2022 in Review

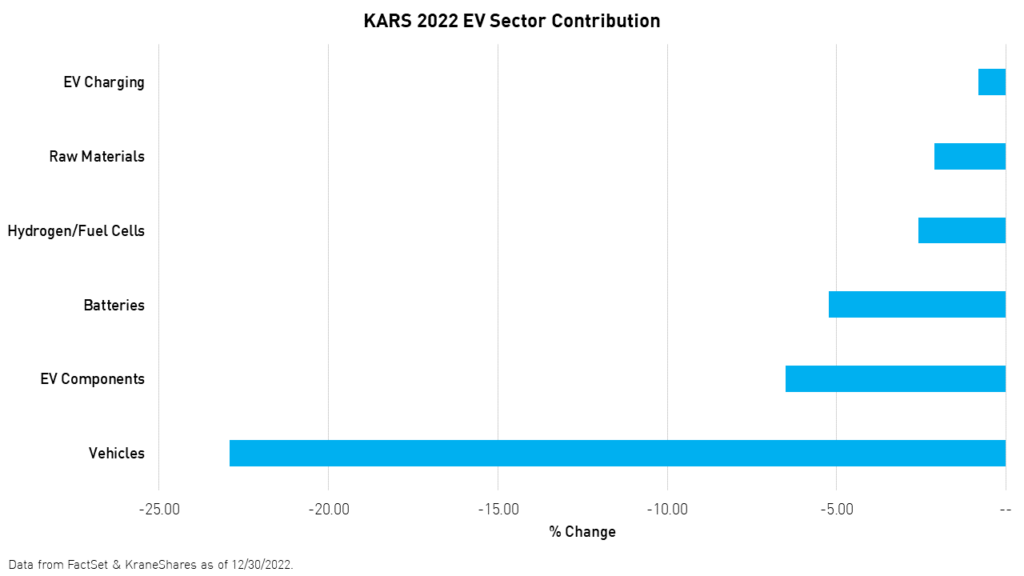

After a strong Q1 for EV sales, the Russia-Ukraine war drove metal prices higher, impacting margins across the EV ecosystem. Meanwhile, lockdowns in China brought the auto manufacturing industry to an abrupt halt in April. Also, the historical rise in rates soured investor sentiment and shifted their attention to lower demand in 2023 and its potential impact on profitability, especially for startup EV manufacturers.

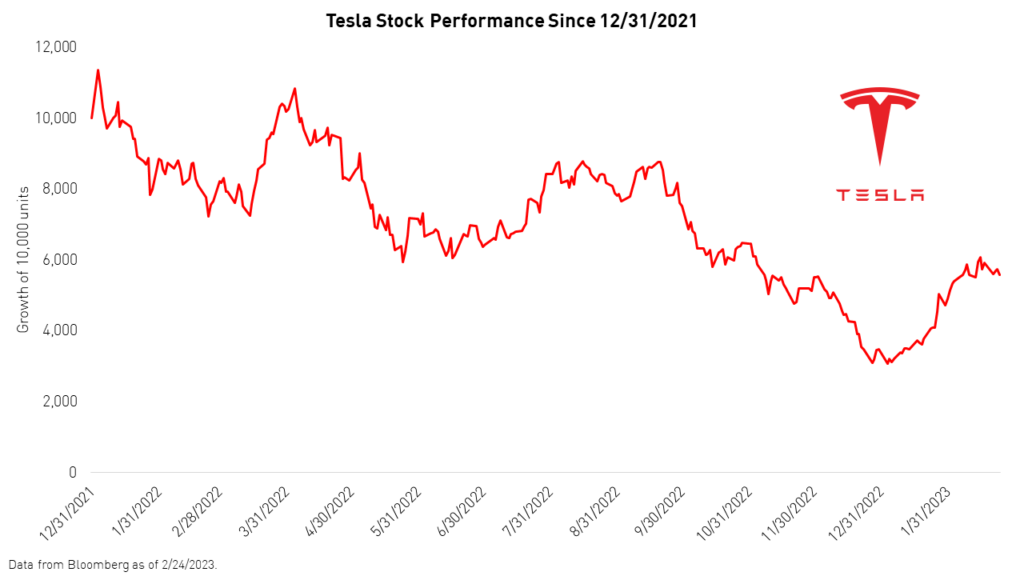

We believe investors have already priced in a bleak outlook for 2023. Even the passing of the IRA, a major surprise for the market during the summer, was unable to spare EV stock prices. In addition, Elon Musk’s acquisition of Twitter and subsequent sale of Tesla shares weighed on the performance of shares in the EV giant.

