A Deeper Look at US-China Trade & Mainland Performance

According to the US Census Bureau, the United States imports more cars from Canada than from any other country in the world1. Considering this statistic, you would assume that Canadian car brands like Intermeccanica and Campagna would be household names in the US, but they are not. The US Census Bureau defines imports as “all goods physically brought into the United States…”2; therefore, in reality, the bulk of the Canadian cars referenced in this statistic are Fords, Chevys, and Lincolns assembled in Canadian plants and shipped back to the US. Even though the revenues of these cars go to the Detroit-based companies and their shareholders, the US Census Bureau still considers them Canadian. In fact, this extends to many other US products that are manufactured in other countries. Almost 50% of the S&P 500’s revenues are derived from abroad3, meaning that the wealth of every American investor is dependent on US companies’ ability to participate in international trade.

Data from the US Census Bureau shows that the US trade deficit with China was $375.2 billion in 20174; however, this statistic does not recognize profits of US products manufactured locally in China. Therefore, a large portion of US trade with China is not reflected by the trade deficit metric. For example, products like Apple’s iPhone which are assembled in China and brought back for sale in the US contribute to the US-China trade deficit, as they are considered Chinese goods despite the revenues flowing to Cupertino.

Over the past decade, US direct investment in China has increased steadily, nearly doubling from $54 billion in 2009 to $107 billion in 20175. This is true across a wide range of sectors and industries. For example, Ford and its Chinese joint-venture partner, Chang'an Ford Mazda Automobile, built two plants in China from 2012 to 2014 for a total investment of over $800 million6. Tyson Foods also established three poultry processing operations in China from 2001 to 2013 with over 4,300 employees7, and in 2016, Wynn Resorts opened a new $4.2 billion resort in Macau8. These are just a few examples of rising US investment in China, and even more investments are being planned such as Tesla’s recent announcement it plans to construct a $2 billion plant in Shanghai capable of rivaling its facility in California9.

Increased investment in China has also led to more revenues for American companies. For example, Apple had net sales of $40.5 billion in China for the nine-month period ending in June 201810, about a 16% increase YTD11, and Nike’s revenues in China have increased from $635 million in 201312 to $1.34 billion in 201813, an increase of 110% in just 5 years. Moreover, US companies have benefited from the export of services to China, where the US ran a trade surplus of $38.4 billion in 201714.

When all of these factors are added to conduct a deeper trade analysis, the US-China trade deficit is much lower than reported. One study published in March 201715 used newly available data from the World Input-Output Database (WIOD) to show that the US-China trade deficit for goods and services in 2014 was around $100 billion lower than the US Census Bureau’s official estimate16.

With US companies benefiting greatly from trade with China, we believe it is unlikely that trade tensions will progress to the more extreme scenarios. Increasing the size of tariffs with China over a prolonged period of time could have a substantial impact on US and global economic growth. General Electric estimated that new tariffs on its imports from China could raise its costs by $300 million to $400 million overall17, and Whirlpool, an American appliance giant, now expects to pay $350 million more for raw materials due to tariffs18. Ford CEO, James Hackett, recently described the effect of tariffs on his company, stating “the metals tariffs took about $1 billion in profit from us… The irony of which is we source most of that in the U.S. today anyway. If it goes on any longer, it will do more damage.” Over the past couple of months, US companies filed nearly 3,000 comments with the U.S. Trade Representative’s Office opposing more tariffs19.

The Trump administration is sensitive to the performance of the US stock market, and we believe that they will not push tariffs so far that they have a prolonged negative impact on US companies. President Trump’s “Art of the Deal” prescribes an extreme starting position that is eventually worked out through a levelheaded compromise. In his book, Trump describes how “The final key to the way I promote is bravado… People want to believe that something is the biggest and the greatest and the most spectacular… It's an innocent form of exaggeration and a very effective form of promotion."20 We believe that the Trump administration’s firm stance on economic protectionism follows his established negotiation strategy – a strategy recently on display in trade negotiations between the US and Canada. After months of posturing from both sides that had some suggesting the bilateral relationship was in a state of political disrepair, the Trump administration struck an 11th-hour deal to form the United States-Mexico-Canada Agreement (USMCA) on September 30th.

There are two events on the horizon that we believe will provide some measure of clarity as to the future of trade negotiations with China. First, the US midterm elections could serve as a litmus test for President Trump to gauge how to direct his future trade strategy. Second, President Trump and Chinese President Xi Jinping will meet again at the G20 Summit in Argentina at the end of November, and President Trump has a history of cutting deals during face-to-face meetings with foreign leaders.

Trade tensions have caused the mainland Chinese market to decline while the US market has increased. The S&P 500 has risen 11.2% YTD, trading around an all-time high of 2,873.23 reached on August 21, 2018. Meanwhile, the Shanghai Composite Index has fallen by 18.9%21. We believe the market has disproportionately penalized China over the United States and that this gap may close in the near future. As we highlighted above, US companies have invested significant resources within China and stand to be negatively impacted if trade tensions continue to escalate.

