Post Party Congress: Back To Business

For China, it's back to business now that the party is over. By party, we mean The National Party Congress, which occurs once every five years. The latest one wrapped up on October 22 this year. The meeting is significant because it is where new top leadership roles are appointed. Heading into the Party Congress, high-level policy changes are typically put on the back burner as government officials focus on ensuring they have jobs for the next half-decade. This year was no exception as leading up to the Party Congress, we saw little movement on significant issues, including China’s zero COVID or “lives first” policy, declining real estate prices, and US-China political relations.

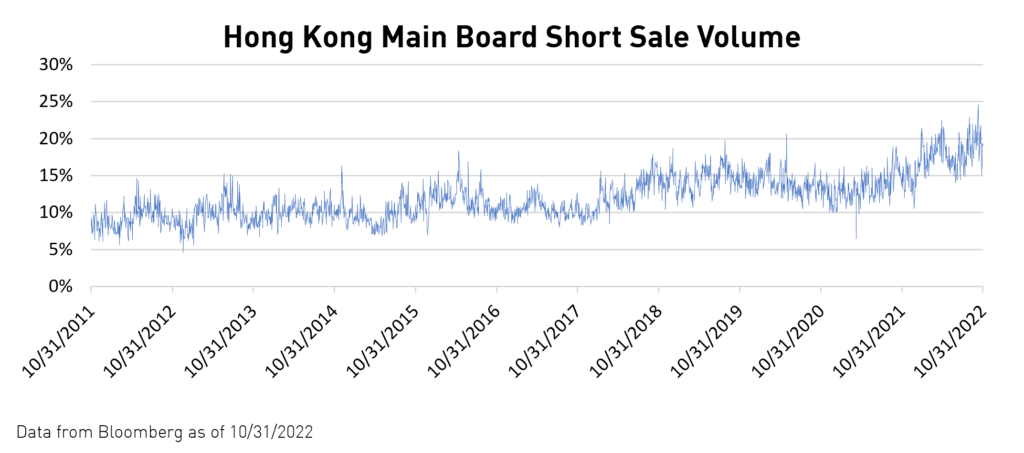

Due to the lack of policy adjustment on these three core issues, many investors have underweighted the space. In the absence of institutional investor ownership, short sellers have pushed the share prices down, knowing buyers are unlikely to materialize even at distressed levels until they see concrete progress.

With the Party Congress now firmly in the rearview mirror, China's government is working to remove the remaining policy headwinds, which have significant implications for China’s economy. Let's take a deeper look.

Relaxing Zero COVID: Test & Expand

China's approach to pandemic controls saved countless lives during the initial onset of COVID and then again during the Delta wave. Now that the less lethal Omicron variant is the dominant strain these policies are being reevaluated. At the same time, China’s elderly population is reluctant to embrace vaccinations. Omicron may be less deadly, but if it were allowed to spread unchecked it could lead to the deaths of approximately 1.5 million elderly Chinese people1, which explains why zero COVID is also called the “lives first” policy in China. Until vaccination rates rise among the elderly and regulators approve a locally made mRNA vaccine for distribution, we do not anticipate an abrupt scrapping of zero COVID policies. However, adjustments are occurring to lessen the economic impact of epidemic

control measures.

Presently, local officials still mandate exposure-driven quarantines on an individual level, and large-group events are contingent on infection rates, but the government is avoiding citywide lockdowns at the scale of what we saw in the Spring of 2022 in Shanghai.

China’s government seldom “pulls the Band-Aid” on significant policy changes, preferring to test and, subsequently, scale up new policies. Such a test is currently taking place in Hong Kong, where visitors from abroad no longer need to quarantine. This more relaxed approach enabled the semi-autonomous city to host the Global Financial Leaders’ Investment Summit on November 1-3 and the famous Rugby Sevens tournament on November 4-6. Hong Kong is now living with the virus, having recorded 6,000 new daily cases, on average, over the past month.2

On the Mainland, visitors from abroad have seen quarantine times reduced incrementally over the past few months and are now down to just five days at the port of entry from a previous seven days at the port of entry and an additional five to seven at the final destination.5 Remember that China is a vast country geographically, so policies in southern, warmer China might differ from those in northern, colder China.

