KSTR: The Startup IPO Spigot Gets Turned On Again

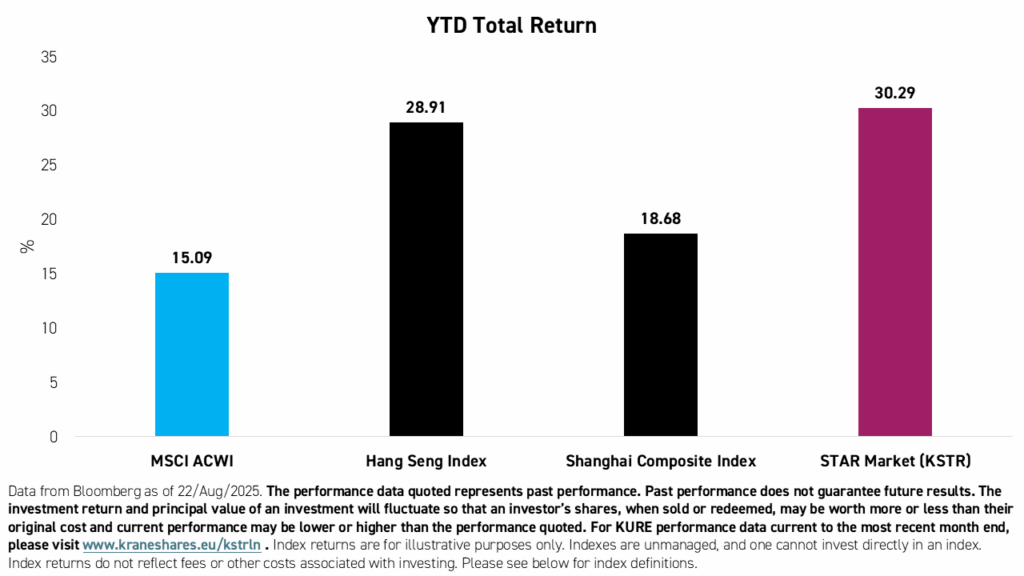

China's re-rating this year, driven by stimulus measures and policy reforms, could lead to increased global flows to the country's equity market, the second-largest in the world. Hong Kong's Hang Seng Index is up +28.91% year-to-date (YTD) as of August 22, 2025, while the Shanghai Composite is up +18.68%, compared to the MSCI All Country World Index (ACWI), which is only up 15.09%.1 Meanwhile, beyond well-known themes like China Internet, we see significant potential catalysts this year in other themes, such as technology hardware and health care, especially with the momentous return of pre-profit startup initial public offerings (IPOs) to China's STAR Market.

On June 18th, the Shanghai Stock Exchange (SSE) announced that the STAR Market would once again welcome the listings of pre-profit companies after a multi-year suspension of the policy. Pre-profit companies that meet the industry classification requirements and high R&D thresholds set forth by the SSE will now be approved for listing as part of a new “Sci-Tech Growth Tier”. According to the SSE, this tier is designed to support high-quality, unprofitable technology-based companies by easing listing requirements and improving investor protections.2

The first IPO under the new regime will be Healthgen Biotechnology Corp. The SSE recently announced that the company’s listing had been approved after years of back-and-forth between the company, the exchange, and regulators. Healthgen Biotechnology was founded in 2006 and focuses on recombinant human albumin serum, essentially artificial blood plasma proteins. The serum is a brand-new innovation with numerous potential medical and cosmetic applications, and Healthgen does not currently have any competitors in the space.

A total of 54 pre-profit companies have listed on the STAR Market. Out of those, nearly half have achieved profitability in the years since listing.2 Companies in the “Sci-Tech Growth Tier” have an extra incentive to turn a profit: they are demarcated with a “U” at the end of the official name used by the exchange. Companies can “graduate” from the tier after achieving a cumulative profit of over RMB 50 million in two years or achieving any profit level from a revenue of RMB 100 million or above.

Historically, the Hong Kong, Shenzhen, and Shanghai stock exchanges were closed off to pre-profit enterprises due to strict profit and revenue requirements. This is one reason so many of China’s startups first went to list in New York. The STAR Market was built to entice startups in specific industries, primarily health care and information technology, to list shares locally.

According to the SSE, Healthgen’s listing will “further strengthen the STAR Market's role as a ‘testing ground' for reform, better promoting the deep integration between technological and industrial innovation, and providing stronger support for achieving high-level technological self-reliance and self-strengthening, as well as fostering the development of new quality productive forces.”

The current pipeline for pre-profit IPOs in the STAR Market is led by two key industries: biotechnology and computer hardware. In addition to Healthgen’s upcoming listing, Guangzhou Be Better Medicine Technology, and Hrain Biotechnology are also preparing to list. In the hardware space, among the top listing candidates are producers of graphics processing units (GPUs), which are heavily used in AI fields, Moore Threads and MetaX.

The KraneShares ICBCUBS SSE STAR Market 50 Index UCITS ETF (Ticker: KSTR) is the only European-listed ETF providing access to this exciting IPO market.1 The fund holds the top 50 largest companies based on free-float market capitalization listed on the STAR Market.

Over the past year, the top-performing industry within KSTR has been the Semiconductors, which accounted for slightly more than half of the portfolio’s average weight and contributed 30% to its overall return. Meanwhile, clean energy has been an underperformer.

Conclusion

As the China re-rating continues, we believe investors should consider thematic exposures. Due to demographic shifts and policy priorities, hardware technology and health care can potentially drive China's growth and development over the next decade. They are also poised to be well represented in China's STAR Market with the return of pre-profit IPOs. While this presents a compelling opportunity, investors should also consider the potential risks involved.

High short-term performance from a limited number of the funds' holdings is unusual, and investors should not expect such performance to be continued over the long-term. Past performance does not guarantee future results.

Citations:

- Data from Bloomberg as of 8/15/2025.

- Data from the Shanghai Stock Exchange (SSE) as of 7/31/2025.

For KSTR standard performance, top 10 holdings, risks, and other fund information, please click here.

Hang Seng Index: The Hang Seng Index ("HSI"), the most widely quoted gauge of the Hong Kong stock market, includes the largest and most liquid stocks listed on the Main Board of the Stock Exchange of Hong Kong. The index was launched on November 24, 1969.

Shanghai Composite: The Shanghai Stock Exchange Composite Index is a capitalization-weighted index. The index tracks the performance of all A-shares and B-shares listed on the Shanghai Stock Exchange. The index was launched on July 15, 1991.

MSCI All Country World Index (ACWI): The MSCI ACWI captures large and mid-cap representation across 23 developed and 24 emerging market countries. With 2,524 constituents, the index covers approximately 85% of the global investable equity opportunity set. The index was launched on May 31, 1990.

Global Flows: This refers to general investments into China's stock market from international investors. We track a variety of flow factors, including flows into our products.