10 Charts On China’s Stimulus And Potential Tailwinds for Equities

China’s National People’s Congress (NPC) kicked off on March 6th. During this annual weeklong meeting in Beijing, China’s leaders outline key economic targets for the year. Among the key announcements from the NPC was China’s 5.5% gross domestic product (GDP) growth target, which, while ranking as one of the lowest rates historically, comes in at the higher end of analysts’ expectations. In order to achieve this ambitious target, the consensus is clear: more stimulus is on the way for China, just as the rest of the world is tightening. Stimulus measures are expected to jump-start consumption and bolster industries that have been hit hard by COVID. Below we give a quick primer on China’s recent economic policy and feature ten charts that highlight why the stimulus may be a potential catalyst for China’s equity markets.

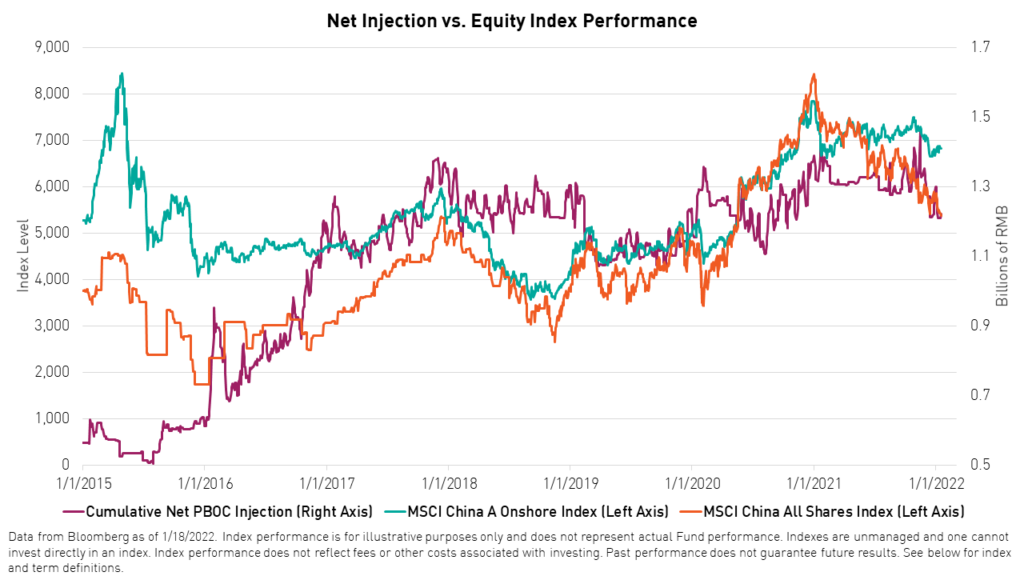

Historically, the performance of China equities has been positively correlated with China’s monetary stance. Following the outbreak of COVID-19 in 2020, China adopted a loose monetary policy, which, in addition to strict COVID-19 measures, helped China rebound quickly from the impact of the pandemic. However, China did not ease nearly as much as the US and EU central banks, leaving its central bank with a great deal of dry powder to be used at a later date.

