Spring’s Sprung

China Market Connect May 2024 Edition by Dr. Xiaolin Chen, Head of International

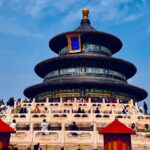

We planted a cherry blossom tree in our garden about five years ago. Over the years, it blossomed slightly later than our neighbours’. However, the reassuring part is that it reliably blooms every season without fail. This reminds me of the resilience and gradual blossoming of Chinese capital markets.

After nearly a year of concerted efforts by Chinese policymakers to rebuild investor confidence, we are beginning to see the fruits of their labour. Like the patient waiting required for our cherry blossom to bloom, investors who were patient with the Chinese market are starting to witness a significant turnaround.

Since February 2nd, the KraneShares CSI China Internet UCITS ETF (Ticker: KWEB) has remarkably outperformed all major indices. Indeed, KWEB's performance has exceeded other indices by margins ranging from 5% to as much as 22%1. What was once considered a contrarian trade is now causing widespread discomfort among those who bet against it, as it transforms into a 'pain trade' for them.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed or sold, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the last month-end, please visit our website at www.kraneshares.eu/kwebln.

This development is a testament to the power of patience and the potential for late bloomers to provide substantial rewards. Just as our cherry blossom tree eventually unfurls its stunning flowers, so too can considered and persistent investment strategies yield beautiful results.

The recent rally in the Chinese markets didn't just appear out of thin air; it was the culmination of a series of deliberate, consistent, and unprecedented pro-market initiatives introduced by Chinese policymakers since March 2023. Over the past year, 38 key policies have been implemented, encompassing fiscal, monetary, and regulatory measures designed to jump-start economic growth and establish a robust, sustainable capital market that attracts global investors.

Moreover, the liquidity conditions have remained highly accommodative. Recent policies announced by regulators have been met with positive feedback. Additionally, the strong corporate earnings, which investors had overlooked for some time, are now being recognized and appreciated, further fuelling the market's upward trajectory. This comprehensive approach by the Chinese government has laid a solid foundation for what we are witnessing today—a dynamic rally in the capital markets.

April proved to be an exceptionally bustling month for China regarding international relations, notably following the National People’s Congress (NPC). The timing of these diplomatic engagements is significant, as they occurred shortly after this major political event. The month saw high-level visits from the United States, with both Treasury Secretary Janet Yellen and Secretary of State Antony Blinken making sequential trips to China. Reports from Chinese social media highlighted the constructive nature of the discussions held during these visits.

Additionally, German Chancellor Olaf Scholz's visit just five days after Yellen's trip underscores the importance of April's diplomatic calendar. She was accompanied by top executives from major German corporations, including the CEOs of BMW and Mercedes. The delegation's visit aimed to foster collaboration between Germany and China. This intent to "work together" was prominently communicated, signalling mutual solid interests in deepening economic ties.

The series of high-profile visits reached a crescendo with a last-minute trip by Elon Musk. Chinese state media covered his engagement with Premier Li Qiang, during which Li highlighted Tesla's operations in China as a paragon of successful US-China economic and trade cooperation. This meeting was particularly noteworthy as it was subsequently revealed that Tesla would receive full approval to roll out its full self-driving software in China, marking a significant milestone in international technological and business cooperation.

The economic data released in the past month presented a slightly mixed but generally positive picture. While retail sales and industrial production figures fell short of market expectations, the Purchasing Managers' Index (PMI) results exceeded forecasts, suggesting a more buoyant manufacturing sector than anticipated.

Most notably, the first quarter's Gross Domestic Product (GDP) outperformed both market estimates and the government's targets, indicating a robust start to the year for the Chinese economy. Despite some ongoing weaknesses in exports, primarily attributed to softer demand, there were significant disparities in performance across different sectors. For instance, exports of toys and t-shirts saw a decline of 23%, whereas automotive exports surged by 28%2. This reflects an ongoing shift in China's export strategy towards higher-value market segments, underscoring a strategic rebalancing within the export ecosystem.

The relative outperformance has relieved strategic investors in China and finally confirmed the diversification* benefits of owning this asset class. I believe the market's swift response also highlighted that this is not merely a tactical investment opportunity.

Looking forward, we still see several unexploited catalysts in China's equity market:

- Economic growth remains a top priority for Xi Jinping, as echoed in various critical meetings with Chinese leaders.

- Liquidity support for the underlying economy will remain highly accommodative, with the issuance of a 1 trillion RMB ultra-long-dated bond starting in May3, signaling just the beginning of such measures.

- Corporate actions such as share buybacks and rising dividend distributions from Chinese companies are expected to continue.

- The China Securities Regulatory Commission (CSRC) is taking steps to clean up 'bad apples,' raising investor expectations for new IPOs, especially those of highly anticipated companies preparing to go public.

- The "Connect-everywhere" initiative aims to remove barriers for Chinese domestic investors looking to invest more broadly.

With several catalysts on the horizon, including economic prioritization, enhanced liquidity, corporate financial strategies, regulatory clean-ups, and investment barrier removals, the outlook for China's equity market remains promising.

*Diversification does not ensure a profit or guarantee against a loss.

Citations:

- Data from Bloomberg as of 5/1/2024

- Data from Bloomberg as of 5/1/2024

- The State Council The People’s Republic of China as of 5/15/2024

Definitions:

S&P 500 Index: The S&P 500 is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

MSCI Emerging Markets ex China Index: The MSCI Emerging Markets ex China Index captures large and mid-cap representation across 23 of the 24 Emerging Markets (EM) countries* excluding China. The index was launched on March 9, 2017.

Nasdaq 100 Index: The Nasdaq 100 Index is a collection of the 100 largest, most actively traded companies listed on the Nasdaq stock exchange.

MSCI Europe Index: The MSCI Europe Index captures large and mid cap representation across 15 Developed Markets (DM) countries in Europe*. With 440 constituents, the index covers approximately 85% of the free float-adjusted market capitalization across the European Developed Markets equity universe.

MSCI China Index: The MSCI China Indexes consist of a range of market capitalization weighted and alternative weighted indexes for the Chinese markets, intended for both domestic and international investors, including Qualified Foreign Institutional Investors (QFII) licensees.

Gross Domestic Product (GDP): Gross domestic product is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

Purchasing Managers' Index (PMI): The Purchasing Managers' Index (PMI) is an indicator of the prevailing direction of economic trends in the manufacturing and service sectors. The indicator is compiled and released monthly by the Institute for Supply Management (ISM), a nonprofit supply management organization.

Initial Public Offering (IPO): An IPO is an initial public offering, in which shares of a private company are made available to the public for the first time. An IPO allows a company to raise equity capital from public investors.

CPI: A consumer price index is a price index, the price of a weighted average market basket of consumer goods and services purchased by households. Changes in measured CPI track changes in prices over time. The CPI is calculated by using a representative basket of goods and services.

Retail Sales: Retail sales are an economic metric that tracks consumer demand for finished goods.

Industrial production: Industrial production refers to the output of industrial establishments and covers sectors such as mining, manufacturing, electricity, gas and steam and air-conditioning. This indicator is measured in an index based on a reference period that expresses change in the volume of production output.

Fixed assets: Fixed assets are long-term, physical assets, such as property, plant, and equipment (PP&E). Fixed assets have a useful life of more than one year.