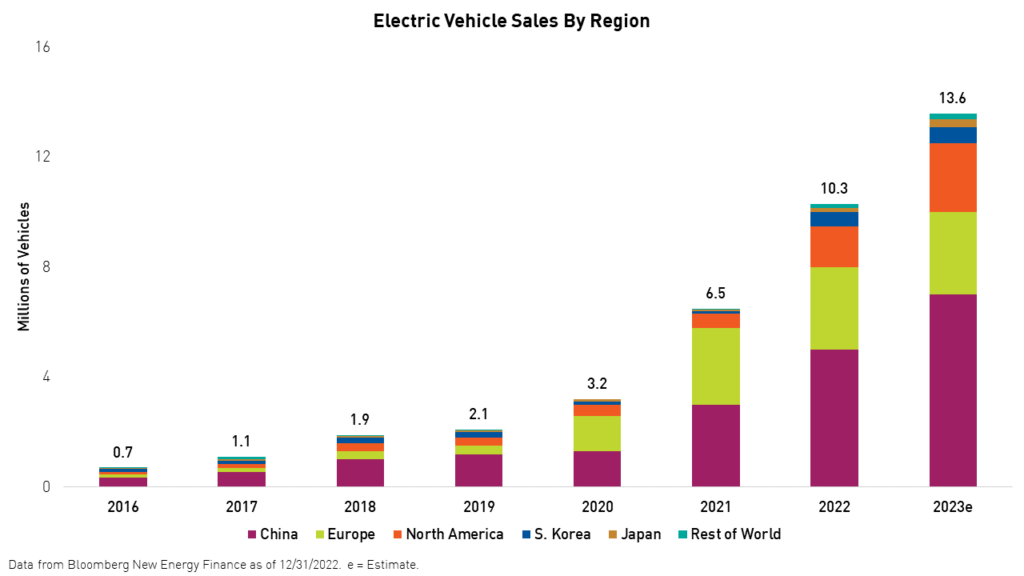

EV sales increased +60% to reach 10.3 million in 2022, up from 6.5 million in 2021. China continued to lead in sales as 6 million EVs were sold in the country. Meanwhile, Europe and the US tracked behind, logging sales of 2.6 million and 800,000 EVs, respectively.1

While Tesla led the market in Battery Electric Vehicle (BEV) sales and gross margins, BYD stood out for its sales growth, as the company registered 250% growth in vehicle sales, briefly surpassing Tesla in BEV sales in May. The company sold ~1.8 million EVs in 2022, and approximately one half of those were sales of BEVs. Another notable development in 2022 was the breakthrough of Tesla’s Y model to the list of the top 5 cars sold in 2022.2 Despite all the progress, EV stock prices suffered in 2022 after a solid 2 years.

Batteries

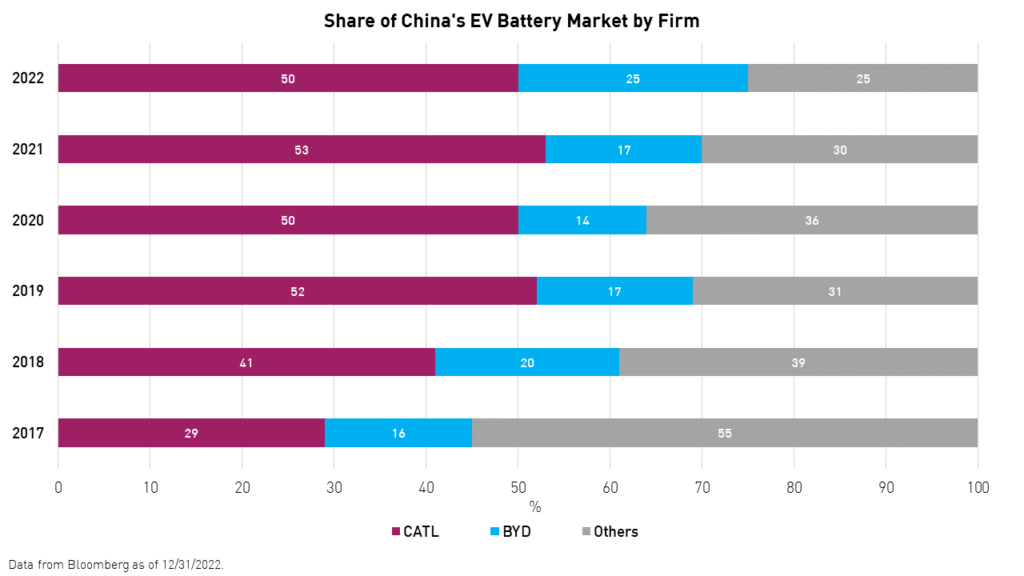

Battery makers had the most to juggle in 2022. Higher metals prices were compounded by pre-set contracts with original equipment manufacturers (OEMs) to deliver at fixed prices. Both headwinds severely tightened battery makers’ margins as Contemporary Amperex Technology Limited (CATL), the world's largest battery maker, missed estimates on gross margins in its Q2 earnings report by approximately 10%.1 If lithium supply continues to be tight in 2023, this may pressure battery makers further.