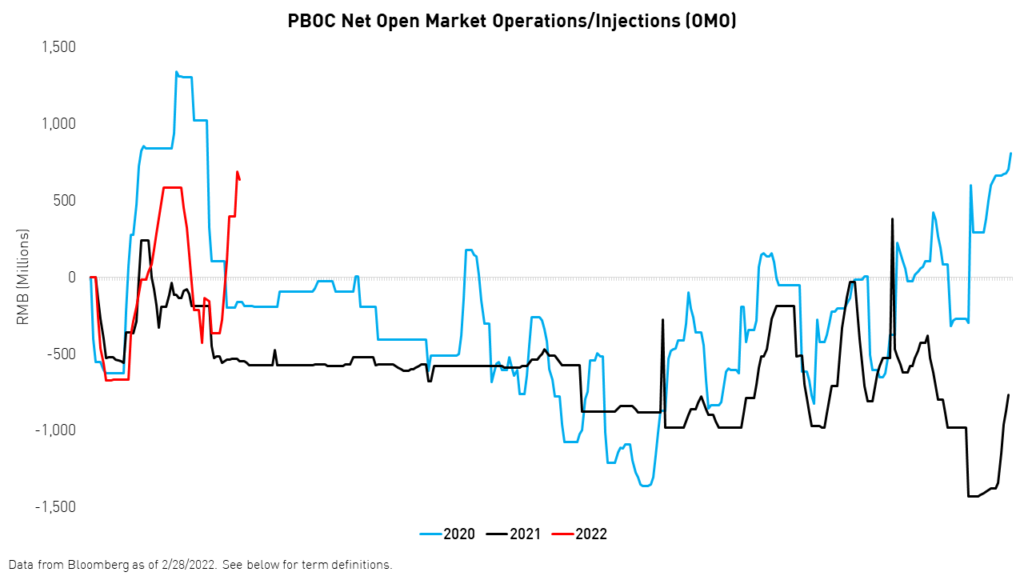

China switched to tightening in 2021, withdrawing much of the liquidity provided in the previous year. However, in December of 2021, and following a challenging year for China’s capital markets, China’s financial policy shifted again with the announcement of front-loading monetary easing measures and a clear mandate to prop up growth in 2022. The aggressive and broad stimulus measures flowing to many sectors of the economy, including real estate, are starting to show in the data and may trickle down to capital markets in short order. China also announced higher fiscal stimulus (~RMB 2 trillion) and higher tax cuts, offering small and medium-sized enterprises (SMEs) nearly RMB 2.5 trillion in tax savings.1

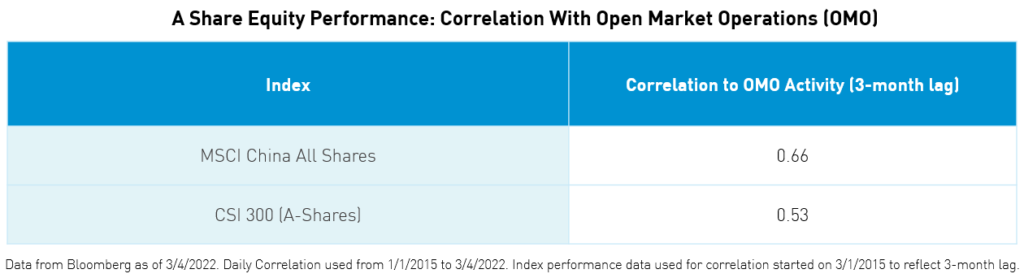

When will all of this stimulus begin to benefit equities? It is difficult to say. However, there tends to be at least a three-month lag between a significant stimulus event and a significant run-up in the equity market. Nonetheless, the correlation between stimulus measures and equity market performance is positive and relatively high.

Perhaps the most intriguing policy move which indicates China’s resolve to support growth is its policy reversal on real estate. In February, major banks in Heze, Chongqing, Ganzhou, and Guangzhou lowered real estate down payment ratios from 30% to 20%. Real estate constitutes indirectly 25 to 30% of GDP and could have been a drag on growth in 2022.2

But… we caution that COVID and consumer sentiment continue to present risks.

