ESG – The Key to Outperformance? In China, it Might Be

In recent years, Environmental, Social, Governance (ESG) investing has experienced a surge in popularity. With ESG scoring methodologies now widely established by reputable companies like leading global index provider, MSCI, investors can utilize ETFs and index funds to systemize their decision-making process through an ESG lens. However, the resulting impact on returns generated from ESG criteria application can vary significantly between markets. This dispersion is particularly evident when comparing the difference between standard and ESG index returns in the US and China.

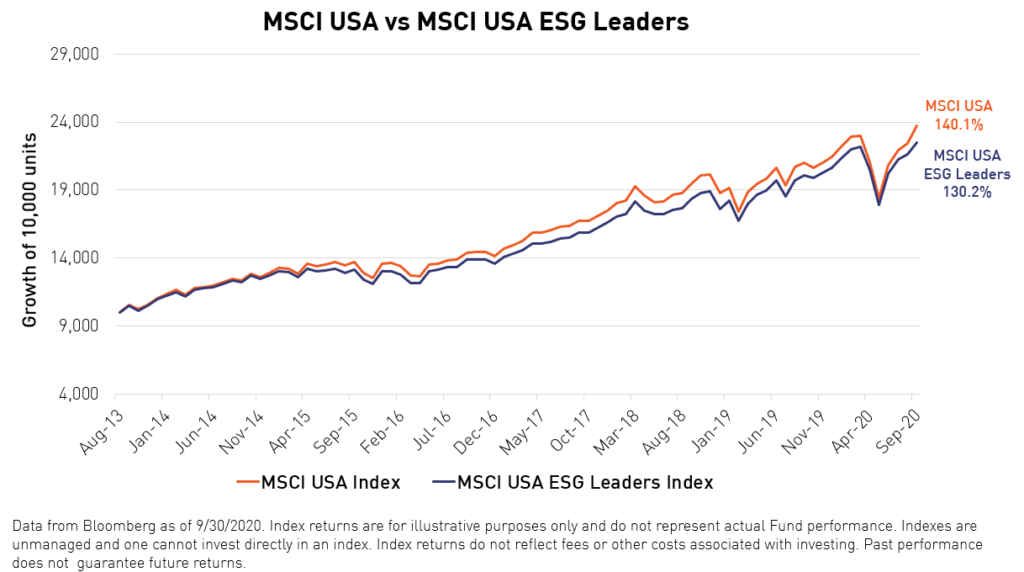

In the US, a comparison of the MSCI USA and MSCI USA ESG indexes shows that ESG did not increase performance with the former returning 140% and the latter 130% since 2013. The 10% underperformance over a seven-year timeframe of the US ESG index may be tolerable for investors who accept trading off performance for the positive social benefits of ESG. Still, in China, a different story is unfolding.

The China ESG Advantage

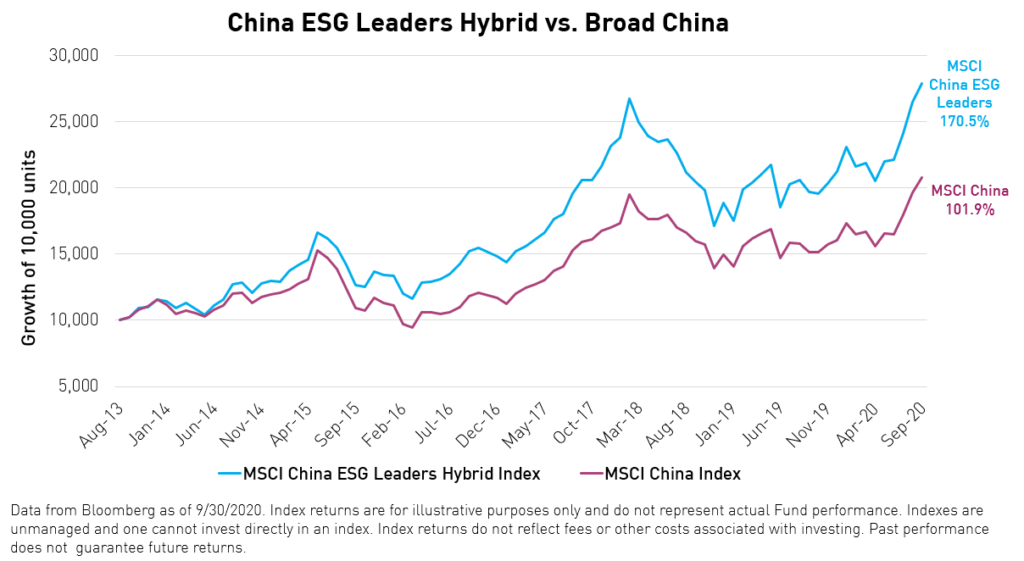

Below is a chart that shows the outperformance of the MSCI China ESG Leaders Hybrid Index1 relative to the MSCI China Index. Since the inception of the ESG index in 2013 through 9/30/2020, the MSCI China ESG Leaders Hybrid Index returned 170%, while the MSCI China Index returned 102%, representing an outperformance of 68% for the ESG index over the broad China market. It is important to note that the ESG criteria MSCI uses for its China ESG indexes are the same criteria MSCI uses in the US and other global markets. MSCI’s ESG criteria have had a significant performance-boosting effect in China that did not occur in the US. In July 2020, we launched the KraneShares MSCI China ESG Leaders UCITS ETF (KESG) which tracks the MSCI China ESG Leaders 10/40 Index.