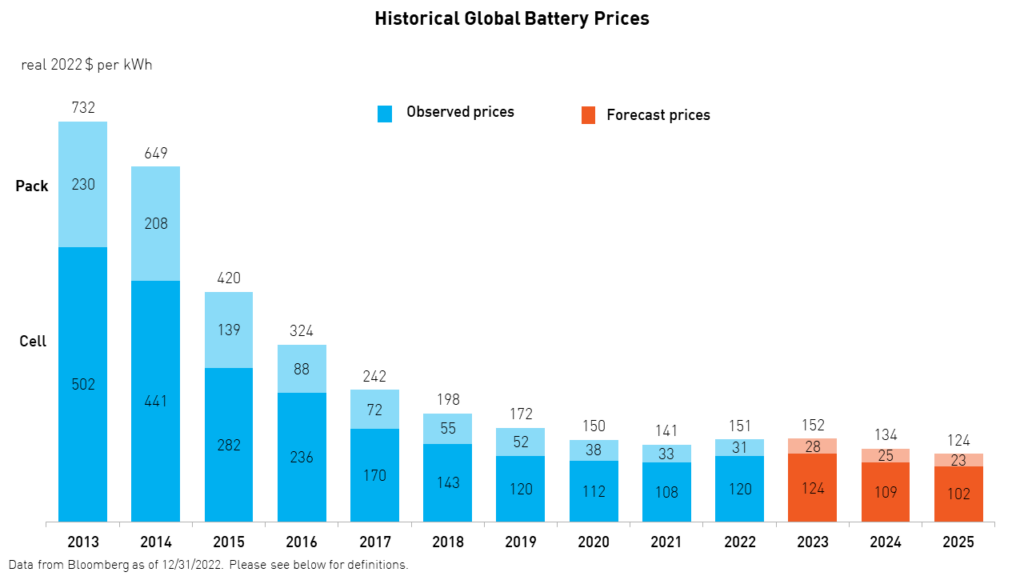

Fortunately for battery makers, battery contracts are now moving away from fixed priced contracts to indexed contracts, which should help battery makers achieve more favorable agreements. For the first time in 10 years, Battery prices rose in 2022 to $152 per KWh.1

On the technology side, CATL rolled out its "Qilin" cell-to-pack battery technology, which is expected to reach 620 miles in range, the longest range ever for a single battery pack.3

Build Your Dreams (BYD), a China-based EV manufacturer, continues to gain market share in battery sales and expand its rolodex of external buyers. Tesla’s 4,680 battery cells production made some progress in 2022, but less than expected.4

The Inflation Reduction Act (IRA)

The biggest surprise in 2022 was the passage of the Inflation Reduction Act (IRA), which allocated $369 billion to climate, including tax credits for new and old EVs, and significant incentives for suppliers to create a local supply chain.

We believe the passage of the act is a game changer and may place the US among the top countries for EVs. Some of the most important transportation-related incentives include a $7,500 credit at the point of sale for buyers of a new EV (given they meet price and income requirements) and a $4,000 tax credit for used cars.

The IRA also provides up to $45 per kWh in incentives for battery makers and more than $3 billion in funds for charging infrastructure. 2022 saw more than 750,000 EV chargers added. The vast majority of the new chargers were installed in China (600,000 chargers), followed by the EU (120,000 chargers), and the US (30,000 chargers). However, more chargers are undoubtedly needed, especially in the US.

2023 Outlook

Electric vehicles were off to a good start in 2023. KARS was up +19% in the first month of the year, before a meaningful correction in February.

Please click here for KARS standard performance.

We have seen a notable comeback from vehicle companies including Tesla, BYD, and NIO. Many car companies, led by Tesla, are starting to cut prices, sacrificing margin for volume.

Metal prices are expected to remain tight, but may decline as more capacity comes online. Lithium is expected to have the tightest supply, leading to potentially another increase in battery prices in 2023.