1. People’s Bank of China (PBOC) net injection in 2022 is positive after negative net injections in 2021

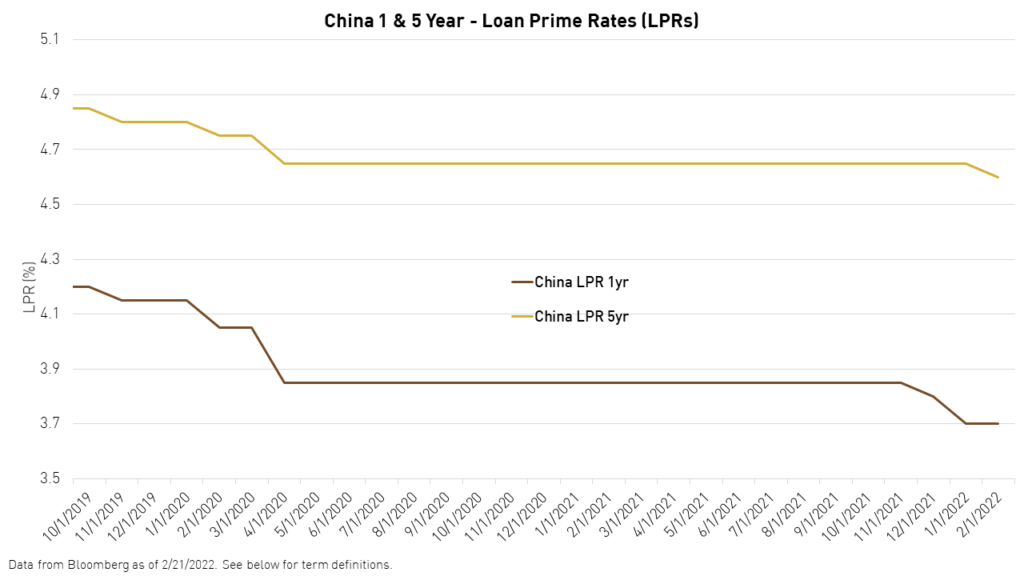

2. For the first time in years, China has cut the 1-year and the 5-year Loan Prime Rates (LPRs).

LPRs are the rates charged to the most creditworthy borrowers. The 1-year LPR helps corporates, while the 5-year LPR is linked to mortgage rates.

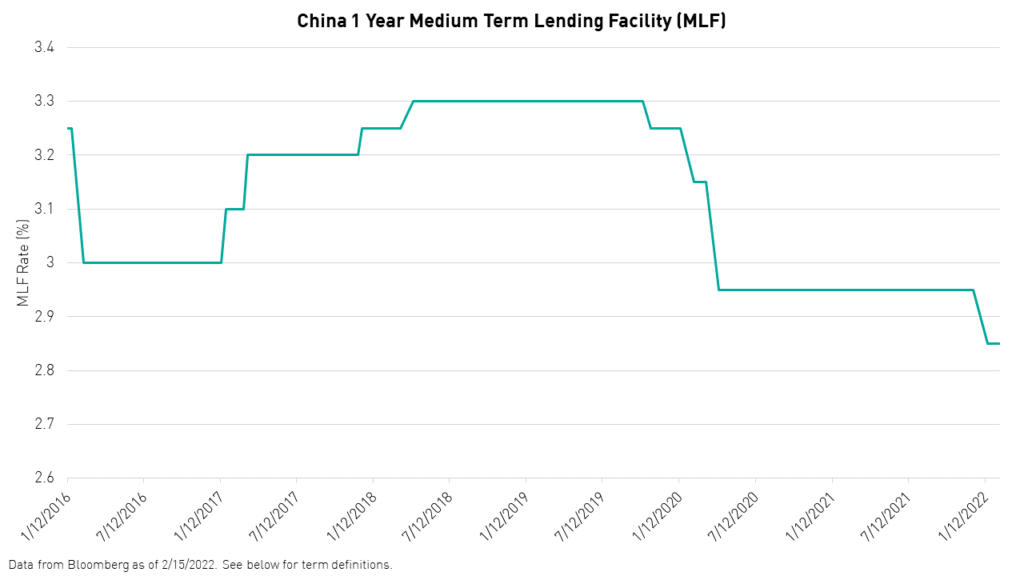

3. China also cut the medium-term lending facility (MLF) for the first time since the onset of the pandemic.

The MLF is a funding channel controlled by the PBOC, China’s central bank, that allows for medium-term loans (usually 1 year or shorter).

4. China followed the MLF cuts with two reserve requirement ratio (RRR) cuts for the first time since the onset of the pandemic.

The RRR is the amount of cash that banks must hold on their balance sheets rather than lend out. Therefore, lowering the RRR frees up more capital for lending. More RRR cuts are expected in the short term. China’s RRR remains above 10% compared to only 4% in the US, providing ample room for more cuts.

5. Real estate prices have started to turn around for the first time since the crackdown began last summer.

Real estate deceleration was a concern as it constitutes 25-30% of China’s GDP.