ESG investing is inherently future-looking. There is perhaps no place more meticulously focused on planning for the future than China. Every five years, the nation issues its Five-Year Plan, where the government outlines its vision for the future. Capping carbon emissions, expanding green energy output, and developing high-tech sectors are fundamental to China’s long-term plans.

China’s economic and technological transformation drives the demand for a more educated workforce. In recent years, many Chinese companies in knowledge-intensive sectors have improved their talent programs, which has upgraded their MSCI ESG rating. Within MSCI’s ESG Rating under its Social Pillar, companies with healthy human capital development, labor management, and employee benefits programs receive higher rankings resulting in large index weightings to companies within the internet/technology and healthcare sectors in China.

Internet/technology companies within the MSCI China ESG Leaders 10/40 index, Meituan Dianping is up +164%, Tencent is up +50%, and Alibaba is up +44% year-to-date2. Wuxi Biologics is up 126% this year within the healthcare sector, driven by the COVID-19 pandemic, which has boosted companies committed to drug and vaccine development within this sector.

Looking specifically at Chinese companies that achieve high scores for their carbon emissions and product carbon footprint reduction within MSCI’s Environmental Pillar, China’s electric vehicle (EV) manufacturers are notable standouts. Nio Inc– known as the Tesla of China, is up 580%, and BYD Co. is up 275% year-to-date. In 2019, China accounted for nearly 50% of all-electric vehicles sold worldwide3, and by 2025, EVs are projected to account for 25% of China’s new car sales4.

Growing Global Demand

Global demand for more sustainably focused investments has become more widespread, in part, because ESG scoring is much more accessible. Moreover, there has been an influx of new funds over the past few years, which provides investors with a growing number of options to better tailor their investments with their personal values. Specific markets, such as China, also lend themselves particularly well to ESG filtering for preferable sector exposure and potentially better returns.

With regard to China, we have seen a growing interest specifically in China’s strong EV sector. However, some individual investors have difficulty accessing these stocks because they are predominantly listed in Hong Kong, Shanghai, and Shenzhen stock exchanges. Our funds can act as access vehicles for these stocks.

Beyond our China ESG ETF (KESG), the KraneShares MSCI China Environment ETF (KGRN) specifically focuses on key clean technology themes driving China’s transition to a greener economy. Included in the fund are EV stars Nio, BYD, and BAIC Bluepark New Energy Co. as well as other big names like world’s largest solar panel manufacturer, JinkoSolar Holding Co., and Asia’s largest wind power producer, China Longyuan Power Group.

The Future of ESG for ETFs

We believe ESG investing will not merely be limited to a niche investment strategy but instead be factored into an investor’s overall due diligence process. ESG scoring may have started as a tool designed for investors who wanted to positively impact or mitigate climate change risk on their portfolios. However, beyond aligning with investors’ values, these ratings prove to serve, at least in China, as an invaluable filter for identifying high-quality growth stocks. As other major economies worldwide begin to make the concerted shift away from fossil fuels toward green infrastructure, we anticipate ESG criteria applied to other markets will provide similar demonstrable performance benefits as it does in China.

Fund holdings mentioned in the article:

- Meituan Dianping (HKG 3690, 8.98% of KESG net assets as of 9/30/2020)

- Tencent Holdings (HKG 700, 8.73% of KESG net assets as of 9/30/2020)

- Alibaba (NSYE BABA, 9.79% of KESG net assets as of 9/30/2020)

- Wuxi Biologics (HKG 2269, 4.73% of KESG net assets as of 9/30/2020)

- Nio Inc. (NSYE NIO, 9.47% of KGRN net assets as of 9/30/2020)

- BYD (HKG 1211, 8.22% of KGRN net assets as of 9/30/2020)

- BAIC Bluepark New Energy (SSE 600733, 0.42% of KGRN net assets as of 9/30/2020)

- JinkoSolar Holdings (NYSE JKS, 3.88% of KGRN net assets as of 9/30/2020)

- China Longyuan Power Group (HKG 916, 3.99% of KGRN net assets as of 9/30/2020)

Index Definitions:

MSCI USA (Gross) Index: is designed to measure the performance of the large and mid-cap segments of the US market. With 619 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in the US.

MSCI USA ESG Leaders (Gross) Index: is a capitalization-weighted index that provides exposure to companies with high Environmental, Social and Governance (ESG) performance relative to their sector peers. MSCI USA ESG Leaders Index consists of large and mid-cap companies in the US market. The Index is designed for investors seeking a broad, diversified sustainability benchmark with relatively low tracking error to the underlying equity market.

MSCI China (Gross USD) Index: captures large and mid-cap representation across China A-Shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs)

MSCI China ESG Leaders Hybrid Index: is comprised of the parent index, MSCI China ESG Leaders Index, from Jul. 12, 2013 to Nov. 7, 2019 and the MSCI China ESG Leaders 10/40 Index going forward. The parent index is used prior to the MSCI China ESG Leaders 10/40 Index’s inception to show long-term historical performance.

Citations:

- The MSCI China ESG Leaders Hybrid Index was created to show historical performance for the MSCI China ESG Leaders 10/40 Index. See index definitions for further information.

- Note: year-to-date company performance as of 10/22/2020.

- International Energy Agency. “Global EV Outlook 2020”.

- Reuters, “China wants new energy vehicle sales in 2025 to be 25% of all car sales”, 12/2/2019.