US-Listed China Internet Stocks: Fact vs. Fiction

In a recent webinar, we addressed a rumor that US-listed China stocks could be delisted amid the latest trade spat. We believe this to be an unlikely potential outcome.

The conversation around the delisting of China internet stocks from US exchanges began in December of 2020 when the US Congress passed the Holding Foreign Companies Accountable Act (HFCAA). The Act addressed the then-long-running issue that China's law prevented foreign auditors, including the US Public Company Accounting Oversight Board (PCAOB), from accessing and reviewing the audit books of US-listed companies. In response, China's authorities changed the law to allow PCAOB inspections to occur on-site. The PCAOB then inspected the auditors, which include the local arms of KPMG, EY, Deloitte, and PWC, in the exact same way they would have if the auditors were located in the US.

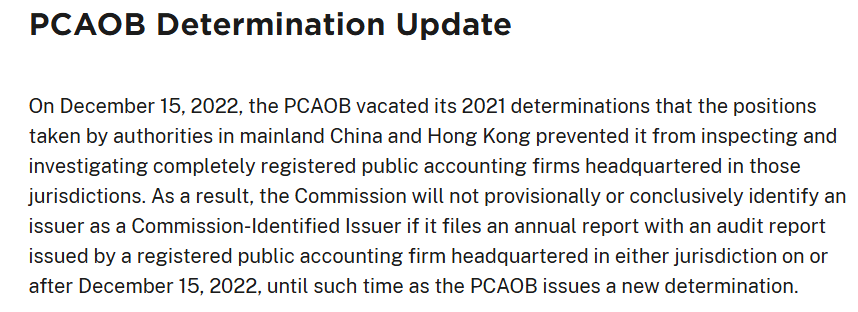

The SEC removed the delisting risk with the below statement in 2022, which can also be found on their website alongside a comprehensive list of US-listed China companies that are in compliance with the law. The issue of delisting only applied to US-listed stocks, not ETFs like KWEB.

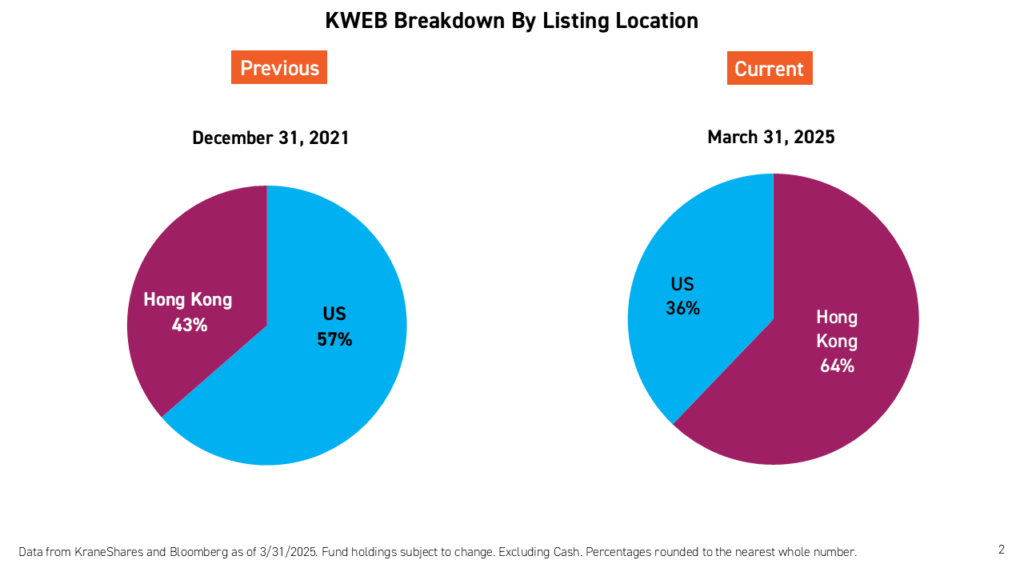

When the HFCAA first passed, we began converting the US holdings of the KraneShares CSI China Internet UCITS ETF (Ticker: KWEB) to their Hong Kong-listed equivalents. Over time, we converted shares in Alibaba, JD.com, Baidu, Trip.com, and others that had Hong Kong listings with sufficient liquidity. We took this step even though we were confident that China would grant PCAOB inspectors local access to the audit reports, making delisting a low probability.