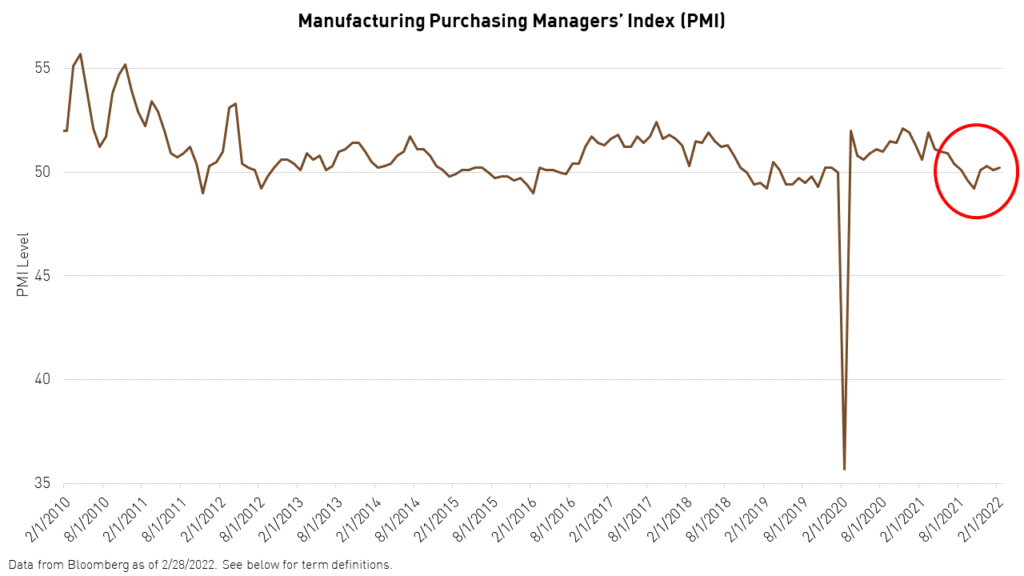

6. The manufacturing purchasing managers’ index (PMI) has stabilized and is now beating expectations, a sign of momentum in economic activity that has been helped by stimulus measures.

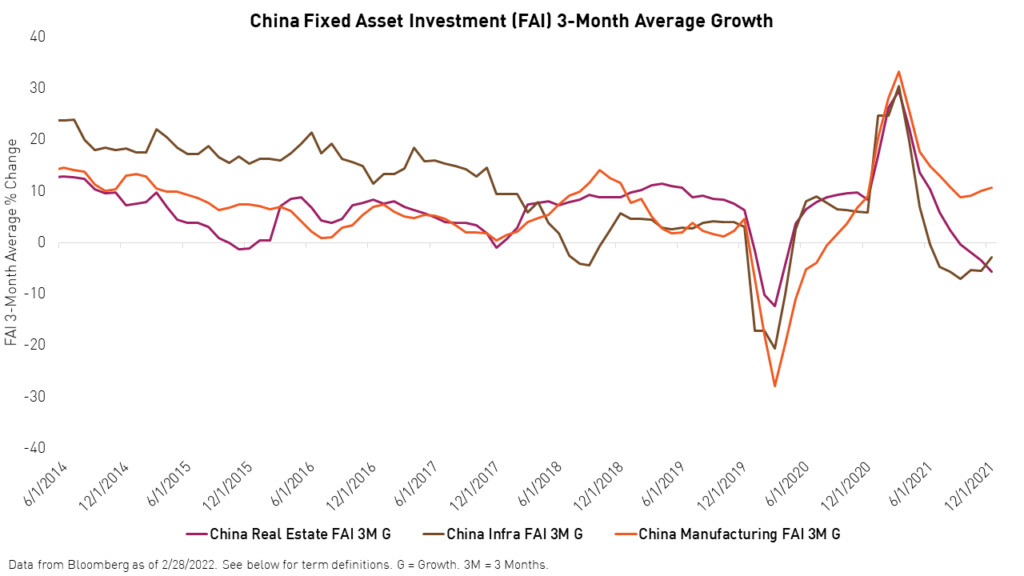

7. The 3-month average fixed asset investment (FAI) growth shows that investment in both infrastructure and manufacturing is rebounding. Will real estate FAI follow suit?

