What Does The World’s Second Largest Bond Market Offer?

By Dr. Xiaolin Chen, Head of International

In 1981, China issued its first government bond to the public. My mother, a radio broadcaster at the time, alerted the public to the new issue. I remember when she and a few of my relatives queued outside of a retail bank to buy the bonds. After all, their choices for investing were limited back then and, as a consequence, issuers in the domestic bond market did not need to worry about finding investors.

Much has changed since then. As China’s economy and financial sector develop, the Chinese public has an ever-expanding universe of stocks, bonds, and other financial instruments to invest in. While China’s government bonds (CGBs) have perhaps become less relevant to the Chinese investor, they are more relevant than ever to the global investor.

The opening of the onshore financial markets means that China’s bond market is now accessible to foreign investors. With low to negative yields pervading the sovereign debt market in much of the developed world, China is one of the only major economies offering an attractive risk-free rate.

The opening up of China’s onshore bond market has been led by reforms of the quota and disclosure requirements for foreign investors and, most importantly, the establishment of the Bond Connect program, which allows foreign investors to purchase onshore bonds through accounts in Hong Kong.

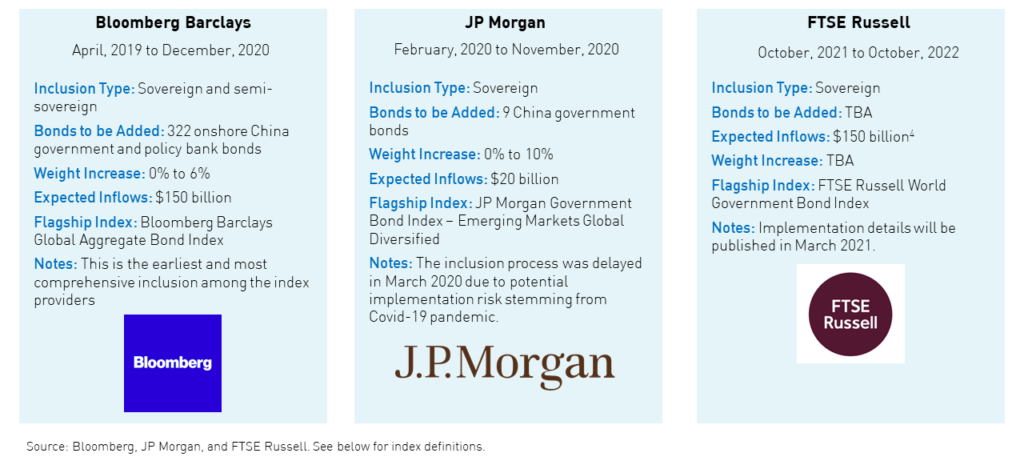

As a result of these reforms, in April 2019, RMB-denominated government and policy bank bonds were added to the Bloomberg Barclays Global Aggregate Index for the first time. Subsequently, both JP Morgan and FTSE Russell have announced similar efforts to include China government bonds in their flagship indexes. The market anticipates over $300 billion in inflows to the onshore bond market as a result of inclusion.