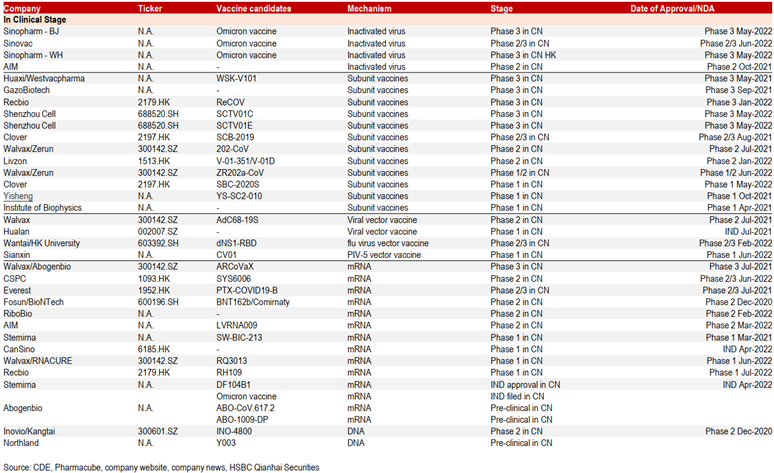

German Chancellor Scholz recently visited China, accompanied by the CEO of German pharmaceutical company BioNTech, which had its mRNA vaccine approved for the more than one million foreigners living in China.3 Meanwhile, local approvals for new variations of the inactivated virus vaccine have been accelerating. Shanghai approved an oral vaccine from CanSino, and 12 other cities followed suit.3 As seen in the chart below, several domestic mRNA vaccines are in the final stages of approval, including CanSino, and Walvax, which received emergency-use authorization in Indonesia.3 We could see a new round of mRNA boosters in China this winter should they receive emergency approval. While most people in China have been fully vaccinated with a traditional vaccine, China’s CDC has suggested that a mixed mRNA booster could provide more effective protection.

On November 10, the State Council sent a strong signal that it intends to balance zero COVID and economic realities. The release stated, "The health and safety of the people must be protected to the greatest extent possible, and the epidemic's impact on economic and social development ought to be minimized.” While steps “…should be taken to contain the spread of the virus and restore the normal order of work and life as soon as possible.” Zero COVID has weighed on China’s economy directly, as seen in Shanghai’s lockdown, and indirectly as the threat of lockdown has led households to horde cash rather than spend it, thus weighing on both consumer confidence and domestic consumption. Investors should recognize the significant adjustment and tolerance with new dynamic zero COVID policies.

While it may seem concerning that cases, hospitalizations, and even deaths are on the rise, this situation is comparable to COVID in the US during the spring of 2021. During this period in the US, there was a lot of uncertainty and sporadic curve-flattening lockdowns as we tried to figure out how to balance making sure hospitals were not overwhelmed and getting back to normal. Once mRNA vaccines were widely available for everyone in the US optimism returned both in daily life and the markets and we moved past the darker days of the pandemic.

Real Estate

We have long argued real estate requires a balancing act for policymakers. In 1980 just 20% of China’s population lived in cities versus nearly 70% today.4 The migration of hundreds of millions meant Chinese cities grew outward, much like many American cities over the last few decades, such as Denver, Miami, Phoenix, and others, only at a more massive scale. For Chinese households, real estate prices consistently climbed due to migration. China Investment Capital Corporation (CICC) estimates nearly 60% of household wealth is in real estate. This concentration is not ideal as China's leaders prefer investors to allocate more toward funding the research and development of technologies and goods that China’s economy will need in the coming years and decades.

Property developers also recognized the continued migration into cities and the outward expansion of Chinese cities. Competition amongst property developers led to unhealthy growth in the sector fueled by debt. Once policymakers recognized the rising debt levels, they looked to rein in these developers by imposing debt limit ratios not to be exceeded. However, these limits were immediately exceeded by several property developers such as Evergrande, leading to work stoppages on hundreds of projects and debt payments missed to a broad consortium of domestic and foreign lenders. The work stoppage affected construction-related companies and their suppliers working on the projects and those who paid for apartments not yet finished. Real estate prices have fallen, dampening consumer confidence and, thus, domestic consumption.