EV Manufacturers

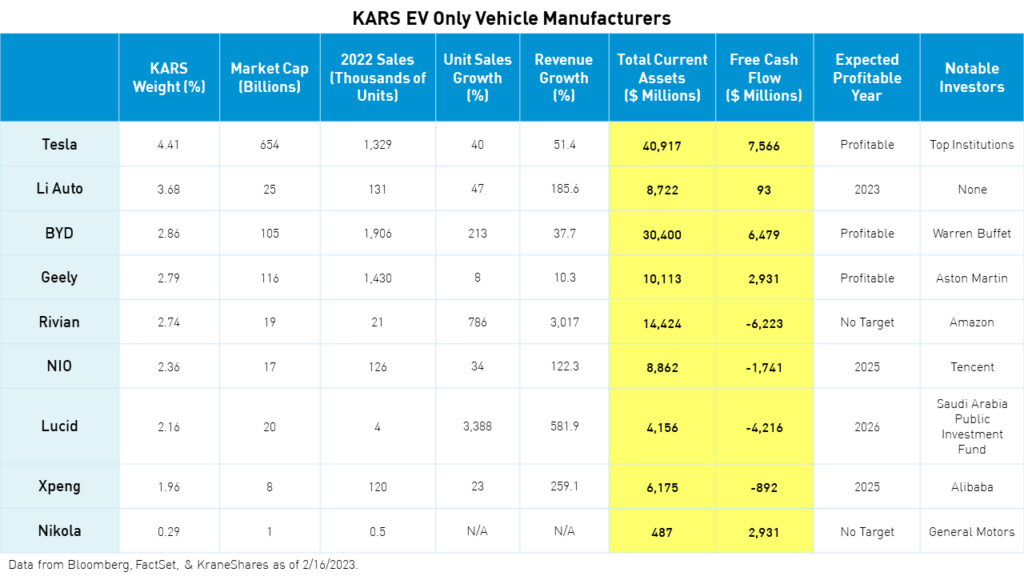

Despite concerns over profitability, many EV manufacturers are on solid financial ground if not already profitable, such as Tesla, BYD, and Geely. Most companies have enough cash on hand to potentially cover their cash burn over multiple years. Furthermore, many of these companies continue to be backed by seasoned investors.

BNEF expects 14 million EVs to be sold in 2023. Commercial vehicles such as vans and buses are expected to lead EV sales growth this year. Tesla has begun delivering its Electric semi-truck as well.4

Passenger electric vehicle growth is projected to hit 30%, as growth is expected to decelerate in China from 80% growth in 2022 to 20% in 2023, with a pickup in the US due to the IRA.1 Europe’s growth could be muted as the continent deals with its energy crisis, hindering the government’s ability to enact stricter carbon emission policies and impacting the economy.

The lower demand led to many EV companies cutting prices. We expect leading companies, including Tesla and BYD, to be less impacted by the price cuts that resulted from a rapid rise in interest rates and a deceleration in demand.

BYD may surpass Tesla in Battery Electric Vehicle (BEV) sales this year. However, Tesla remains the leading EV company by far due to its brand, manufacturing know-how, scale, battery innovation and manufacturing capabilities, and more.

Most Chinese startups (NIO, Xpeng, and Li auto) should continue to do well. Recent sales figures, however, have suggested a preference for NIO and Li Auto over Xpeng. NIO, with the release of the ET5 and ET7 models, has revived momentum. Meanwhile, Li Auto, which is focused on plug-in hybrids (PHEVs), is about to reach annual profitability. In fact, the last 12 months of free cash flow already suggest that Li auto is profitable.

Rivian had a difficult 2022 after a highly successful IPO. However, multiple management mistakes and the overestimation of sales targets have made investors hesitant. Nonetheless, the company continues to have one the most advanced and highly rated products in a large market and enjoys Amazon’s backing.

Lucid, on the other hand, struggles to gain sales momentum. They sold a mere 4,379 EVs in 2022 but exceeded their production target of 6,000 to produce 7,000 EVs. The company is backed by the Saudi Arabia Public Investment Fund, and a significant order from the Saudi government of 100,000 EVs over the next 10 years.

EV startup Fisker, on the other hand, is in a tough situation. The company has no sales, low cash, and no backing. It will be interesting to see how it navigates the treacherous waters of 2023.

Traditional car companies continue to struggle to catch up with leading EV only manufacturers. Ford's CEO reported manufacturing setbacks in Q4. Also, many of these companies are struggling to secure battery supplies and still carry the heavy weight of a declining internal combustion engine (ICE) business and potential cannibalization effect from lower margin EVs.