We believe the China A-Share market represents an attractive long-term growth and value opportunity for investors. As detailed in our recent article titled MSCI China A-Share Phase Two Inclusion And Mainland Market Outlook, fundamentals remain strong with year over year earnings growth up over 22%. At the same time, valuations also look attractive with price to earnings (P/E) ratios at historic lows compared to the U.S. market22.

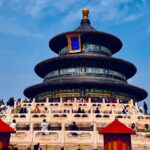

The chart below details the relationship between forward P/E and 5-year annualized returns for the Shanghai Composite Index from 2005 to 201823. The graph shows a strong inverse relationship between forward P/E and total return over the past 13 years, inclusive of the financial crisis. Historically, as monthly forward P/E decreases, total return tends to increase. Today, the Index’s forward P/E stands at 10.7x, and investments made at forward P/E levels of 10-11x over this time period produced average annualized returns of 10.8%, with a range of 7.6% to 24%24.

![Presentation1[1]](https://europe.kranesharesnet.wpengine.com/wp-content/uploads/sites/2/2019/06/Presentation11.jpg)

Additionally, in September 2018, both of the leading global index providers, MSCI and FTSE Russell, made China A-Share inclusion announcements. MSCI launched a consultation to increase the inclusion factor of MSCI China A Large Cap securities from 5% to 20% of their respective free float‐adjusted market capitalizations25. Following suit, FTSE Russell announced its plans to increase the weight of China A-shares to represent 5.5% of the FTSE Emerging index which, on completion, is predicted to cause initial net passive inflows of $10bn into the mainland market26.

Taking a deeper look, we believe that the direction of US-China trade tensions could become clearer in the near future. In the meantime, these tensions may provide an excellent entry point for investors seeking long-term exposure to the Chinese markets.

- Price-Earnings Ratio: (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

- Forward Price-Earnings Ratio: (Forward P/E) is a quantification of the ratio of price-to-earnings (P/E) using forecasted earnings for the P/E calculation.

- MSCI Emerging Markets Index: captures large and mid cap representation across 23 Emerging Markets (EM) countries. With 834 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

- FTSE Emerging Index: is a free-float, market-capitalization weighted index representing the performance of around 850 large and mid cap companies in 22 emerging markets

- Trade Map, International Trade Centre. Data calculated in terms of total value of car imports. Retrieved 9/21/2018.

- United States Census Bureau, Trade Definitions, https://www.census.gov/foreign-trade/reference/definitions/index.html#S

- S&P Dow Jones Indices, S&P 500 2017: Global Sales, retrieved 9/20/2018.

- United States Census Bureau, Trade in Goods with China 2017, https://www.census.gov/foreign-trade/balance/c5700.html

- US Department of Commerce Bureau of Economic Analysis, U.S. Direct Investment Abroad: Balance of Payments and Direct Investment Position Data, retrieved 9/20/2018.

- Reliable Plant, "Ford To Build Second Engine Plant In China". Retrieved 9/24/2018.

- Tyson Foods Inc., Fiscal 2013 Fact Book.

- Wynn Resorts, "Wynn Palace Now Open in Cotai, Macau", PR Newswire, 8/22/2016, Retrieved on 9/24/2018.

- Chris Isidore and Steven Jiang, "Tesla is going big in China", CNN Money, 7/10/2018, Retrieved on 9/24/2018.

- Apple Inc., Form 10-Q filed 7/20/2018.

- Apple Inc., Form 10-Q filed 8/2/2017.

- Nike Inc., Form 10-Q filed 4/4/2013.

- Nike Inc., Form 10-Q filed 4/5/2018.

- Office of the United States Trade Representative, U.S. China Trade Facts, retrieved 9/20/2018.

- Erik Lundh, China Center Chart Dive: New data reveal less severe trade imbalance between the US and China. March 2017.

- United States Census Bureau, Trade in Goods with China 2017, https://www.census.gov/foreign-trade/balance/c5700.html

- Bloomberg, “Companies Report the Impact of Tariffs on Their Businesses”, 7/17/2018.

- Michael Larkin, "Trump Tariffs Hit Top American Companies", Investor's Business Daily, 7/25/2018, Retrieved on 9/26/2018.

- Julia La Roche and Krystal Hu, "Apple, other US companies say Trump’s tariffs will make products pricier", Yahoo Finance, 9/7/2018, Retrieved on 9/26/2018.

- Donald Trump and Tony Schwartz, “Trump: The Art of the Deal”, 11/1/1987.

- Data from Bloomberg as of 9/27/2018. YTD calculated as of 8/31/2018 in USD.

- Data from Bloomberg as of 7/31/2018.

- Data from Bloomberg as of 7/31/2018.

- Data from Bloomberg as of 7/31/2018.

- Consultation of Further Weight Increase of China A Shares in the MSCI Indexes, MSCI. Data as of 9/3/2018.

- Tony Eckett, "FTSE Russell to include China A-shares in major benchmarks", Investment Week, 9/27/2018, Retrived on 9/27/2018.