China's leaders quickly recognized that the medicine was killing the patient leading to a post-Party Congress pivot. On November 13, the People's Bank of China (PBOC) and China Bank and Insurance Regulatory Commission (CBIRC) released sixteen measures dialing back previous regulations and providing significant policy support to property developers.6

The real estate situation will not disappear until distressed property developers finish what they started, and debt matures. Investors should recognize the significant effort to stabilize the real estate sector and, thus, consumer confidence post-Party Congress.

US-China Relations

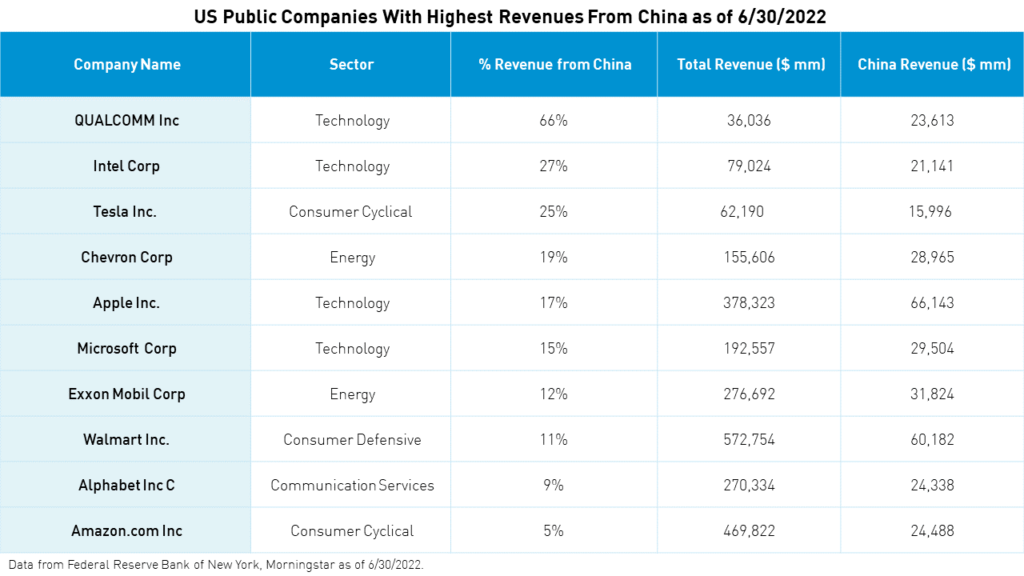

China’s economy is highly geared towards and integrated into the global economy. Many great US and global multinationals have significant revenues generated in China. Strained diplomatic relations put these US companies and their investors at risk. We recently examined how US export controls on semiconductors could hurt US semiconductor companies.

While US and Chinese business people appear to be getting along fine, US-China diplomatic relations have been fraught. During the Party Congress, China’s Ambassador to the US, Qin Gang, received a notable promotion to China's central committee. We believe this strongly signals that relations and communication with the US remain a priority for Xi’s administration.

President Biden and President Xi recently met in person at the G-20 summit in Bali, Indonesia. As a follow-up to the leaders’ meeting, Secretary of State Blinken will visit China for further dialogue. US Trade Representative Katharine Tsai and Commerce Minister Wang Wentao, her Chinese counterpart, met for the first time at the Asia-Pacific Economic Cooperation meetings in Bangkok on November 19. President Xi and US Vice President Kamala Harris also briefly met at the same event.

Both countries have significant economic interests that should allow for more communication and dialogue. As our Head of International, Dr. Xiaolin Chen, noted in a recent CNBC International appearance, the happy photo of Biden and Xi, with a big smile on Xi’s face, that was released on China's state media after the meeting is noteworthy. We believe the positive coverage of the discussion from both the US and China indicates constructive progress. Post-Party Congress, investors should note the improvement in US-China communication.

In August, the US and China reached an agreement to allow officials from the Public Company Accounting Oversight Board (PCAOB) to inspect the audit books of Chinese companies. This could allow US listed Chinese companies to avoid delisting due to the Holding Foreign Companies Accountable Act (HFCAA) passed by US lawmakers in December of 2020. PCAOB officials arrived in Hong Kong to perform audits of Alibaba, Yum China, JD.com, among other companies in September. On November 16th, the US SEC announced the PCAOB would likely announce the results of their inspection before the end of the year. Given the increasingly positive diplomatic environment we entered after the Biden-Xi meeting, we are optimistic that Chinese companies will be allowed to continue listing on US exchanges. Regardless of what happens, we have been moving to Hong Kong share classes for top holdings in our KraneShares CSI China Internet UCITS ETF (Ticker: KWEB) throughout the year.

