Relationship Status? It’s Complicated. How Alibaba, Pinduoduo & JD.com Court Chinese Consumers for Singles’ Day

Only in China could an unofficial holiday celebrating singledom grow into the biggest E-Commerce shopping day in the world1. Started as an alternative to Valentine’s Day by Chinese college students in 1993, the Singles’ Day tradition to buy a gift for oneself to celebrate - or mourn – one’s single status has morphed into something totally new.

Alibaba was the first E-Commerce platform to monetize Singles’ Day starting in 2009. During the final 24-hours of last year's 30-day 11/11 Global Shopping Festival, Alibaba generated $30.8 billion of gross merchandise volume (GMV)2. This figure represents nearly 5 times the reported 2018 online sales for all US retailers on Black Friday3. This year as stats come in, Alibaba is on track to beat last years' record settling $12 billion GMV within the first hour of the sale. As Singles’ Day has grown into a national celebration over the past decade, the competition has studied Alibaba’s playbook, mimicked their formula for success and in some cases, exceeded their capacity to inspire online shopping fervor amongst citizens of the world’s largest internet population.

Alibaba’s eleventh 11/11 Global Shopping Festival concludes today. With this year’s event, not only did Alibaba have to contend with rising competition, but they also had to meet their own expectations for creating the biggest spectacular, with the highest sales achievable.

Evoking Hollywood-grade production quality, the 2018 11/11 Global Shopping Festival culminated around a 24-hour televised and online streamed gala with celebrity performances and appearances. Original songs (focused on the theme of shopping) were debuted.

How can Alibaba outdo 2018’s performances? One name: Taylor Swift. Swift performed in the televised and live-streamed Countdown Gala in the hours leading up to 11/11. While the 2019 Shopping Festival appears to follow the same theatrical formula of the 2018 festivities, behind the scenes Alibaba used a new metric for measuring the success of the Global Shopping Festival.

Measuring Success: Consumer Lifetime Value

Until this year, Alibaba used the total value of merchandise sold during its 24-hour flagship event, or GMV, to measure the success of the shopping festival. This year, Alibaba decided to focus on customer lifetime value (CLV), which is the net profit a business earns over the duration of a customer relationship. Alibaba has 730 million customers in China, however, many only transact on one of Alibaba’s 9 core channels4. Using CLV as a success metric, Alibaba aims to increase the number of customers who transact across multiple channels in the Alibaba ecosystem. Customers who transact across more than one channel have a higher retention rate and, more importantly, they provide more value to the company than single-channel (users who are both expensive to acquire and have lower retention rates). To achieve this objective, Alibaba focused on growing users in less-developed markets.

We believe Alibaba's new focus on lower-tier markets is a reaction to the Chinese E-Commerce upstart, Pinduoduo. Pinduoduo’s business strategy is aimed at capturing throngs of deal-seeking consumers through “team purchasing”. Under this model, users receive discounts by having their friends and family buy the same products as they do. Often located in less-developed markets, Pinduoduo’s consumers have a lower average order value with a higher volume of transactions of fast-moving consumer goods (FMCG) such as fresh fruit and toothpaste. We believe the sudden attention Alibaba, and the entire Chinese E-Commerce industry as a whole, is paying to less developed markets underscores just how formidable a competitor Pinduoduo has become. Alibaba’s GMV for 2018 was much larger than Pinduoduo’s ($853 billion US as compared to Pinduoduo’s $68.6 billion US), year over year5. However, Pinduoduo’s GMV grew a staggering 234% as compared to Alibaba’s 19%6.

Alibaba versus Pinduoduo: A race for new market share

To engage less-developed markets for the 11/11 Global Shopping Festival, Alibaba held a concurrent kickoff event in the northeastern city of Harbin. Emulating Pinduoduo’s categorical success selling fresh fruit, Alibaba has begun agriculture live streams showing farmers harvesting produce that users can buy on Alibaba's platform. Turning farmwork into an unusual form of entertainment, farmers not only show harvesting to demonstrate freshness, they cut into the fruit to show the ripeness and discuss the taste and smell. In Q2 of 2019, over 70% of Alibaba’s new annual active consumers came from lower-tier cities7. “The success of our focus on less-developed markets in China is reflected in our new customer acquisition growth,” said Alibaba Group CMO Chris Tung.

