Outlook Healthier For Key Chinese Sector

By Anthony Sassine, CFA and Henry Greene

Executive Summary

- China’s leading biotechnology and other health care companies have continued to grow revenues rapidly over the past two years and are expected to see strong growth in the years to come.

- Recently, concerns over domestic regulation, increased domestic competition, US Food and Drug Administration (FDA) rejections of China-made medications, and delisting risks have led to a significant downdraft in the shares of China-based health care companies.

- We believe now could be an opportune time to add exposure to high-quality companies that we believe are currently selling at a discount.

Introduction

The growth of China’s health care industry is driven by a rapidly aging population, expanding domestic health care services and infrastructure, and the increasing international recognition of China-based health care firms’ contributions to the medical field. Although recent market volatility took the sheen off of this focus sector, we believe its prognosis is positive. Furthermore, the recent dip presents an opportunity to purchase shares in high-quality companies that we believe are currently selling at a discount.

Major Developments and Performance

Investor sentiment started to sour in May 2021 when the government named education, real estate, and health care costs the three “mountains” or key factors leading to high living costs for families in May of 2021. Over the years, China’s health care industry has gone through multiple regulatory cycles, all of which have ended up benefitting the industry. As a result, revenues among the top players in the industry are higher than ever. We believe that the latest regulatory cycle is no different.

In June, the National Healthcare Security Administration (NHSA) announced the addition of injectables and some medical devices to the central procurement program, which was created in 2018 as a mechanism to control drug prices. Although the addition was expected, investors saw it as a sign of expanding regulation.

Investors likewise did not take kindly to the updating of oncology guidelines by China’s Central Drug Evaluation (CDE). This led to analysts lowering price targets for Chinese biotech stocks. However, as the industry matures, regulatory changes are likely to be less frequent. Furthermore, as Vice Premier Liu He’s recent speech indicated, the government has learned to balance investor interests with the need to improve regulatory regimes.

China has also been contending with rising covid-19 cases and a commitment to a zero covid policy, leading to large-scale lockdowns in major cities. Fortunately, CanSino Biologics and CSPC Pharma, both KURE holdings at 0.36% and 3.83% weights, respectively as of May 6, 2022, have been approved for clinical trials of mRNA vaccines for distribution in China.1

Developments on Investors’ Minds: Price Pressure On Innovative Drugs, Globalization Challenges, WuXi’s Addition to US Unverified List, Health Technology Regulation, & Delisting

PD-1 and PD-L1 are autoimmune drugs for cancer treatment. There are currently eight or more approved PD-1 and PD-L1 drugs in China, with other products under development. These drugs are darlings of China’s biotechnology industry. Not only are they at the cutting edge of cancer treatment, but they also represent a product category within the fastest-growing segment of the pharmaceutical market in China: treatments for non-communicable diseases (NCDs), such as cancer. Initially, Innovent Biologics’ PD-1 cancer treatment was thought to be in a league of its own as the only cancer treatment of its kind available in China. However, competitor products were added to the Central Procurement (CP) program over time, leading to volatility in Innovent shares. We believe this illustrates the potential risks associated with being too heavily concentrated in the biotechnology subsector and why we prefer a basket approach to investing in China health care.

Investors’ bearishness reached its peak as the US added WuXi Biologics to the unverified list, meaning that US inspectors were unable to verify the end-use of sensitive materials imported by WuXi due to covid-19 restrictions. In the eyes of investors, this put the whole sector in the crosshairs of the US-China geopolitical spat. Lastly, the delisting issue also impacted biotechnology companies, especially as many are listed in New York.