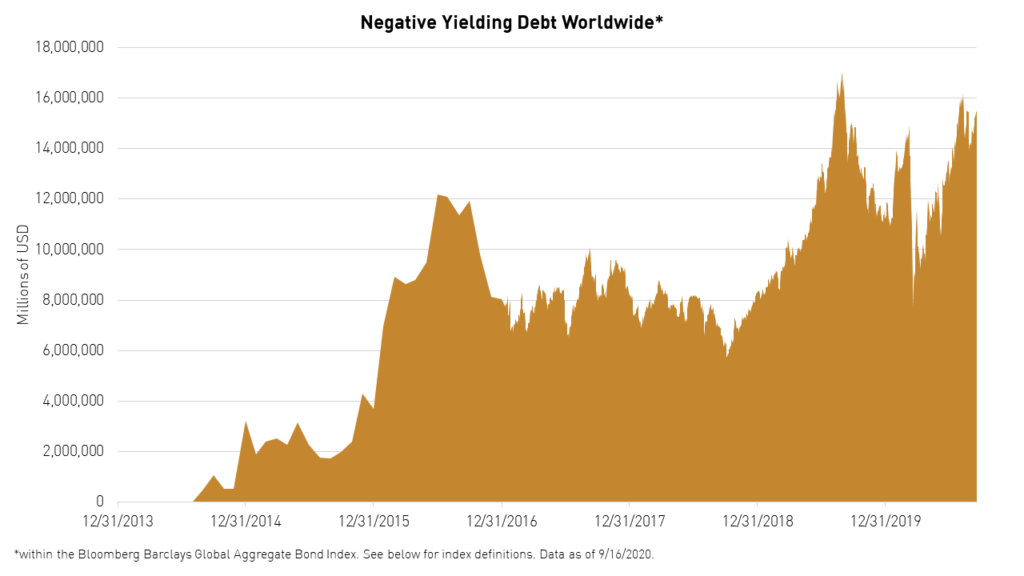

It has now been over a decade since I first heard the phrase “hunting for yield” and the task is proving to be even more challenging today as 25% of global debt worth nearly $15 trillion currently carries a negative yield. Fixed income investors now have to either move up the risk spectrum or go for extra-long-dated bonds to achieve a positive pick up in yield.