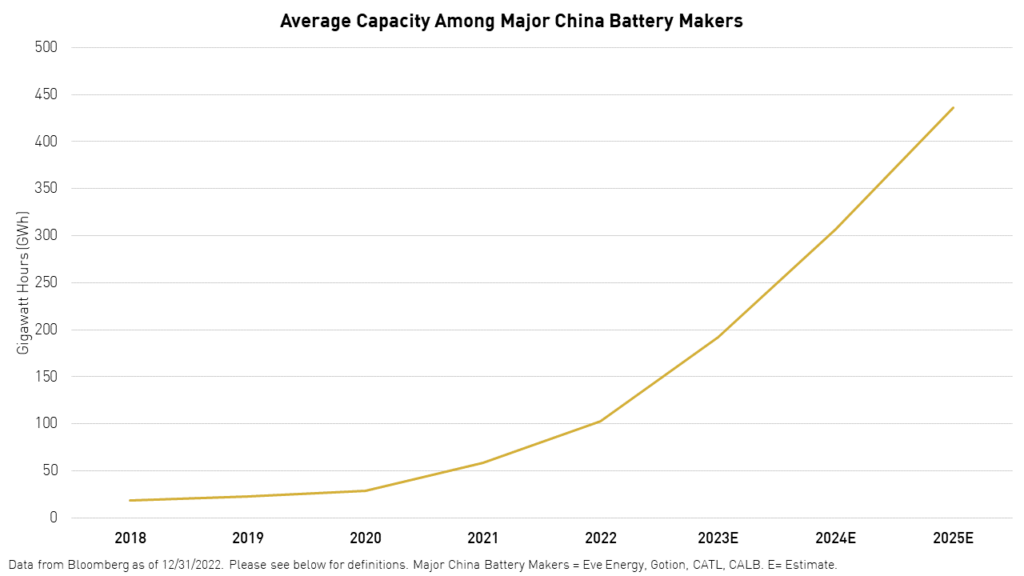

China and Korea continue to dominate the battery space, with tier one players CATL, LGES, BYD and Panasonic leading. Tier two Chinese battery makers such as EVE energy, Gotion, and CALB are ramping up production and innovation to become a real competitive threat. Battery demand may continue to exceed supply next year, but an avalanche of capacity is on the way.

Although the IRA was positive for supply chains in the US, Mexico, and Canada, it could present some difficulty for China-based firms looking to expand, though some of the Act's requirements are ambiguous. However, what remains clear is that Chinese battery makers continue to grow market share globally at the expense of their Korean counterparts. Meanwhile, CATL and BYD continue to be leaders in their home market, outpacing CALB and Gotion handily.

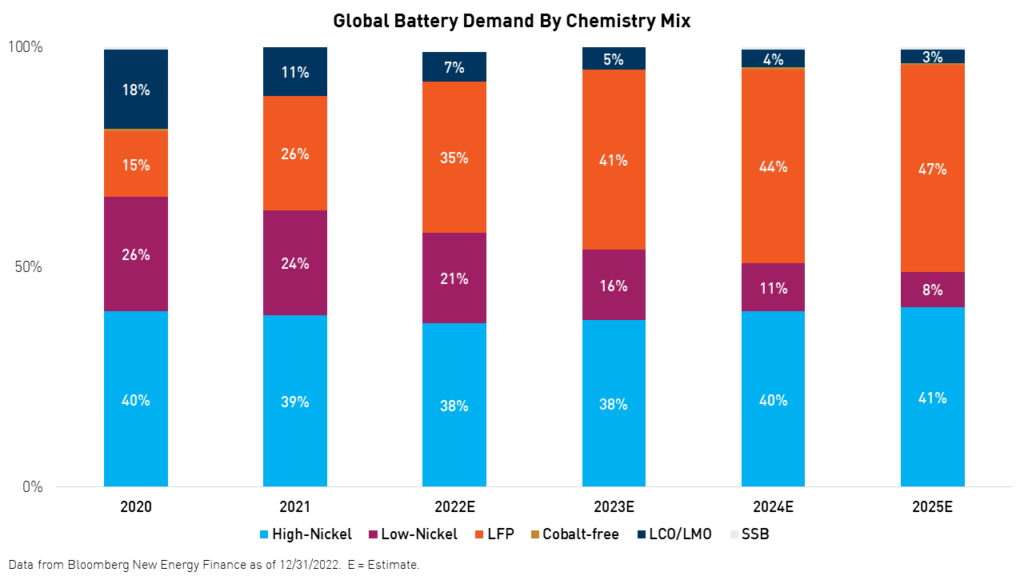

The shift toward Lithium based batteries such as Lithium Ion Phosphate (LFP), which reached 35% of all batteries in 2022, and away from Nickel based batteries continued to accelerate in 2022, applying pressure on Lithium prices. While Nickel-based batteries can yield a longer range, lithium-based (LCO/LMO) batteries are more economical, though have a slightly lower range. Demand for Lithium batteries increased by +55% in 2022 from 496 gigawatt-hours (GWh) in 2021 to 769 GWh in 2022. The average EV battery has a capacity of 50 kilowatt-hours (KWh), which is equivalent to 50/1,000,000 GWh.1 Meanwhile, demand for solid state batteries (SSBs) remains low.