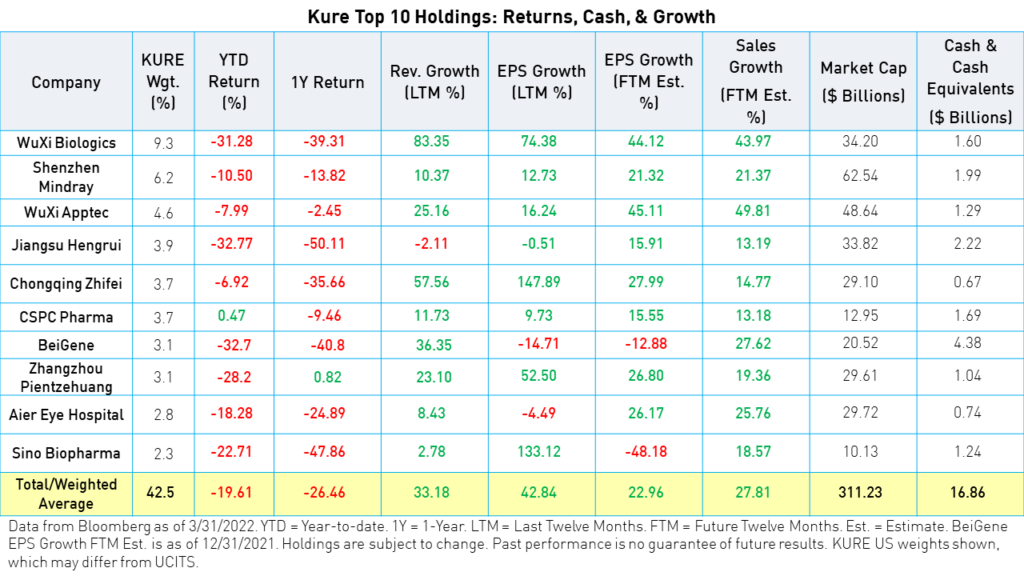

The performance of the KraneShares All China Health Care ETF (Ticker: KURE) was impacted by the events outlined above for the YTD and 1-year periods. KURE has lost 34% year-to-date as of May 8, 2022 and 46% over the past twelve months. Health care technology and equipment led declines as draft regulations caused investor uncertainty. Biotechnology and the Life Sciences industries also declined substantially.

However, China’s premier Liu He’s speech on March 15th regarding dealing with China’s economic issues, including delisting, ignited a rally in China’s Health care sector, led by biotechnology and life sciences companies. WuXi’s strong earnings report also fueled the rally further. Will this be the turning point we have been looking for?

The Impact?

We believe the impact of the recent events to be limited, especially since many of the issues at hand are either solvable, as in the case of Wuxi, or manageable and priced-in, as in the case of Innovent. We believe investors should expect more drugs to be added to the Central Procurement (CP) program. However, these additions will serve as the impetus for pharma companies to step-up research, development, and innovation, rather than a regulatory shackling.

WuXi Biologics: Growing Revenues But Devalued by US-China Geopolitical Spat

Contract Research Organizations (CROs) are some of the most lucrative businesses globally. WuXi Biologics is the crown jewel of the CRO business in China. The industry has seen a rapid rise driven by strong growth in R&D expenditure.

CROs provide pharma companies with unique and valuable end-to-end services in the R&D process spanning molecule discovery, research, regulatory approvals, manufacturing, and commercialization. It saves pharma companies the agony and expense of setting up internal labs and hiring scientists for ideas and assets that could prove unworthy.

Recently, the US government added WuXi Biologics to the US Unverified List (UVL) in the fourth quarter of 2021. WuXi imports sensitive materials from the US, such as bioreactor hardware and filters. The US Department of Commerce has not had the chance to verify the end-use of these materials due to COVID-19 restrictions. However, other WuXi Subsidiaries in the US and EU are not affected. During a conference call, the company assured investors that UVL should not impact operations for at least the next two years. They reiterated that the issue is easily solvable as soon as US inspectors can travel to China.

The company is expected to grow revenues by 45% next year. It has over 480 projects in the pipeline and a long backlog of projects.2 WuXi added more than 150 projects in 2021 alone, more than many smaller CROs combined.2 It has a deep bench of scientists, which doubled over the past couple of years and is expected to double again in the coming years.2 WuXi reported an 88% growth in revenue and a 103% growth in earnings in 2021, beating analysts’ expectations.