JD.com and the mid-year shopping festival

In 2018, JD.com sold $23 billion US of goods over an 11-day Singles’ Day campaign8. Targeting middle-class customers, JD.com has carved out a niche for itself by selling globally recognized brand names such as Apple, Dell, Dyson and L’Oréal products. Given that JD.com focuses on higher-end retail, their Singles’ Day sales are smaller. However, instead of diluting their core value proposition by selling less expensive merchandise or discounting products beyond profit, instead, they have differentiated their sales strategy by starting an annual anniversary sale shopping event on June 18th. Known as the 618 Anniversary Sale, Alibaba, Pinduoduo and other E-Commerce platforms have since emulated the sale, instead dubbing it the “618 Mid-Year Shopping Festival”. Success at first was huge, JD.com surpassed Alibaba's Singles' Day GMV during their first event in 2017. However, their first mover advantage was shorted lived. Now Pinduoduo and Alibaba both have their own versions of the mid year shopping festival. Pinduoduo’s volume-based strategy garnered 135 million daily active users (DAUs) during last year’s 618 Mid-Year Shopping Festival, far exceeding JD.com’s 88 million DAUs. Add to that Pinduoduo’s lightening fast 48% YoY user growth rate, it is no wonder the whole industry is "pinduoduofying" their growth strategy.

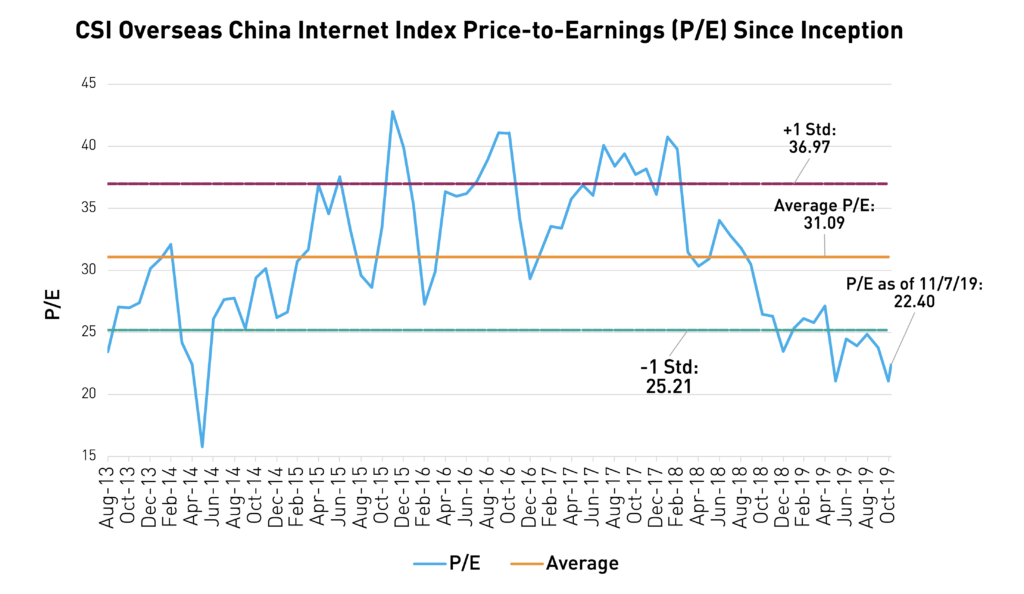

China’s shopping festival is positioned for a strong 2019 season. Alibaba recently reported a 40% revenue growth year over year. JD.com reported net revenue growth of 42% year over year. Pinduoduo reported a 169% revenue increase year over year. With an internet population that has not reached peak adoption and thunderdome-level competition, we believe E-Commerce in China has a strong potential for continued growth. For investors seeking to gain exposure to Chinese E-Commerce giants Alibaba, Pinduoduo and JD.com the KraneShares CSI China Internet ETF (Ticker: KWEB) tracks all three companies within its top 10 holdings.

- CNBC, "The world’s biggest shopping holiday is in China — not the US. Here’s how Singles Day became No. 1"

- Alibaba press release, November 12, 2018

- CNBC, "Black Friday pulled in a record $6.22 billion in online sales: Adobe Analytics"

- Businesswire, Alibaba Unveils Five-Year Goals for China Consumer Business, September 24, 2019

- Alibaba and Pinduoduo 2018 earnings report

- Walkthechat.com, 618 data comparison between major e-commerce platforms, June 30, 2018

- Alibaba press release, October 21, 2019

- JD.com press release

- Weights of KWEB Holding Mentioned:

- Alibaba % of KWEB net assets as of 11/11/2019: 9.37%

- Pinduoduo % of KWEB net assets as of 11/11/2019: 7.43%

- JD.com % of KWEB net assets as of 11/11/2019:6.43%

Top 10 holdings for KWEB can be found here.

This information is being communicated by KraneShares, which is an appointed representative of DMS Capital Solutions UK Limited, which is authorised and regulated by the Financial Conduct Authority in the United Kingdom under the reference number 503325. R_KS_DMS.