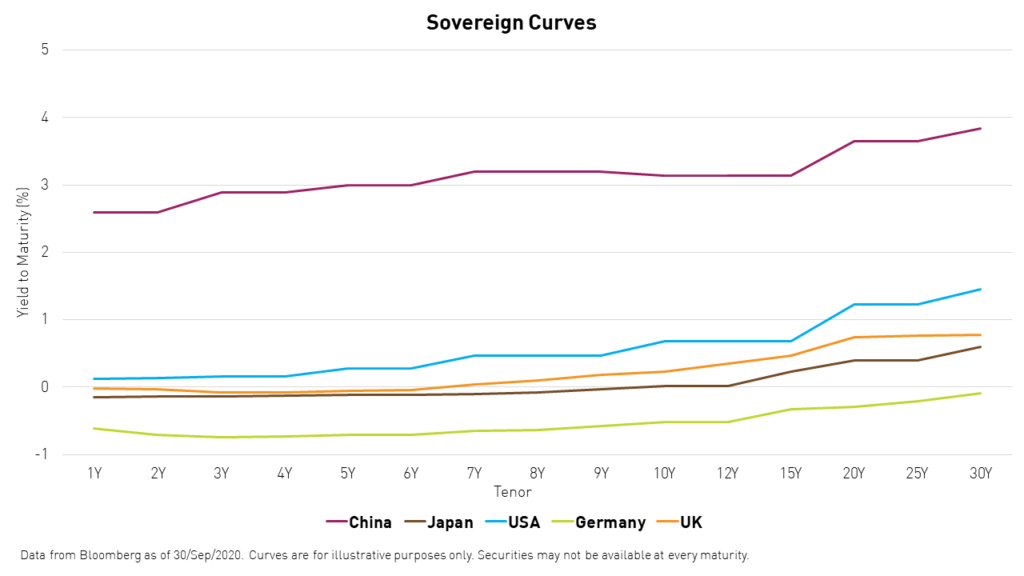

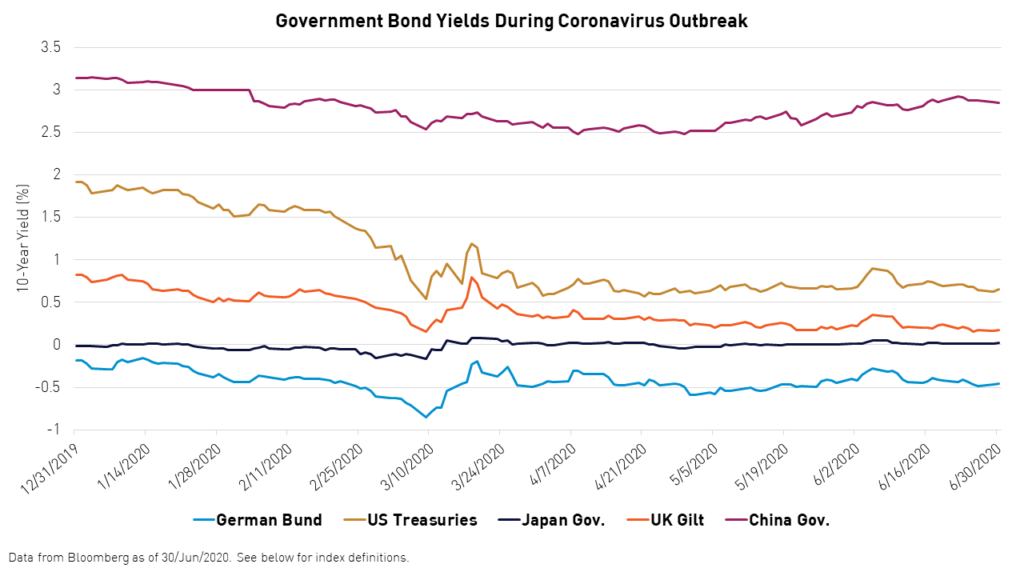

Unlike central banks in developed economies, China refrained from pursuing an ultra-low interest rate monetary policy in response to the pandemic. It is now one of the only countries with both a strong economy and high yields. Furthermore, the steepness of China’s yield curve also offers a safety buffer, which is not a given in developed markets. The 10-year China government bond (CGB), for example, currently offers around a 250 basis point7 yield pick-up over the 10-Year US Treasury. China’s sovereign yields are significantly higher than most developed economies on both a real and nominal basis. Compared with the rest of emerging Asia, China offers a higher credit rating without much compromise in the way of return.

During the flight to cash seen globally in late February and early March of this year, China's government bond yields exhibited stability compared to their regional peers. Chinese policymaking is usually more self-styled to reflect domestic economic needs, rather than adhering closely to other global central banks.

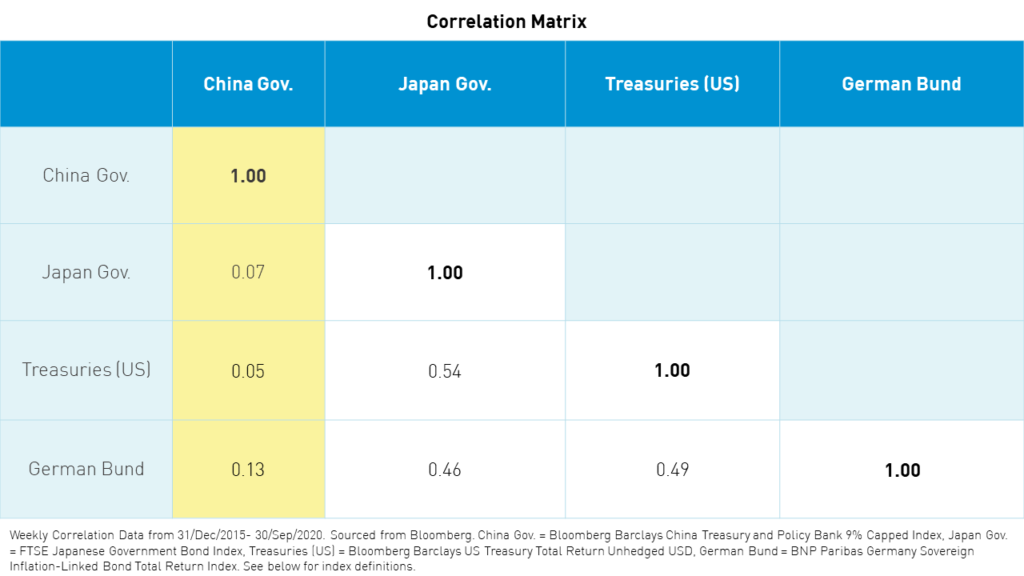

According to our analysis, over the past five years, CGBs exhibited a correlation of under 15% to government bonds issued by the US, Japan, and Germany.