Innovent Biologics & The FDA

As mentioned above, Innovent is a leading biotechnology company in China that was one of the first movers in China’s PD-1 market. Revenues rose from a few million RMB in 2018 to almost 4 billion RMB estimated for 2022.3 However, in March of 2022, the FDA rejected the application of Eli Lilly and Innovent to approve Tyvyt in the US, citing a lack of diversity in the population of the trials.4 Experts believe that their application underwent special scrutiny due to the availability of similar treatments in the US. Drugs with no equivalent on the US market, by contrast, tend to see faster and easier approvals as a need can be demonstrated.

Innovent and the market have already priced in Tyvyt‘s forgone revenue from the US. However, Innovent has 6 commercialized products and 5 scheduled for launch in the next two years. The company has 23 global partnerships, most notably the out-licensing and in-licensing deal with Eli Lilly. The in-licensing deal was announced in April of 2022, allowing Innovent to market and sell Eli Lilly’s cancer drugs suite in China.5 The market expects Innovent’s revenue to grow by +44% in 2022.3

China Biotechnology Regulations, Globalization, & Delisting

Innovent’s encounter with the FDA has taught China’s biotechnology companies many lessons. It has set a new dynamic for drug testing and development. Global operations and multiregional clinical trials (MRCTs) are now a must for companies looking to globalize. Also, for a drug to have a higher chance of approval, China biotechnology companies will need to focus on new drugs unavailable in foreign markets, that could become first-in-class drugs or, at least, a close second to a top-tier drug in the phase testing process.

This is also true domestically. A high concentration of specific innovative drugs, such as PD-1 today in China, could increase competition and price pressure. China’s biotechnology companies need to step-up innovation in the drug development space.

Investors were concerned that the FDA’s rejection of Innovent’s PD-1 cancer treatment was politically motivated. We do not believe this is the case. The FDA’s decisions have a long track record of being data-driven. Furthermore, the US agency represents the gold standard of drug approvals, with other agencies following its lead around the globe.

Shanghai Junshi and BeiGene are currently awaiting final Prescription Drug User Fee Act (PDFUA) and Biologics License Application (BLA) decisions for two PD-1 drugs. However, their case is different from Innovent as the drugs under evaluation can target specific diseases that are rare and, most importantly, lack a competitor in the US market. Junshi’s PD-1 targets nasopharyngeal carcinoma, and BeiGene’s PD-1 drug targets a rare disease with no current treatment approved for the US market. Junshi’s drug toripalimab was recently granted priority review by the FDA as the agency is considering the treatment a breakthrough therapy when combined with chemotherapy.

The delisting risk presented by the Holding Foreign Companies Accountable Act (HFCAA) has also impacted the share prices of Chinese biotechnology firms, as many are listed in the US. BeiGene and Zai Labs are among the companies listed on the New York Stock Exchange (NYSE).

In response, BeiGene restructured its auditing process, making Ernst & Young US responsible for auditing its US operations. Although Ernst & Young China will still have an involvement in the process, BeiGene was hoping to gain the approval of the Securities Exchange Commission (SEC)

However, Liu He’s speech on March 15th, which praised the progress made by regulators from both sides in negotiations, raised the probability of a deal between the SEC the China Securities Regulatory Commission (CSRC), China’s primary securities regulator, and initiated a rally in China’s health care sector.

Upcoming Health Technology Regulations

We believe new regulations for China’s online health care industry are much needed given the nascency of the industry and the sensitivity of drug sales, storage, and distribution. The draft regulations target good manufacturing practices for pharmaceutical companies and quality management for retail distribution. They also include provisions to ensure doctors are not oversubscribing online and that doctors’ compensation for medical services is independent of drug prescriptions. We believe the impact of these new regulations will be manageable, especially for the prominent players with the strongest brand and logistical presence, which include JD Health, Ping An Good Doctor, and Ali Health.