As of the market close on April 10th, 2025, 67% of KWEB 's portfolio by weight consisted of Hong Kong listings. Out of the remaining 33% in US listings (11 companies), 12% (four companies) have secondary Hong Kong listings that KWEB could hold.

The two largest holdings without corresponding Hong Kong listings are PDD Holdings and Full Truck Alliance. Full Truck Alliance filed for a Hong Kong listing back in 2021. However, the company did not proceed with the relisting after the PCAOB confirmed that its US listing was secure.

Although we believe that the probability of delisting is low, relisting in Hong Kong continues to be a viable option. Full Truck's CFO indicated the company remains open to potentially listing in Hong Kong in the future, saying, "Against this broader backdrop, we will actively re-examine and consider a listing in Hong Kong again. However, no specific plans have been decided yet."1

Hong Kong Exchanges & Clearing has demonstrated its willingness to work with US-listed China-based companies to make relisting in its market as quick and easy as possible, viewing the potential influx of new or upgraded listings as a significant opportunity for the exchange. Meanwhile, Hong Kong's Financial Secretary said on April 13th, 2025, "We are actively attracting high-quality issuers from around the world to list in Hong Kong. At present, Hong Kong has established a regulatory framework to facilitate dual listing or secondary listing of enterprises listed overseas in Hong Kong. In view of the latest changes in the world, I have instructed the Securities & Futures Commission (SFC) and the Hong Kong Stock Exchange to be prepared to make Hong Kong their preferred listing venue if overseas-listed Chinese concept stocks wish to return."2

What about VIEs?

The White House's America First Investment Policy memo calls for a "review" of the variable interest entity (VIE) structure that many China-based companies use to list shares. The VIE structure was a popular vehicle used by US and global private equity investors to invest in Chinese technology companies at a time when foreign investment in certain industries was restricted. What was originally only a private structure became a public one when these companies were listed on US exchanges. The VIE structure is used in many listings from all over the world, whether the ultimate listing venue is Hong Kong, New York, Shanghai, Frankfurt, or somewhere else. To learn more about VIEs, please click here to read our article from 2022.

Why are these issues resurfacing now?

The second trade conflict with China and the appointment of a new SEC Chairman have led to speculation with regard to the future of China listings on US exchanges. During his confirmation hearing, incoming SEC Chairman Paul Atkins said that any China-based companies that do not comply with US accounting standards will be delisted. However, this seemingly strong statement just reiterates the existing policy.

Because China internet companies are relatively immune to tariffs due to their low foreign revenue exposure, some have also speculated that the Trump Administration would employ delisting as an additional lever to exert pressure on China. However, official communication on the subject has focused on accounting standards and regulatory compliance, rather than delisting for its own sake.

Currently, the US Administration's trade policies focus on goods rather than services. However, China purchases a large amount of financial services from the US. For example, when AI-driven education technology company Ruanyun Edai Technology recently went public on April 10th, 2025, it paid its Florida-based investment bank an underwriter's compensation along with over $1 million in additional fees paid to the SEC, the Nasdaq Exchange, and other US businesses.3

The US capital markets are the largest and most liquid in the world because of the strong rule of law. Indiscriminately delisting companies because of trade disputes could jeopardize that reputation and decrease the revenue from abroad earned by financial services.

Conclusion

In the unlikely event that US-listed China internet companies are delisted from US exchanges, we will act swiftly to convert our remaining US holdings to their Hong Kong-listed equivalents.

Citations:

- Zhu, Julie. "China's Full Truck Alliance eyes Hong Kong listing, strong 2025 growth, says executive," Reuters. March 10, 2025.

- The Government of Hong Kong Special Administrative Region: Financial Secretary & Deputy Financial Secretary. "Blog Post: Another opportunity for Hong Kong in the midst of a century of changes." April 13, 2025.

- Ruanyun Edai Technology Co. Ltd. IPO Prospectus.