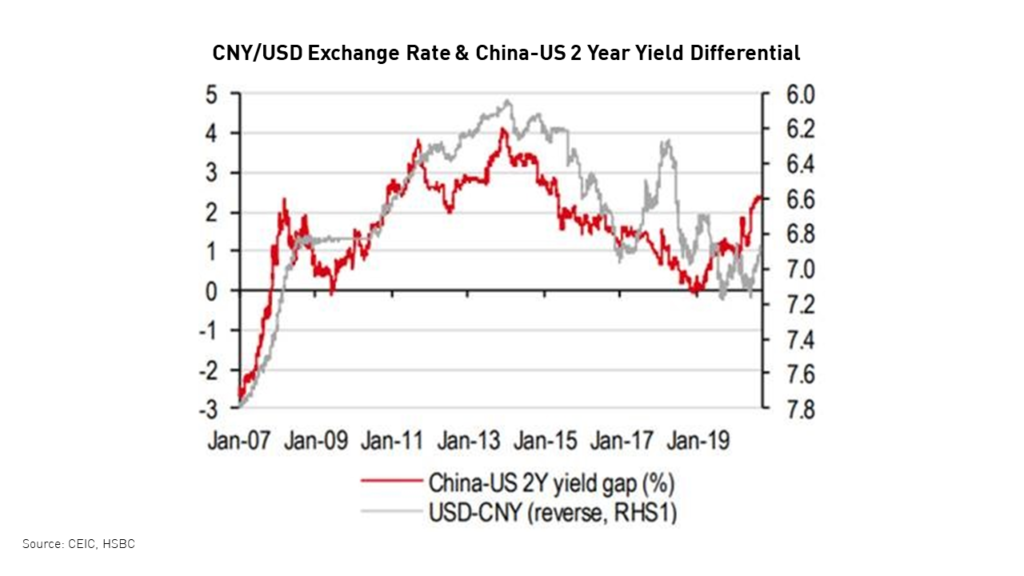

China’s interest rate differential versus the US and other major economies has reached a record high due to divergent central bank policies. The current 2-year rate differential between China and the US suggests that the Renminbi (RMB) may continue to appreciate versus the dollar.

China's current account surplus is widening and expected to stay wider for longer due to favorable terms of trade and a sharp decline in imports. This year, China's onshore bond market has seen significant inflows as global indices move forward with their inclusions of RMB-denominated bonds.

Market data shows monthly average year-to-date inflows of $10 billion into China's fixed income market1, which has resulted in consistent demand for RMB. This is occurring before FTSE has even begun its inclusion of RMB-denominated bonds into its indices, which is expected to drive at least another $150 billion in inflows4. Additionally, we expect Equity inclusion to resume next year, which will also drive demand for RMB.

Moreover, the PBOC is keen to promote RMB internationalization by accelerating market reforms and capital account liberalization. Given the yield advantage, strong portfolio inflows, and the expected widening pf China's current account surplus are all supportive of long-term RMB appreciation.

China bonds have become easier than ever to invest in. Regulators have been delivering on their promises to remove investment quota restrictions, provide clarity on tax rules, and lengthen the bond settlement cycle. In November 2018, regulators announced that foreign investors would be exempt from taxation on all types of onshore bonds until at least November 2021.2 This makes investing in CGBs and policy bank bonds all the more attractive to global investors.

Since the Bond Connect program was introduced in 2017, the issuance of CGBs has risen by nearly 8x. At present, CGBs are primarily owned by institutional investors including banks. China’s banks hold 60% of central government and policy bank bonds and typically hold them to maturity as long-term investors.5 Although foreign investors bought 1/3 of the net supply of CGBs in 2019, their ownership of the market, at just 2.2% according to the People’s Bank of China (PBOC), remains low compared to more internationalized sovereign debt markets such as the US and Japan. For example, over 30% of bonds in the US are owned by foreigners.6 This suggests that there remains significant room for investors to allocate to the asset class.

China is on track to issue RMB 3.78 trillion worth of CGBs this year, which is almost 130% more than in 2019.5 However, the aggregated bond supply from the central government, local governments, and policy banks is poised to fall from November 2020 to February 2021. This is because bond issuance quotas require a stamp of approval from the National People’s Congress, which is usually convened in March. As such, now represents an excellent entry point into the market.