Despite the new regulations, we believe China is committed to “healthcare + the internet” as it helps widen the access to high-quality medical services across China, especially in rural areas. Also, the new strategic direction has helped reduce wait times at doctors’ offices and hospitals from an average of 3 hours to 8 minutes or less. The sector has been mentioned frequently in high-level government working papers.

We believe the market has already priced in the potential impact of the new regulations. We believe it has even priced in a much more pessimistic scenario. JD Health’s recent earnings report for the second half of 2021 revealed 61% growth year-over-year, beating expectations by 11%. The growth was driven by a 37% increase in subscribers and an 11% increase in average revenue per user.6

Outlook

China’s health care stocks have been hit with many negative developments over the past 9 months, shaking investors’ confidence in the sector. The current macroeconomic backdrop and the rotation from growth to value are also not accommodative to shares of companies in the industry.

In times of high market stress, it is easy to forget about the bigger picture. However, the long-term potential of China’s health care sector did not change. There is a major need for innovative drugs as the Chinese continue to age and require medical care. Valuations are currently at a multi-year low, reflecting investors’ bearishness. However, sector growth remains evident, despite recent events. We believe now could be an opportune time to add exposure to high-quality companies currently selling at a discount.

The government’s policy remains supportive of the development of the sector. However, risks include regulatory fine-tuning and further price pressure, especially for generic drugs.

In vitro diagnostic devices (IVDs) are next in line for regulatory scrutiny. However, Mindray, the largest IVD provider in addition to the largest medical devices company, says that this is positive for Chinese players as price pressure seems to be driving out multinationals such as Roche, Abbott, and Siemens. They also believe that regulators are targeting inefficiencies and corruption among the distributors, which we believe is a positive for the market.

The market is currently pricing in a disastrous scenario, especially for the growth related to globalization and US expansion. Although globalization may be delayed due to technical and covid-related issues, we believe we will see China-made innovative drugs on the market in the US and Europe sometime soon. Until that time, domestic demand should unlock material growth opportunities for these companies. Furthermore, we believe the delisting issue will be resolved soon, and representatives from the US Department of Commerce will make it to China to inspect facilities run by WuXi Biologics and other firms that import sensitive materials from the US.

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KIID before making any final investment decision.

Citations:

- "CanSinoBIO's mRNA COVID vaccine candidate cleared for trials in China," Reuters. April 3, 2022.

- Data from WuXi Biologics and Bloomberg as of 12/31/2021.

- Data from Bloomberg as of 3/31/2022.

- Liu, Angus. "Eli Lilly, Innovent hit with FDA rejection for China-developed lung cancer drug after tough review," Fierce Pharma. March 24, 2022.

- Data from Innovent Biologics as of 3/31/2022.

- Data from JD Health as of 12/31/2021.

Definitions:

In/Out Licensing: When a company works to license a drug in one or more foreign countries.

Revenue Growth: Growth in a company’s top-line sales.

Earnings per Share (EPS): a company's profit divided by the outstanding shares of its common stock.

Price-to-Earnings Ratio (P/E): The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its earnings per share (EPS).

Forward Price-to-Earnings Ratio (P/E): The forward price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its expected earnings per share (EPS) at some point in the future.

Price/Earnings-to-Growth Ratio (PEG): A stock’s P/E ratio divided by the growth rate of its earnings for a specified time period.

MSCI China All Shares Health Care Index: The MSCI China All Shares Health Care Index captures large and mid cap representation across China H shares, B shares, Red chips and P chips. Currently, the index also includes Large Cap A shares represented at 10% of their free float adjusted market capitalization. All securities in the index are classified in the Health Care sector as per the Global Industry Classification Standard (GICS®). The index was launched on January 1, 2001.

Holding Foreign Companies Accountable Act (HFCAA): An act passed by the US Congress that requires foreign companies listed in the United States to allow the Public Company Accounting Oversight Board (PCAOB) to inspect their audit books and disclose government ownership, if any.

R_EU_KS