For KWEB standard performance, top 10 holdings, risks, and other fund information, please click here.

Events To Watch For

- The US Public Company Accounting Oversight Board (PCAOB) announced audit results for top Chinese companies will be released by year-end.

- Calendar Year Third Quarter Earnings beginning mid-November

- Central Economic Work Conference (CEWC) in early December

- Further addition of Hong Kong-listed stocks to Southbound Stock Connect

The stock market is a probability machine taking into account potential outcomes and weighing them in a stock price. The price action of Chinese stocks listed in the United States and Hong Kong has become significantly detached from fundamentals due to investors’ concerns about the big three issues discussed. Price action represented the sum of all fears as investors priced in a negative outcome on these issues. Post-Party Congress, we have seen significant policy adjustments that diminish the negative outcome probabilities on these three issues. We believe a notable rebound in Chinese equities is in the foreseeable future as investors refocus on the fundamentals of individual equities rather than issues that may no longer concern the whole market.

Major City Mobility Tracker

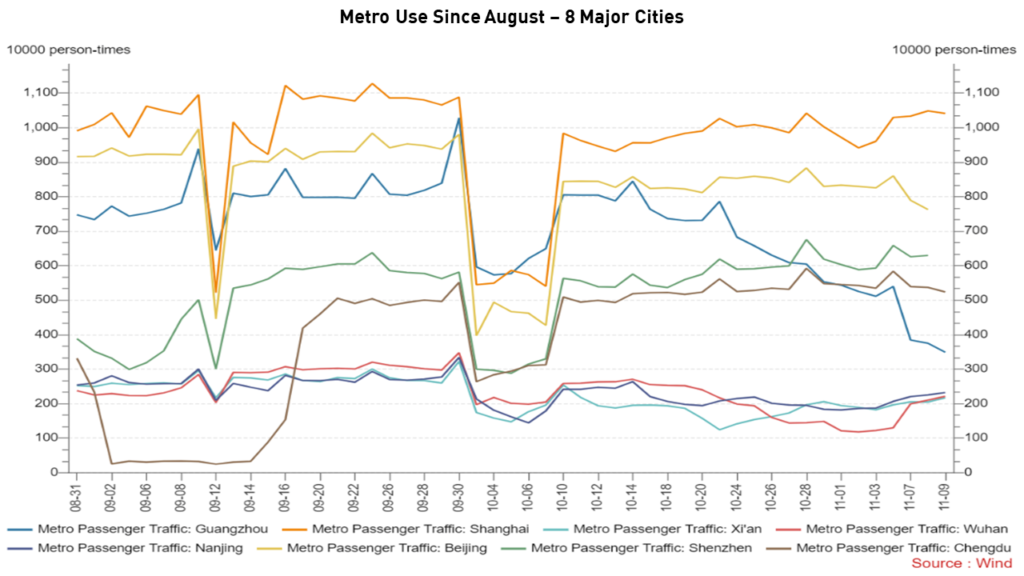

To measure China’s incremental move away from its Zero COVID Policy, we will provide data so investors can make their own determination. The chart below tracks subway traffic from major Chinese cities. Crowded subway cars can allow for COVID transmission. As such, shutting down subways is an effective way to limit the spread of the virus. Today, Guangzhou is seeing subway traffic decline, likely because of restrictions. We will also track traffic congestion in several Chinese cities, another key indicator of whether China is open for business.

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KIID before making any final investment decision.

Citations:

- Cai, J., Deng, X., Yang, J., et al. “Modeling transmission of SARS-CoV-2 Omicron in China,” Nature Medicine. May 10, 2022.

- “Number of COVID-19 cases and deaths over the past 14 days,” The Government of the Hong Kong Special Administrative Region. November 14, 2022.

- Hua, S. (n.d.). “China Agrees to Approve BioNTech’s Covid-19 Vaccine for Foreigners, German Chancellor Says,” WSJ. November 22, 2022.

- Data from The World Bank as of 11/22/2022.

- Cheng, Evelyn. “China Eases Covid Measures, Trims Quarantine Time by Two Days,” CNBC. November 11, 2022.

- “China Regulators Order More Financing Support for Property Firms,” Reuters. November 14, 2022.