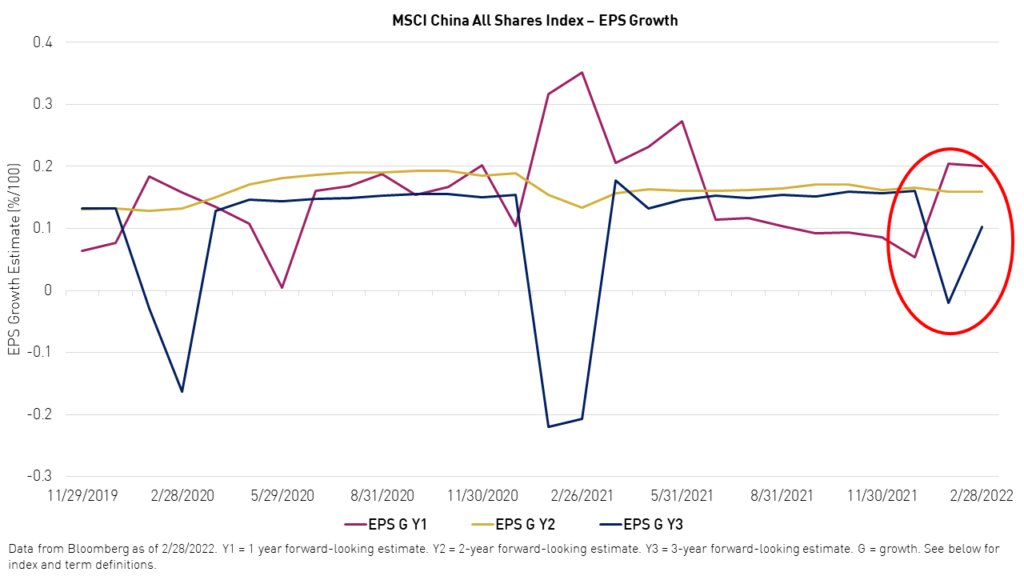

8. Expectations for earnings per share (EPS) growth among the companies within the MSCI China All Shares Index are on the move as well after a period of negative investor sentiment.

We believe the decline in earnings growth in China may have reached the bottom.

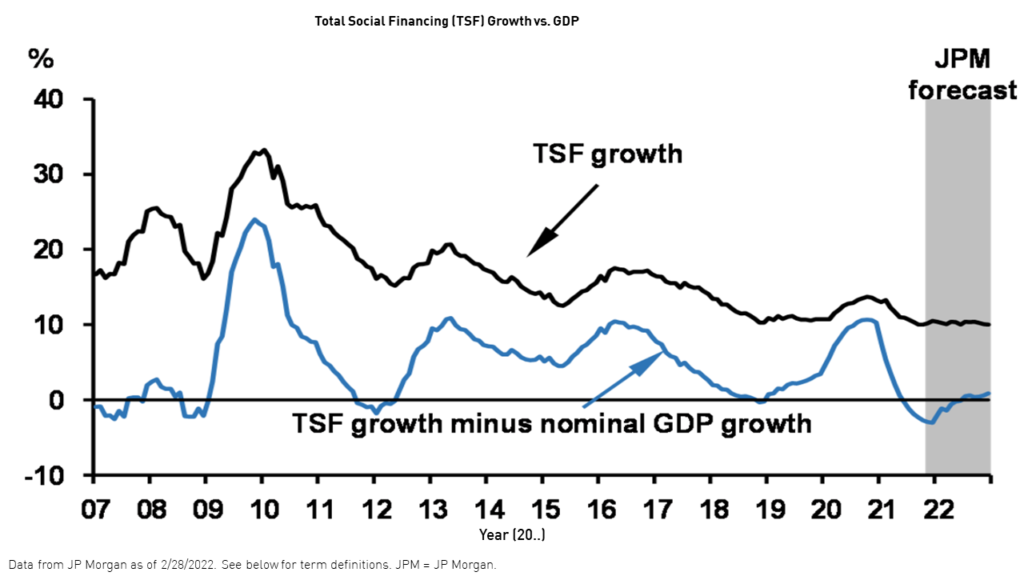

9. Another sign of momentum is total social financing (TSF) growth, which came in at 11.5% in February, beating expectations and leading the credit impulse indicator (credit growth – GDP growth) to recover though it remains in negative territory.