Conclusion

China’s bond market offers a unique investment opportunity due to its outlier status in terms of yield. With a low correlation to other financial assets and billions of dollars still expected to be invested due to continuing inclusion efforts, this opportunity has yet to be fully realized by the global investment community. We believe this asset class matters to clients’ portfolios. The second-largest bond market in the world can offer global investors tax-free, enhanced returns and diversification benefits. In addition to the benefits of owning the market, at $15 billion3, it is simply too big to ignore.

I continue to be amazed at how much has changed in China in the nearly 40 years since 1981 and how much the country will change over the next 40 years. Back then, my savings-minded family had to wait in line at a physical bank in order to get their hands on the only financial asset available to them. Nowadays, Chinese citizens can invest in a wide variety of securities and investment products with ease using cutting-edge financial technology platforms that have become ubiquitous. It is truly remarkable that that the same bonds that Chinese investors flocked to back then are now enjoying a moment in the spotlight for yield-seeking international investors.

Citations

- Data from Bloomberg as of 11/20/2020

- “Financial Services Tax News Flash: China issues formal tax regulation for three-year tax exemption on bond interest for foreign investors,” PWC. November, 2018.

- Data from the Bank for International Settlements as of 3/31/2020.

- Estimate based on Bloomberg data as of 11/30/2020 and assumption that FTSE inclusion takes RMB bonds to >6% of FTSE World Government Bond Index, mirroring Bloomberg's inclusion. Inflow amount proportional to present asset level tracking index.

- Based on data from the People's Bank of China (PBOC)

- Shu, Chang. “China’s bond market is too-big-to-ignore,” Bloomberg Professional Services. 18 April 2019. Retrieved 30/Sep/2020.

- Data from Bloomberg as of 12/10/2020.

Index Disclosure

Index returns are for illustrative purposes only. Indexes are unmanaged and one cannot invest directly in an index. Index returns do not reflect fees or other costs associated with investing. Past performance does not guarantee future results.

Index Definitions

Bloomberg Barclays Global Aggregate Bond Index: The Bloomberg Barclays Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate, and securitized fixed-rate bonds from both developed and emerging markets issuers. The index was launched on January 1, 1990.

Bloomberg Barclays China Treasury and Policy Bank 9% Capped Index: The Bloomberg Barclays China Treasury and Policy Bank 9% Capped Index seeks to track the performance of the Chinese onshore Renminbi-denominated government and government-related bank fixed-income market. The index was launched on January 1, 2013.

FTSE Japanese Government Bond Index: The FTSE Japanese Government Bond Index aims to reflect the performance of fixed-rate tradable bonds issued in Japanese Yen by the Japanese government. Only bonds which pay holders a fixed rate of interest are eligible for inclusion in the index. Certain additional requirements may be considered in order to determine the eligible universe of bonds, such as minimum remaining time to maturity or a minimum size of the bond issue. The index base date is December 31, 1984.

Bloomberg Barclays US Treasury Total Return Unhedged USD Index: The Bloomberg Barclays US Treasury Total Return Unhedged USD Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint, but are part of a separate Short Treasury Index. STRIPS are excluded from the index because their inclusion would result in double-counting. The index was launched on January 1, 1973.

BNP Paribas Germany Sovereign Inflation-Linked Bond Total Return Index: The BNP Paribas Germany Sovereign Inflation-Linked Bond Total Rturn Index measures the performance of German government debt securities linked to the rate of inflation.

FTSE World Government Bond Index (WGBI): A broad Index providing exposure to the global sovereign fixed income market, the index measures the performance of fixed-rate, local currency, investment-grade sovereign bonds. It comprises sovereign debt from over 20 countries, denominated in a variety of currencies. The index was launched on February 17, 1995.

JP Morgan Government Bond Index – Emerging Markets Global Diversified Index: The index is a comprehensive global local emerging markets index and consists of regularly traded, liquid, fixed-rate, domestic currency government bonds.