Demand in 2023 is expected to be for 1,043 GWh, or +36% more capacity than 2022. Among the Chinese battery manufacturers, CATL ranks first in terms of capacity with 315 GWh in 2022. BYD is second with 100 GWh of capacity, and Gotion is third with 70 GWh of capacity. China's total battery capacity has grown has growth from 312 GWh in 2020 to 843 GWh in 2022, a record increase in response to supply shortages. Battery capacity in China is expected to grow by another 73% to reach 1,459 GWh in total and just under 450 GWh on average, among China's major battery makers by 2025.1

The IRA’s impact on China's battery manufacturers could be significant. However, China controls most of the capacity and remains the main source of innovation in vehicles, batteries, and more, which is essential for advancing the transition. More clarifications are needed, but in order for EVs or supply chain companies to be eligible to tax breaks or subsidies under the IRA, they must adhere to the act's requirements for assembly location and the country source of parts.

The IRA also aims to encourage the localization of manufacturing and innovation. As a result, many China-based battery makers have inked deals with US manufacturers. CATL and Ford's deal to supply batteries starting in 2023 is a prime example. Foxconn also reached an agreement with Lordstown Motors by which the former would own Lordstown's factory allowing Lordstown to benefit from the favorable economics of a China-based battery maker.4 Lithium-ion Phosphate (LFP) batteries continued to gain popularity in 2022 to reach 35% of total batteries.1 This is putting more pressure on lithium prices and demand which is expected to be tight this year. More supply is being sourced, but may take until the second half of 2023 or even 2024 to impact lithium prices.

However, should China-based companies be labeled as “foreign entities of concern," then they may be unable to benefit from the IRA through partnerships. That could help explain the lower valuation of these companies, especially CATL, despite their strong growth.

Consumer

While 2023 may prove challenging for US and EU consumers in light of higher rates and slowdowns, China is on the opposite trajectory, with improving consumer sentiment. Rates are at a multi-year low, and savings are at a multi-year high following lockdowns in China.

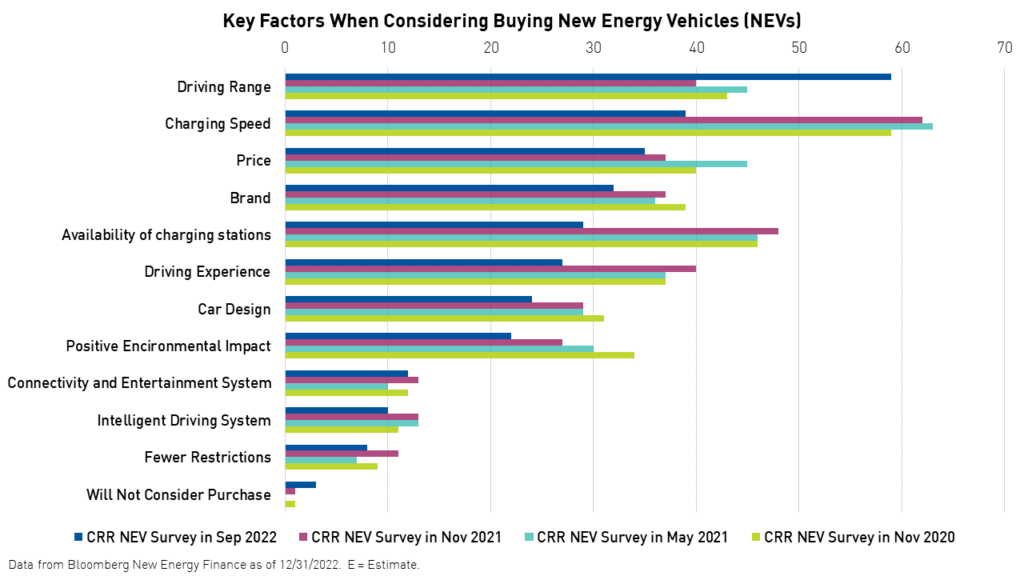

According to China Reality Research (CRR) surveys, which have been asking the same questions since 2020, driving range is now the biggest factor that buyers consider when deciding whether to buy a new energy vehicle (NEV) or an internal combustion engine (ICE) vehicle. Chinese consumers appear less concerned with charging speed and the availability of charging stations compared to consumers in the US and Europe. That could be a reflection of the wide availability of charging stations in China, which today leads globally after having built more than 1.5 million chargers over the past four years compared to 503,932 in Europe and 84,750 in the US.1