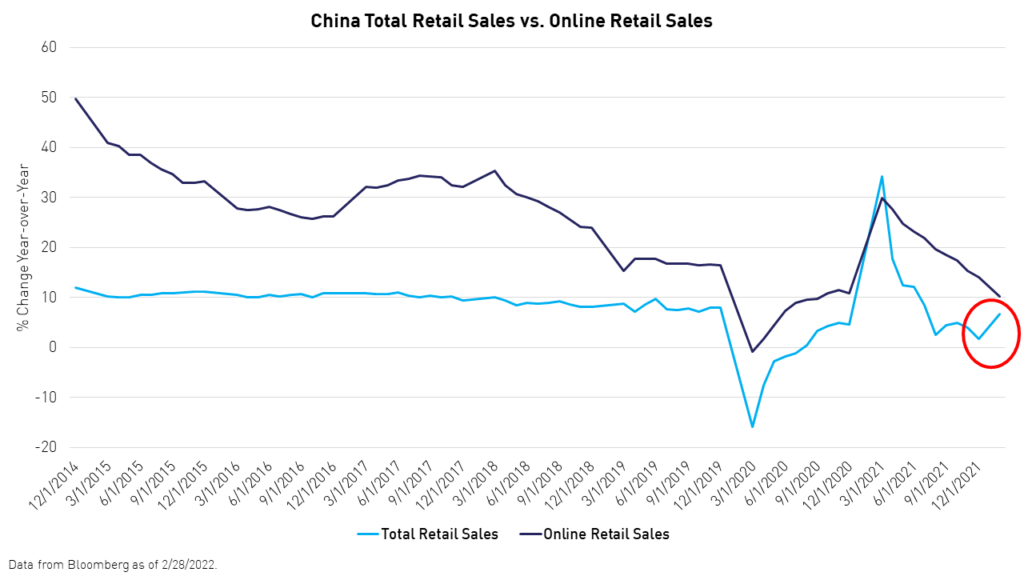

10. Wouldn’t you love to see retail sales rebound as a sign of a consumer recovery?

China recently loosened its COVID zero policy, which we believe will help consumer sentiment. We observed a slight uptick in retail sales in the January/February period.

Conclusion

The third and fourth quarters of 2020 represented the height of the COVID 19 recovery, providing a tough benchmark to beat on a year-over-year growth basis. However, the high base effect is now behind us, and we believe growth will normalize going forward. In addition, the Chinese government seems to be adamant about supporting growth, especially considering the political importance of 2022 as the National Party Congress (NPC) will convene to elect a president in the fall.

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KIID before making any final investment decision

Citations:

- JP Morgan Research. "China: 2022 growth target set at around 5.5%, with pro-growth fiscal policies," JP Morgan. March 6, 2022.

- Data from Bloomberg and JP Morgan as of 31/Dec/2021.

Index & Term Definitions:

Net PBOC Injections: Capital released into the market by People’s Bank of China (PBOC), China’s central bank, through open market operations (OMO) only. Does not account for the impact of rates on overall liquidity.

MSCI China All Shares Index: The MSCI China All Shares Index captures large and mid-cap representation across China A‐shares, B‐shares, H‐shares, Red‐chips, P‐ chips, and foreign listings (e.g. ADRs). The index aims to reflect the opportunity set of China share classes listed in Hong Kong, Shanghai, Shenzhen, and outside of China. It is based on the concept of the integrated MSCI China equity universe with China A-shares included. The index was launched on June 26, 2014.

MSCI China A Onshore Index: The MSCI China A Onshore Index captures large and mid cap representation across China securities listed on the Shanghai and Shenzhen exchanges. The index was launched on May 10, 2005.

Earnings Per Share (EPS): Earnings per share (EPS) is calculated as a company's profit divided by the outstanding shares of its common stock.

Purchasing Managers’ Index (PMI): The Purchasing Managers' Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors. It consists of a diffusion index that summarizes whether market conditions, as viewed by purchasing managers, are expanding, staying the same, or contracting. A reading above 50 indicates expansion and a reading below 50 indicates contraction.

Reserve Requirement Ratio (RRR): A reserve requirement ratio is the percentage of reservable liabilities that commercial banks must hold onto rather than lend out or invest.

Loan Prime Rate (LPR): The rate that commercial banks charge their most creditworthy corporate customers.

Medium-term Lending Facility (MLF): A funding channel controlled by the People’s Bank of China (PBOC), China’s central bank, that allows for medium-term loans (usually 1 year or shorter).

Open Market Operations/Injections (OMO): Open market operations (OMO) refers to the Peoples’ Bank of China (PBOC) practice of buying and selling Chinese Treasury securities, along with other securities, on the open market in order to regulate the supply of money that is on reserve at Chinese banks.

Fixed Asset Investment: Investment in fixed assets, which are physical, immobile items such as railroads, highways, bridges, buildings, etc.

Total Social Financing (TSF): Total social financing is a broad measure of credit and liquidity in the economy that includes off-balance sheet forms of financing such as initial public offerings (IPOs), loans from trust companies, and bond sales.

Gross Domestic Product (GDP): Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

r-eu-ks