Key Investment Considerations

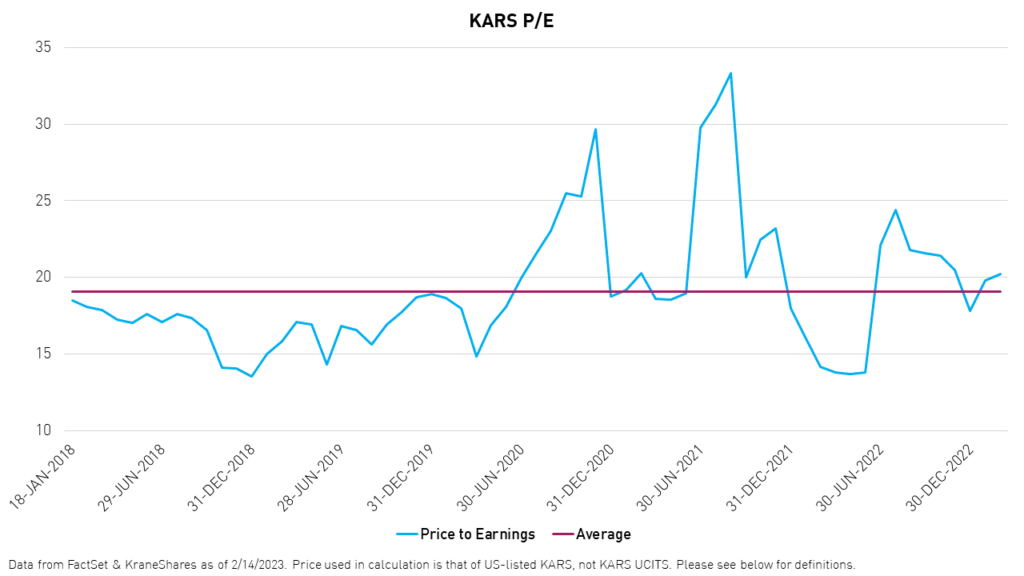

As we look forward to the near and far future, electric vehicles are expected to grow faster than the global economy. BNEF expects 30% growth for EV unit sales this year, while global gross domestic product (GDP) growth expectations are anchored at 2.9%.1 Valuations are also supportive, at this point, and near the five-year average, despite the run-up in January.

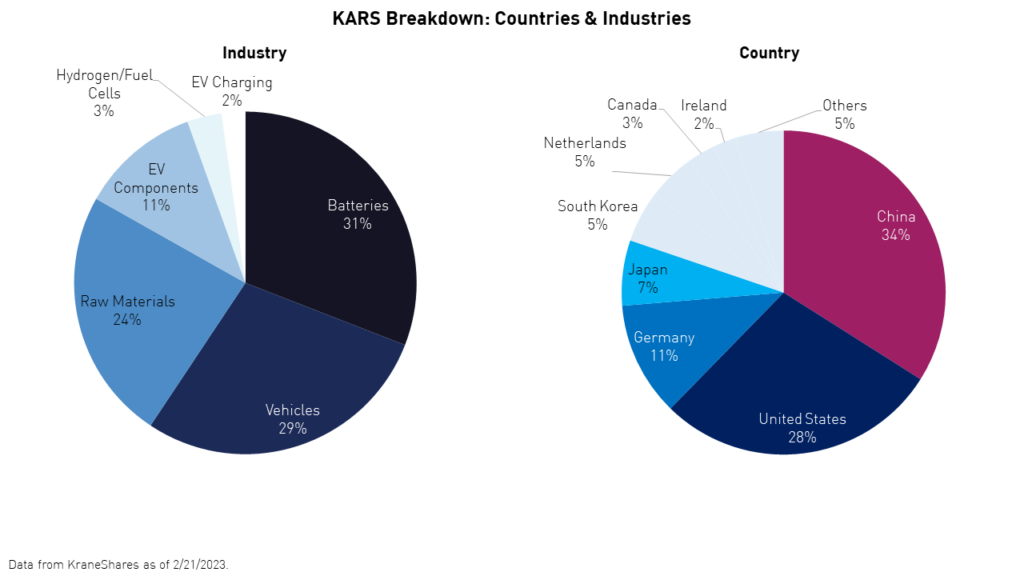

We believe KARS can add value to investors’ global equity portfolios as it provides a balanced and comprehensive exposure to the EV ecosystem (i.e. the companies making this transition happen).

We believe KARS can also provide significant diversification* benefits as its overlap is below 4% with the S&P 500 Index, the MSCI ACWI, and the MSCI Europe Index.1 As such, the fund exposes investors to companies not traditionally included in global indices, all of which are part of a transformational investment theme. KARS is further diversified on a country level, with a balanced exposure to the world’s largest EV markets: China, the US, and the EU.

Conclusion

Although we may see growth of EV unit sales decelerate in 2023 to only 30%, the undervaluation of companies in the industry from the stock market declines of 2022 could provide long-term investors an attractive entry point.

Rapidly rising rates and tight metal supplies have led to downward pressure on demand and upward pressure on battery prices. As some of the most significant issues begin to dissipate, such as the Fed pivoting or more lithium supply coming online, we expect to see a rebound in demand and a readjustment of earnings expectations for the EV ecosystem.

We believe investors may benefit from EV exposure in their global equity portfolios. This exposure can be difficult to attain from broad indexes or even active managers. In addition to its visible long-term growth potential, EVs could provide investors with diversification* benefits, especially as we enter a potentially challenging period for global growth.

For KARS top ten holdings, please click here.

*Diversification does not ensure a profit or guarantee against a loss. Neither the MSCI ACWI, the S&P 500, nor the MSCI Europe indexes are KARS underlying index.

This material contains the author/speaker's opinion and it should not be regarded as investment advice or a recommendation of specific securities. Holdings are subject to change. Securities mentioned d

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KIID before making any final investment decision.

Citations:

- Data from Bloomberg as of 12/30/2022.

- Armstrong, Kevin. "Tesla Model Y Set to Take Top Spot as World's Best Selling Car in 2022," not a tesla app. February 1, 2023.

- Walz, Eric. "Zeekr's New 009 Electric Passenger Van is the World's First EV to Feature CATL's Advanced 'Qilin' Battery," Future Car. December 19, 2022.

- Data from Company Releases as of 12/31/2022.

Definitions:

Gigawatt Hour (GWh): Gigawatt hour, abbreviated as GWh, is a unit of energy representing one billion (1,000,000,000) watt hours and is equivalent to one million kilowatt hours. Gigawatt hours are often used as a measure of the output of large electricity power stations. A kilowatt hour is equivalent to a steady power of one kilowatt running for one hour and is equivalent to 3.6 million joules or 3.6 megajoules.

Kilowatt Hour (kWh): A kilowatt-hour is a unit of energy: one kilowatt of power for one hour. In terms of SI derived units with special names, it equals 3.6 megajoules. Kilowatt-hours are a common billing unit for electrical energy delivered to consumers by electric utilities.

Revenue Growth: The growth of a company's top line revenue, in this case expressed as a percentage taken year-over-year.

Gross Margin: The term gross margin refers to a profitability measure that looks at a company's gross profit compared to its revenue or sales. A company's gross margin is expressed as a percentage. Gross profit is determined by calculating gross sales. The higher the gross margin, the more capital a company retains, which it can then use to pay other costs or satisfy debt obligations. The revenue or sales figure is gross revenue or sales, less the cost of goods sold (COGS), which includes returns, allowances, and discounts.

Net Margin: The net profit margin, or simply net margin, measures how much net income or profit is generated as a percentage of revenue. It is the ratio of net profits to revenues for a company or business segment.

Price to Earnings (P/E): The price to earnings ratio is a company's earnings per share (EPS) divided by the price per share. The price to earnings ratio is a commonly used metric for determining how undervalued or overvalued a company is.

MSCI All Country World Index (ACWI): The MSCI ACWI captures large and mid cap representation across 23 Developed Markets (DM) and 27 Emerging Markets (EM) countries*. With 2,978 constituents, the index covers approximately 85% of the global investable equity opportunity set. The index was launched on January 1, 2001.

S&P 500 Index: The S&P 500 Index is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 9.9 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 3.4 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization. The index was launched on March 4, 1957.

MSCI Europe Index: The MSCI Europe Index captures large and mid cap representation across 15 Developed Markets (DM) countries in Europe*. With 434 constituents, the index covers approximately 85% of the free float-adjusted market capitalization across the European Developed Markets equity universe. The index was launched on March 31, 1986.

Gross Domestic Product (GDP): Gross domestic product is the sum of the value of all goods and services produced in a nation. The metric is widely used to measure the size of national economies and the global economy.